Scenarios That Warrant Short-Term or Temporary Insurance

While our agency does not specialize in short-term insurance policies, there are a few scenarios that can warrant the need for short-term insurance policies. Let’s take a closer look at a few of these.

While our agency does not specialize in short-term insurance policies, there are a few scenarios that can warrant the need for short-term insurance policies. Let’s take a closer look at a few of these.

Traveling to Mexico:

If you’re driving into Mexico it is likely that your existing auto insurance policy excludes travel to Mexico. You’ll want to find an agency that offers Mexico Auto Coverage. Your typical coverages are available to cover your vehicle and can include roadside assistance. Talk to an agent about what might be the best fit for you if you’re traveling to and from Mexico.

Renting A Vehicle

If you plan to rent a vehicle as a temporary replacement while on vacation, your existing auto coverage should transfer to the rental vehicle. However, items like loss of use are not covered and could cause you to accrue some out-of-pocket expenses should you be found at fault for an accident that removes the vehicle from the rental fleet. Talk to an agent before you rent a vehicle and ensure your existing coverage will transfer to the temporary replacement. You can always purchase the rental agency’s coverage as a primary coverage as well.

Vacation or Travel Insurance

If you’re going on vacation you might want to consider travel insurance if your plans get interrupted. Things like sickness, injury, and lost luggage can be covered with a simple policy. You can even find coverage for “cancel for any reason” which could help with some unusual circumstances for having to cancel a trip. Be sure to ask your agent about the coverage details so you fully understand your coverage.

Wedding & Special Event

If you are planning on hosting a special event such as a wedding, bar mitzvah, baby shower, charity auction, Easter egg hunt, or even a cocktail party, you should consider special event insurance. Getting a one-day (multi-day also available) special event insurance policy is an easy chore.

Even if you don’t serve alcohol at your party, by inviting guests and children onto your property you have a liability that needs to be protected. Consider trip and fall accidents, food poisoning, or even a dog bite. Many things can happen during an event that should be planned for.

As an independent insurance agency, we not only represent a variety of great insurance carriers but we can help you plan for these temporary insurance policies. Purchasing a policy can be as simple as a quick phone call with your travel or plan details and we can provide you with a quote.

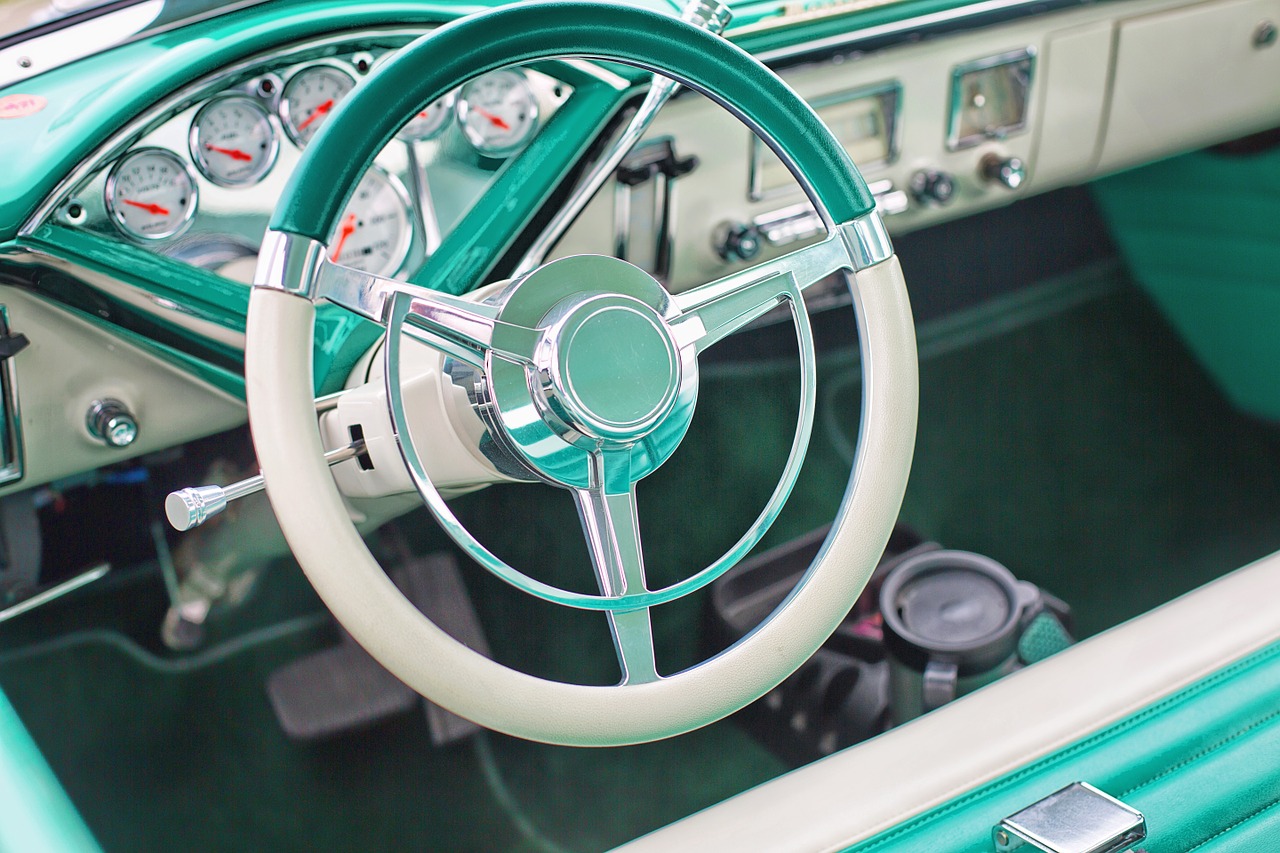

If you are the lucky owner of a classic car, you can appreciate the uniqueness of the vehicle as well as cherish the nostalgia of owning it.

If you are the lucky owner of a classic car, you can appreciate the uniqueness of the vehicle as well as cherish the nostalgia of owning it.