Umbrella Liability Insurance Kitsap WA: Extra Protection For Your Finances

A single lawsuit can wipe out years of financial progress. Most homeowners and auto policies cap coverage at $300,000 to $500,000-far below what a serious accident could cost.

Umbrella liability insurance in Kitsap WA fills that gap. At H&K Insurance Agency, we help residents protect their assets with affordable coverage that starts where standard policies end.

What Umbrella Liability Actually Covers

Umbrella liability insurance sits on top of your homeowners and auto policies, activating only after those base policies hit their limits. If someone sues you for injuries or property damage they suffered, your standard homeowners policy might cover up to $300,000 in liability, and your auto policy another $250,000 to $500,000. Once those amounts are exhausted, your personal assets become exposed. An umbrella policy picks up where those limits end, typically offering $1 million to $5 million in additional coverage. You cannot buy umbrella coverage without maintaining adequate underlying policies first. Most insurers require at least $300,000 in homeowners liability and $250,000 to $300,000 in auto liability before they’ll write an umbrella policy. This requirement exists because the umbrella only pays after your base policies are depleted, so those foundations must be solid.

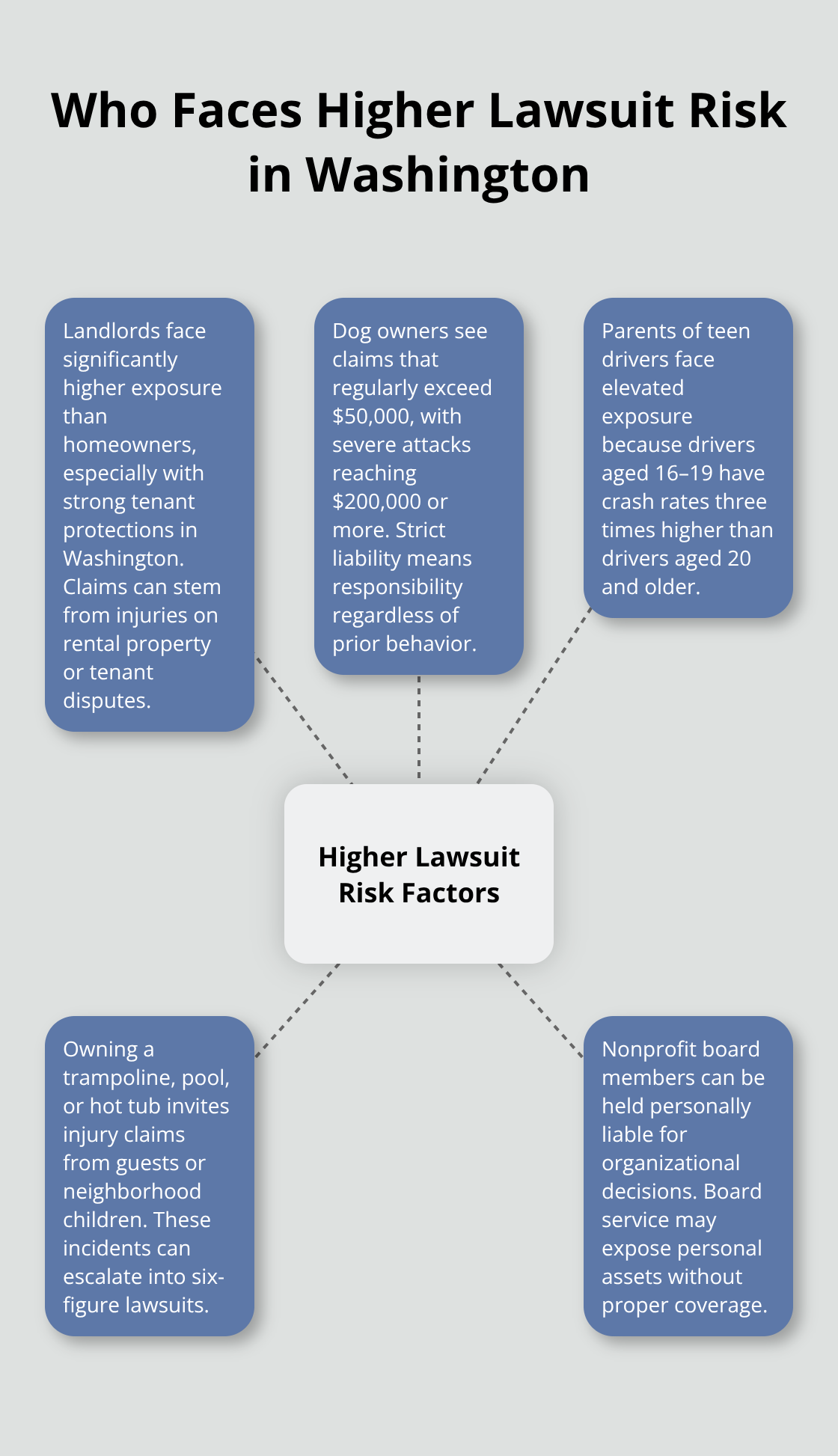

Who Actually Gets Sued in Washington State

Certain situations dramatically increase your lawsuit risk. Landlords face significantly higher exposure than homeowners, particularly in Washington where tenant protections are strong. Dog owners in Washington must understand that dog bite claims regularly exceed $50,000, and serious attacks can reach $200,000 or more in medical costs and liability judgments. Parents of teen drivers should recognize that teenage drivers aged 16-19 have crash rates three times higher than drivers aged 20 and older, according to the National Highway Traffic Safety Administration.

If you own a trampoline, pool, or hot tub, you invite liability claims. Nonprofit board members also face personal liability exposure for organizational decisions. These aren’t theoretical risks-they’re documented patterns that insurance companies track closely. Your umbrella coverage should reflect your actual exposure level, not a generic amount.

Matching Coverage to Your Specific Situation

A landlord with multiple properties needs higher limits than a homeowner with no rental income. A parent carpooling neighborhood kids to sports faces different exposure than someone without that responsibility. Your umbrella limits should align with what you actually do and own, not what you think you should own. Most people approach umbrella limits backward, thinking only about their net worth. That’s a mistake. A lawsuit judgment can include future earnings, not just current assets. Someone might sue you for $2 million in damages, and if that exceeds your assets, the judgment can follow you for years through wage garnishment and bank levies.

Understanding Your Asset Protection

Washington State law protects your primary residence up to a certain amount depending on your situation, but rental properties, investment accounts, vehicles, and future income typically have no such protection. If you own a home worth $600,000, have $150,000 in investments, and earn $80,000 annually, your exposure extends beyond that $750,000 figure because future earnings are at stake. The good news: umbrella premiums are remarkably affordable compared to raising your base policy limits. Adding $1 million in umbrella coverage typically costs $200 to $400 annually, whereas increasing your homeowners liability limit by $1 million would cost significantly more. This cost advantage makes umbrella coverage an efficient way to close the gap between what your standard policies cover and what a serious lawsuit could cost. As you evaluate your specific situation, the next step involves understanding how to select the right coverage limits and structure for your household.

When Umbrella Coverage Actually Matters Most

A multi-vehicle collision on Highway 3 near Silverdale sends two cars into a ditch. The at-fault driver’s auto policy maxes out at $500,000, but medical bills for three injured passengers total $1.2 million, plus ongoing rehabilitation costs and lost wages push the claim to $1.8 million. Without umbrella coverage, that driver faces a $1.3 million judgment against personal assets. This scenario plays out regularly in Washington State. An umbrella policy activates immediately after your base auto coverage exhausts, covering legal defense costs and the judgment amount up to your umbrella limit. Most people underestimate how quickly medical costs accumulate. A single hospitalization for a spinal injury runs $150,000 to $300,000 before rehabilitation, home care, or future surgery. Add two more injured parties and you’re well beyond $500,000. The umbrella acts as the financial barrier that prevents a lawsuit from destroying your household.

Auto Accidents Create Massive Liability Exposure

Medical expenses from serious crashes spiral fast. A spinal injury alone costs $150,000 to $300,000 before rehabilitation and home care. When multiple people suffer injuries in one accident, costs exceed $500,000 within weeks. Your standard auto policy stops paying once it hits its limit, typically $250,000 to $500,000. The injured parties still pursue compensation for lost wages, pain and suffering, and permanent disability. That’s where umbrella coverage steps in. It covers the gap between what your auto policy paid and what the court awards. Legal defense costs also mount quickly in serious injury cases. Attorneys charge $200 to $400 per hour, and a complex multi-party lawsuit can consume 100+ hours before trial. Your umbrella policy covers these defense expenses in addition to any judgment amount, protecting both your finances and your legal representation.

Property Liability Exposes More Than You Think

Your homeowners policy covers slip-and-fall incidents on your property, but only up to its stated limit, typically $300,000. A guest slips on ice near your front steps, fractures their hip, requires surgery and six weeks of hospitalization, then files suit for pain, suffering, and lost income totaling $600,000. Your homeowners policy covers $300,000; the remaining $300,000 judgment becomes a personal liability. Dog bites present even sharper risk. The CDC reports that roughly 4.5 million dog bites occur annually in the United States, with approximately 27,000 requiring reconstructive surgery. A serious dog bite claim can easily exceed $250,000 in medical costs, scarring treatment, and psychological damages. In Washington, dog owners carry strict liability, meaning you’re responsible regardless of the dog’s prior behavior or your negligence. If your homeowners policy caps dog liability at $250,000 and the claim reaches $500,000, your umbrella coverage bridges that $250,000 gap plus covers legal defense.

Other Property Incidents That Trigger Claims

Any incident on your property that injures someone-a trampoline accident, a pool drowning, a guest injured during a gathering-can generate five-figure to seven-figure claims that your base homeowners policy cannot fully cover. A teenager breaks their neck on your trampoline and faces $400,000 in medical costs plus lifetime care needs. A neighbor’s child nearly drowns in your pool and requires emergency treatment costing $75,000. These events happen to real families in Kitsap County. Your homeowners liability coverage stops at its limit, leaving you exposed to the remainder. Umbrella coverage isn’t optional for property owners; it’s the difference between keeping your financial stability and losing it to a single bad event. Understanding your specific risks helps you determine the right coverage limits for your household situation.

Sizing Your Coverage to Your Real Financial Exposure

Calculate What a Court Can Actually Reach

List every asset you own that a court judgment can seize: your home value, investment accounts, vehicles, jewelry, and financial assets and future earning potential. This calculation differs from net worth-it focuses on what a judgment can actually reach. Washington State protects your primary residence to a certain extent, but rental properties, investment portfolios, and future wages have no such protection. If you own a $500,000 home, have $200,000 in retirement accounts, and earn $75,000 annually, a court judgment pursues all three categories. A $1 million judgment won’t stop at your house; it will pursue wage garnishment for years. Your umbrella limit should exceed your liquid assets plus several years of income, not just match your current net worth. Most people in Kitsap County underestimate this calculation and purchase coverage that’s too low.

Determine Your Actual Exposure Level

Your exposure multiplies significantly if you own rental properties, operate a business from home, have a trampoline or pool, or frequently host gatherings. Landlords face the highest risk-tenant disputes, injuries on rental properties, and fair housing violations generate claims regularly. Your umbrella limit should reflect this elevated exposure, potentially $2 million or higher depending on your portfolio size. A $1 million umbrella policy costs roughly $200 to $400 per year for most homeowners, making it remarkably affordable compared to the financial catastrophe it prevents.

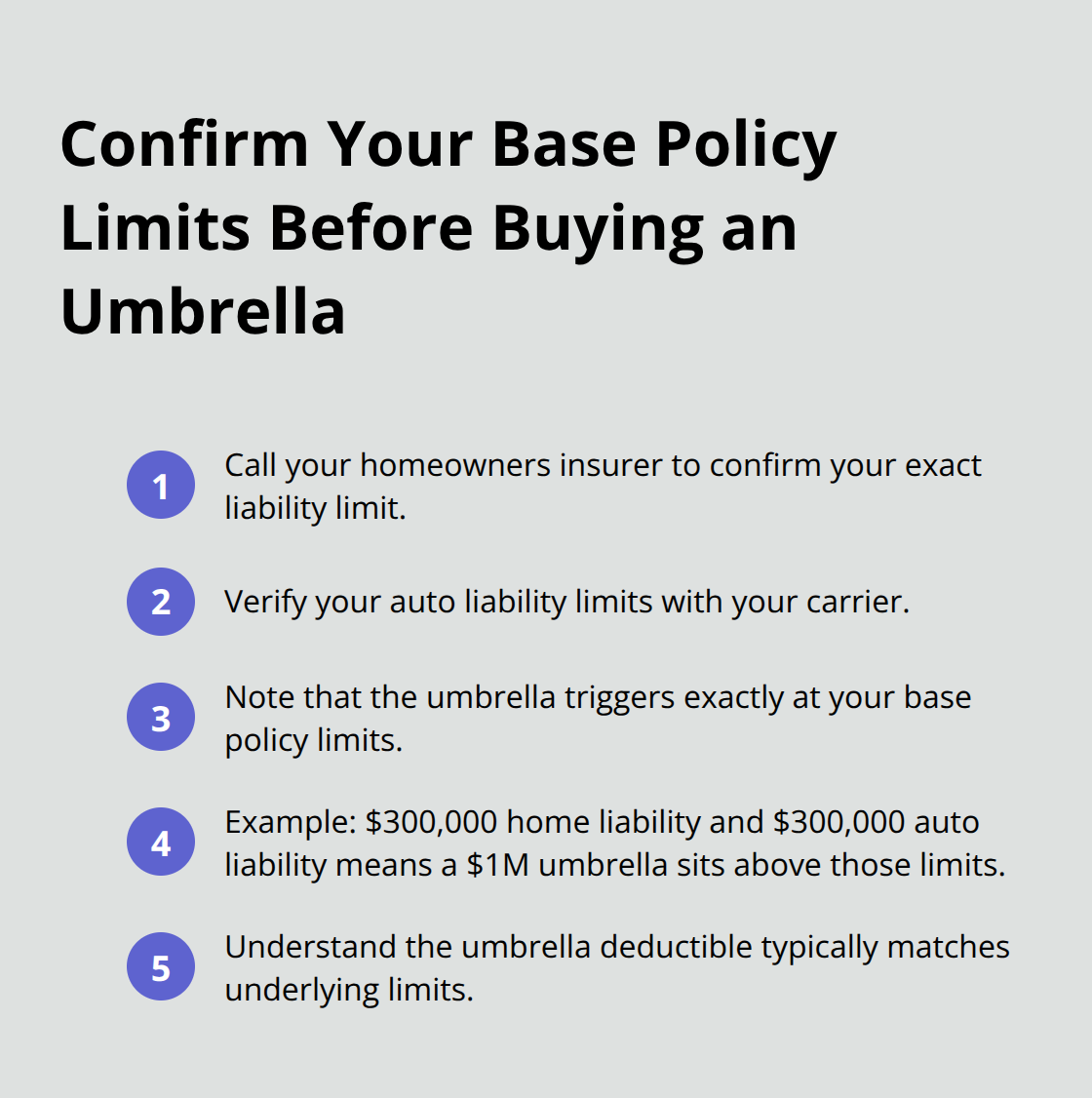

Know Your Base Policy Limits Exactly

Contact your homeowners insurer and request your specific liability limit-most policies cap at $300,000, but some go higher. Do the same for your auto policy; limits typically range from $250,000 to $500,000. Once you know these numbers, your umbrella activates at that exact threshold.

If your homeowners policy maxes at $300,000 and your auto at $300,000, a $1 million umbrella provides an additional $1 million beyond those combined limits. The deductible on your umbrella policy typically matches your underlying policy limits, so no separate out-of-pocket cost occurs when a claim triggers the umbrella-your base policies pay first, then the umbrella activates.

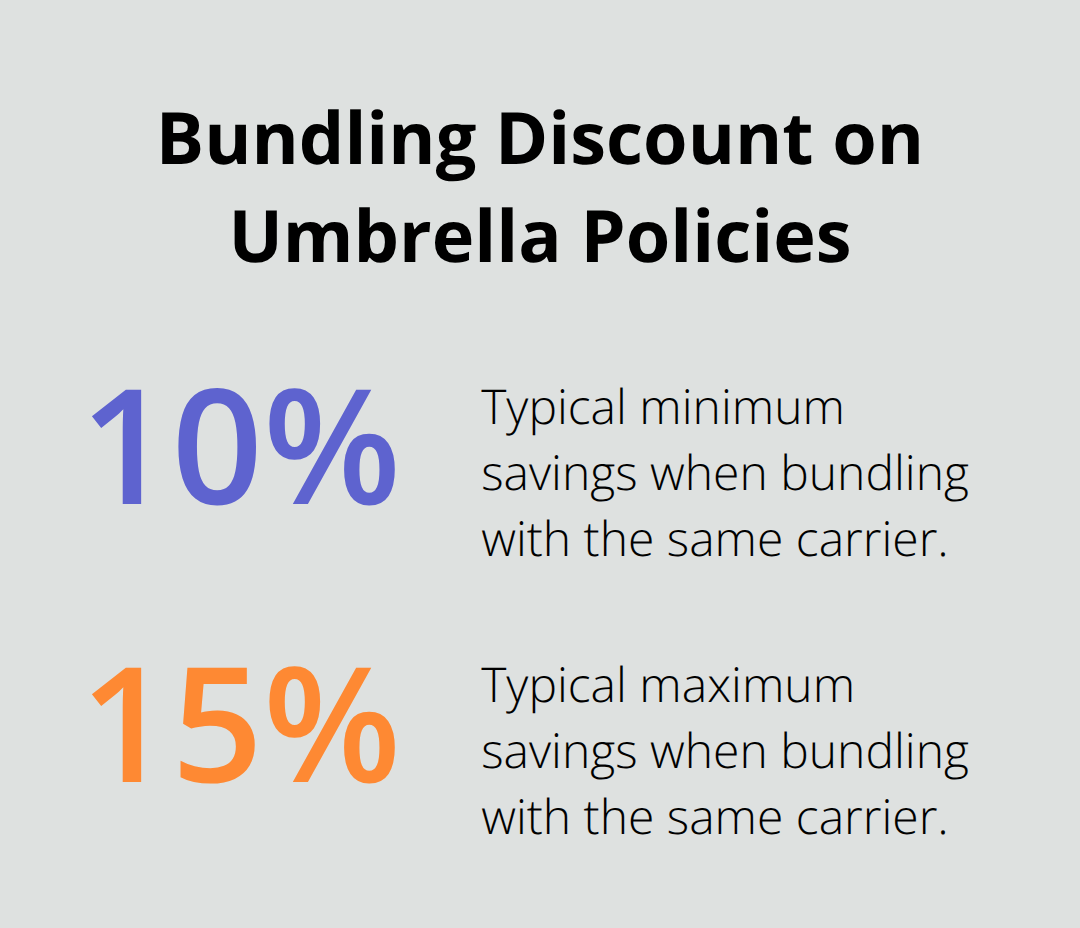

Structure Your Coverage for Maximum Savings

Bundling your umbrella with your auto and homeowners policies through the same carrier typically saves 10 to 15 percent on premiums compared to purchasing umbrella coverage separately. Multiple carriers serve the Kitsap County area, and comparing quotes across providers reveals significant price variations.

An independent agent who represents multiple carriers can show you bundled options that match your specific household composition, assets, and lifestyle risks. Don’t accept generic recommendations; your umbrella structure should reflect your actual exposure, not industry averages.

Final Thoughts

A single lawsuit destroys years of financial progress, but umbrella liability insurance in Kitsap WA prevents that outcome. The scenarios throughout this guide-serious car accidents, slip-and-fall incidents, dog bites, and property injuries-happen to real families in our region. Standard homeowners and auto policies simply don’t provide enough protection when damages reach $500,000, $1 million, or beyond.

Your umbrella coverage activates exactly when you need it most, covering legal defense costs and judgment amounts that would otherwise consume your assets and future earnings. The process of securing this protection requires only minutes, not months of research or complicated decisions. At H&K Insurance Agency, we serve the Puget Sound region with personalized insurance solutions tailored to your specific household, and as a locally owned, independent Bremerton agency, we represent multiple top carriers to compare rates and customize packages that match your actual exposure level.

Contact H&K Insurance Agency today to discuss your umbrella needs with someone who understands Kitsap County risks and your household situation. A $1 million umbrella policy typically costs $200 to $400 annually-a small investment that stands between financial stability and catastrophic loss. Your wealth deserves that protection.