Vacant Rental Insurance WA: Protect Your Property Between Tenancies

Leaving a rental property vacant between tenants puts your investment at serious risk. Standard homeowners insurance won’t cover theft, vandalism, or squatting during these gaps.

Vacant rental insurance in WA is specifically designed to fill this protection gap. We at H&K Insurance Agency help property owners understand what coverage they need and how to avoid costly claim denials.

Why Standard Insurance Fails Vacant Properties

Standard homeowners and landlord policies assume someone lives in the property. The moment your rental sits empty, those protections disappear. Most carriers explicitly exclude or severely limit coverage for theft, vandalism, and water damage once a property becomes vacant.

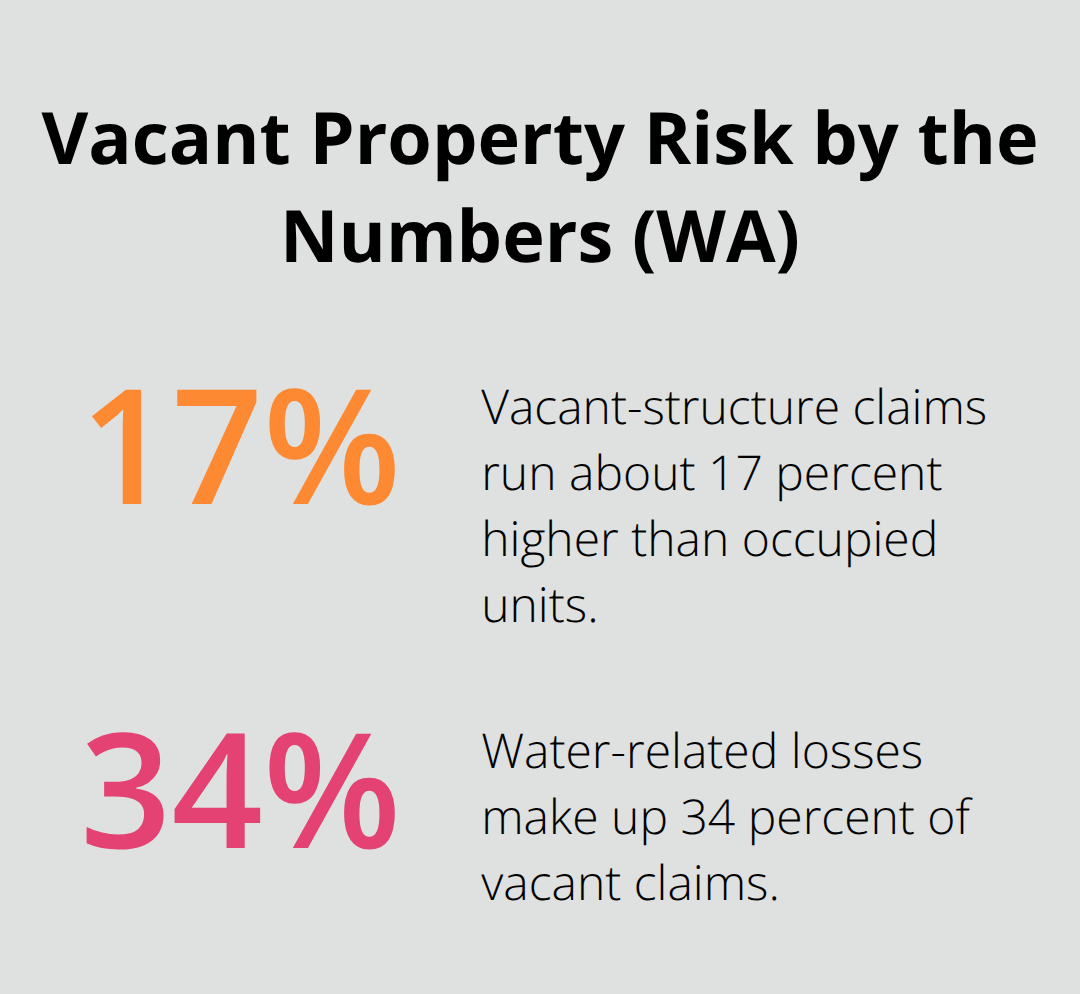

The Scale of Vacant Property Risk

The numbers tell a stark story. The U.S. Fire Administration reports about 20,000 vacant-building fires annually, with direct property damage exceeding 600 million dollars. Burglary risk in unoccupied dwellings runs up to three times higher than occupied homes, according to the National Crime Prevention Council. Industry data from Property Claim Services show vacant-structure claims run about 17 percent higher than occupied units, with water-related losses making up 34 percent of vacant claims and average payouts exceeding 14,000 dollars-often double what occupied properties receive.

Your standard policy won’t cover any of this. When the property sits empty between tenants, your coverage gaps widen significantly.

How Carriers Build in Exclusions

Insurance companies view vacant properties as high-loss exposures and build exclusions directly into standard forms. Even if you technically have a policy in place, the fine print often contains language that voids coverage once the property remains unoccupied beyond 30 days. A broken pipe, a break-in, or storm damage during vacancy gets rejected because your policy never addressed that specific risk.

What Happens When You File a Claim

You face this problem only when you file a claim and receive a denial letter. The carrier points to vacancy language in your policy and refuses to pay. Vacant rental insurance in Washington eliminates this trap by explicitly covering the risks that appear when no one occupies the building. The policy restores protections for perils typically restricted or excluded during vacancy periods.

Understanding what your current policy excludes is the first step toward finding the right vacant coverage. The next section walks through exactly what vacant rental insurance covers in Washington.

What Vacant Rental Insurance Actually Covers

Structural Protection and Core Coverage

Vacant rental insurance in Washington restores the protections that disappear the moment your property sits empty. Coverage A handles structural damage to the building itself-the walls, roof, foundation, and built-in fixtures that form the core of your investment. Fire, wind, hail, and theft damage receive coverage during vacancy, which standard landlord policies often exclude.

Coverage B extends protection to detached structures like garages, sheds, or carports. Coverage L provides liability protection if someone gets injured on the vacant property, protecting you against lawsuits that could otherwise drain tens of thousands from your pocket.

Vandalism, Theft, and Crime Protection

Most vacant policies in Washington include vandalism and theft coverage, which directly addresses the crime risks that spike when properties sit unoccupied. The National Crime Prevention Council reports burglary risk three times higher in vacant dwellings, which explains why carriers now bundle this protection into vacant-specific forms rather than treating it as an add-on. This coverage matters most during the between-tenancy window when your property faces its highest exposure to criminal activity.

Water Damage and Loss of Rent

Water damage presents the biggest claim exposure for vacant properties. Property Claim Services data show water losses comprise 34 percent of vacant claims with average payouts exceeding $14,000. A frozen pipe, a roof leak, or a burst fitting causes exponentially more damage when no one occupies the building to catch it early. Water damage and loss of rent coverage in vacant buildings costs an average of 42 percent more than in occupied ones because leaks often go unchecked for weeks. Vacant policies typically cover these scenarios when you maintain proper winterization and keep utilities active, which carriers now require as a condition of coverage. Some policies include loss of rent coverage, reimbursing your rental income during restoration when the property becomes uninhabitable-a feature that matters enormously if a covered loss forces weeks of repairs.

Customizing Your Coverage with Endorsements

Endorsements for sewer backup, equipment breakdown, and ordinance or law coverage remain available to customize protection for your specific property and local building codes. Median vacant home policies run roughly $80 to $135 per month depending on location, building age, and local crime scores, compared to $45 to $65 monthly for occupied landlord coverage. Shorter vacancy windows carry steeper daily rates, so accurately estimating how long the property will sit empty directly impacts your total premium. A local independent agent can compare carriers and explain exactly which perils stay covered during your between-tenancy window and which conditions-like utilities remaining on or monthly inspections-your specific carrier requires to keep the policy active.

Finding the Right Vacant Rental Insurance in Washington

Shopping for vacant rental insurance requires a direct comparison of what carriers actually cover during your between-tenancy window, not just a price hunt. The median cost for vacant home policies in Washington ranges from $80 to $135 per month, but premium alone tells you nothing about whether the policy will pay when you file a claim. Contact independent agents who represent multiple carriers rather than calling individual insurers directly. An independent agent can pull quotes from five to ten carriers simultaneously and explain the specific conditions each one requires to keep coverage active during vacancy. Some carriers demand utilities stay on and heat maintained at 55 degrees Fahrenheit; others require monthly inspections or professional monitoring systems. These requirements directly affect your operational costs between tenants, so understanding them upfront prevents surprises when you activate the policy.

How Location and Property Characteristics Drive Your Premium

Location matters significantly for pricing. Properties in Tukwila average around $585 annually for landlord coverage, while similar homes in Olympia run closer to $823 per year. Vacant policies cost more than occupied landlord coverage in the same area because vacancy creates concentrated risk during the exact window when no one monitors the building. A wood-frame duplex in a dense urban area with higher crime scores will cost substantially more than a brick townhouse in a fire-protected suburban area, even at identical replacement values. Ask your agent for the specific protection class rating for your property, which measures distance to the nearest fire station and hydrant. Properties within 1,000 feet of a fire hydrant and fire station receive better rates than those further away.

Deductibles and Coverage Forms Shape Your Costs

Deductible selection directly controls your monthly premium. Raising your deductible from $500 to $1,000 typically reduces the premium by 10 to 15 percent, but only choose this strategy if you can absorb that out-of-pocket cost when a covered loss occurs. For properties with older roofs-roughly 10 years or more-choose a broader form like DP-3 rather than DP-1, which covers only named perils and excludes theft and vandalism. DP-3 uses open-perils coverage, meaning damage is covered unless a specific exclusion applies, and protects against roof-related losses that plague aging rental stock.

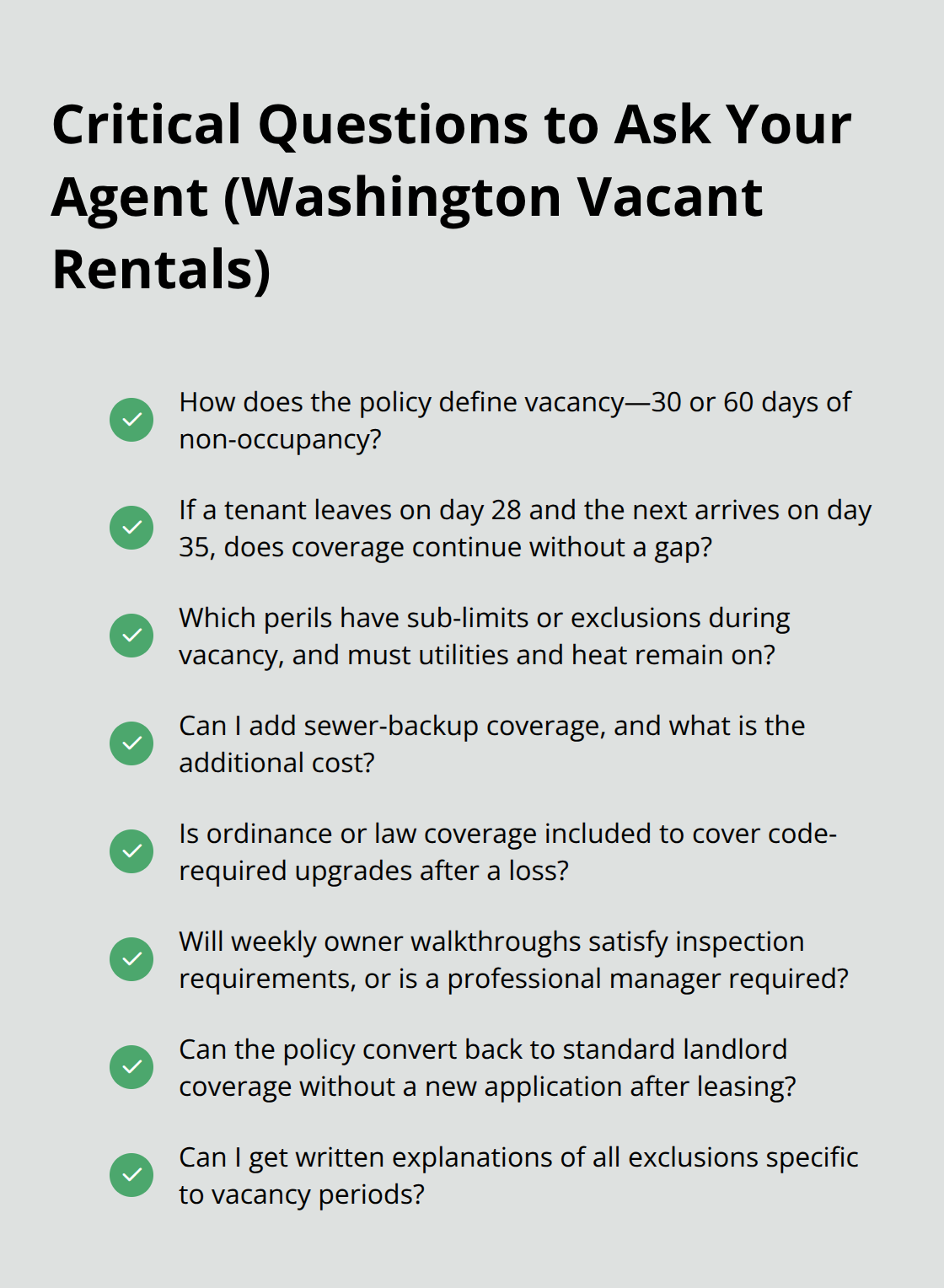

Critical Questions to Ask Before You Sign

Before signing any policy, ask your agent these specific questions: Does the policy define vacancy as 30 days or 60 days of continuous non-occupancy? What happens if you have a tenant move out on day 28 and a new one move in on day 35-does coverage stay active or does a gap appear? Which perils face sub-limits or exclusions during vacancy, and does the carrier require proof of utilities remaining active and heat maintained?

Can you add a sewer-backup endorsement, and what does it cost? Does the policy include ordinance or law coverage to help pay for building code upgrades after a loss? Will the carrier accept a weekly walkthrough from you instead of requiring a professional property manager? Can you convert the policy back to standard landlord coverage without a new application once you place a tenant, or do you need to restart the underwriting process? Request written explanations of any exclusions that apply specifically during vacancy periods.

Risk Management Systems and Lender Requirements

Carriers offer premium credits for professionally monitored leak detectors, thermostats, and security cameras. These systems also create documentation that strengthens your position if you file a claim, because you have dated records showing the property’s condition and how quickly you responded to any issues. Washington landlords with financed properties face a requirement from their lenders to maintain continuous coverage for the loan term, so lapses during vacancy can technically violate loan agreements. Discuss this directly with your lender to understand whether your current policy needs to remain active during vacancy or whether switching to a vacant-specific policy for the between-tenancy period satisfies the requirement. Some lenders accept either approach; others insist on a single continuous policy.

Final Thoughts

Activate vacant rental insurance WA before your property sits empty to prevent the coverage gaps that lead to claim denials. Contact your agent at least two weeks before a tenant moves out so the policy takes effect on your target date. Waiting until after vacancy begins leaves your property unprotected during the exact window when theft, vandalism, and water damage pose the highest risk.

Property maintenance between tenancies directly reduces your claims risk and can lower your premium. Change door locks immediately after a tenant leaves, board ground-level windows if the property will sit vacant for months, winterize plumbing by draining lines and maintaining heat at 55 degrees Fahrenheit, and install motion-activated lighting and security cameras (these physical safeguards demonstrate due diligence to your carrier and often qualify you for premium discounts up to 15 percent). Keep inspection logs, dated photos, and contractor receipts documenting your maintenance efforts so you have evidence showing the property’s condition if a loss occurs.

We at H&K Insurance Agency work with multiple carriers to compare vacant rental insurance options tailored to your specific property and timeline. Contact H&K Insurance Agency to discuss your vacant property coverage and get quotes from carriers that match your risk profile and budget.