Landlord Insurance Puget Sound: Protecting Rental Income Across The Region

Owning rental properties in the Puget Sound region comes with real financial exposure. Standard homeowners insurance won’t protect your rental income, and Washington’s liability laws create significant gaps in coverage that most landlords don’t realize until it’s too late.

At H&K Insurance Agency, we’ve seen landlords lose thousands because they didn’t have the right landlord insurance Puget Sound policies in place. The good news is that understanding your coverage options takes just a few minutes, and it can save your entire investment.

Why Landlord Insurance Protects What Homeowners Policies Cannot

Standard Homeowners Policies Exclude Rental Properties

Your standard homeowners insurance policy explicitly excludes losses that occur when a property is rented long-term. This isn’t a fine-print technicality-it’s a fundamental gap that leaves landlords financially exposed. Insurance companies exclude rental properties because the risk profile changes dramatically once tenants occupy the space. Higher foot traffic, more people on the property, and reduced owner oversight all increase claim frequency and severity. If you file a claim on a rented property using a homeowners policy, the insurer can deny coverage entirely, leaving you to cover the entire loss out of pocket.

Washington’s Comparative Negligence Laws Create Liability Exposure

Washington’s comparative negligence laws make liability exposure particularly acute for landlords. Under Washington law, a property owner can be held partially liable even when a tenant or guest shares responsibility for an injury. Without landlord-specific liability protection, a single slip-and-fall injury could wipe out years of rental income. A standard homeowners policy provides liability limits typically between $100,000 and $300,000, which falls dangerously short in a region where medical costs and legal settlements run high. Landlord policies in Washington should start with at least $500,000 in liability coverage per occurrence, with many experienced investors carrying $1 million or more through umbrella policies.

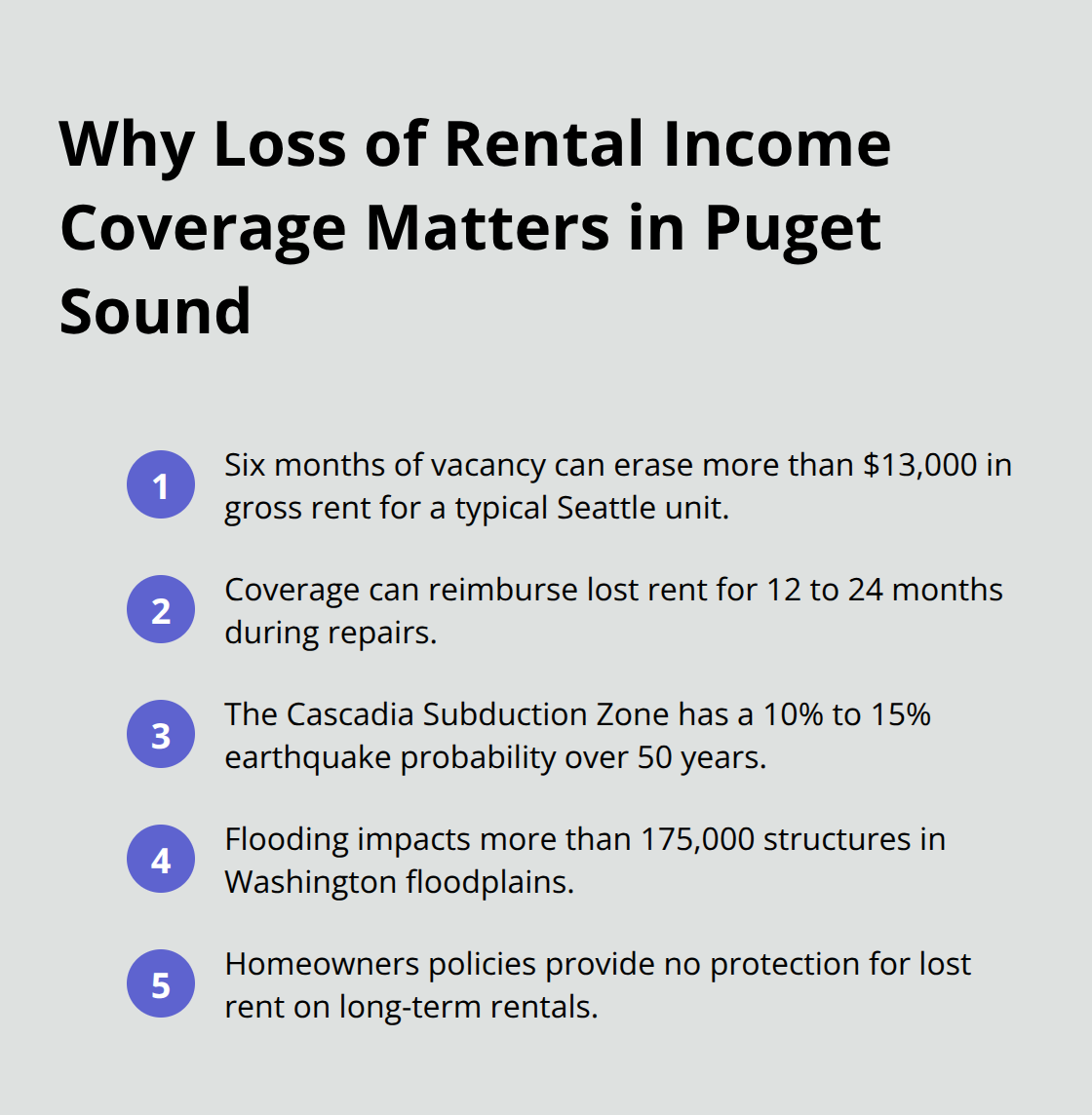

Loss of Rental Income Becomes Critical During Reconstruction

Loss of rental income coverage protects your cash flow when a covered peril renders a property uninhabitable. In Seattle’s rental market, a six-month vacancy could erase more than $13,000 in gross rent based on current market rates. This coverage reimburses actual lost rent during the reconstruction period, typically for 12 to 24 months. Standard homeowners policies provide zero protection here-you lose both the building and the income simultaneously. The Cascadia Subduction Zone presents a 10 to 15 percent chance of a magnitude 9.0 earthquake within the next 50 years, and flooding affects more than 175,000 structures in mapped Washington floodplains.

When disaster strikes, loss of rental income coverage becomes the difference between weathering a temporary loss and financial ruin. Understanding which coverage types address these specific risks helps you build a policy that actually protects your Puget Sound investment.

Coverage Types That Protect Your Puget Sound Rental Property

Dwelling Fire Coverage Requires Accurate Replacement Cost Estimates

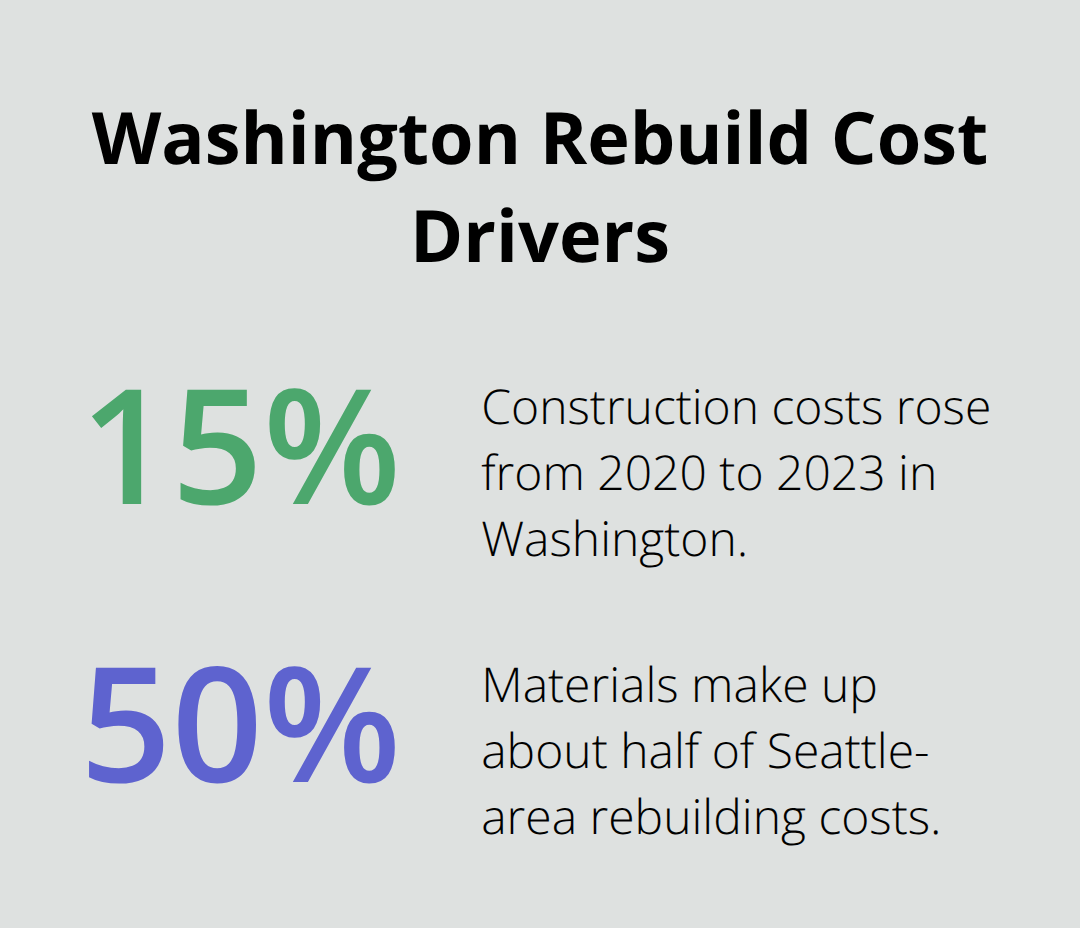

Dwelling fire coverage protects the physical structure of your rental building, but the dollar amount matters far more than most landlords realize. Washington construction costs rose nearly 15 percent from 2020 to 2023, according to data from the Washington State Office of the Insurance Commissioner. Seattle-area rebuilding costs now run roughly $350 to $500 per square foot, with materials accounting for about 50 percent of that expense.

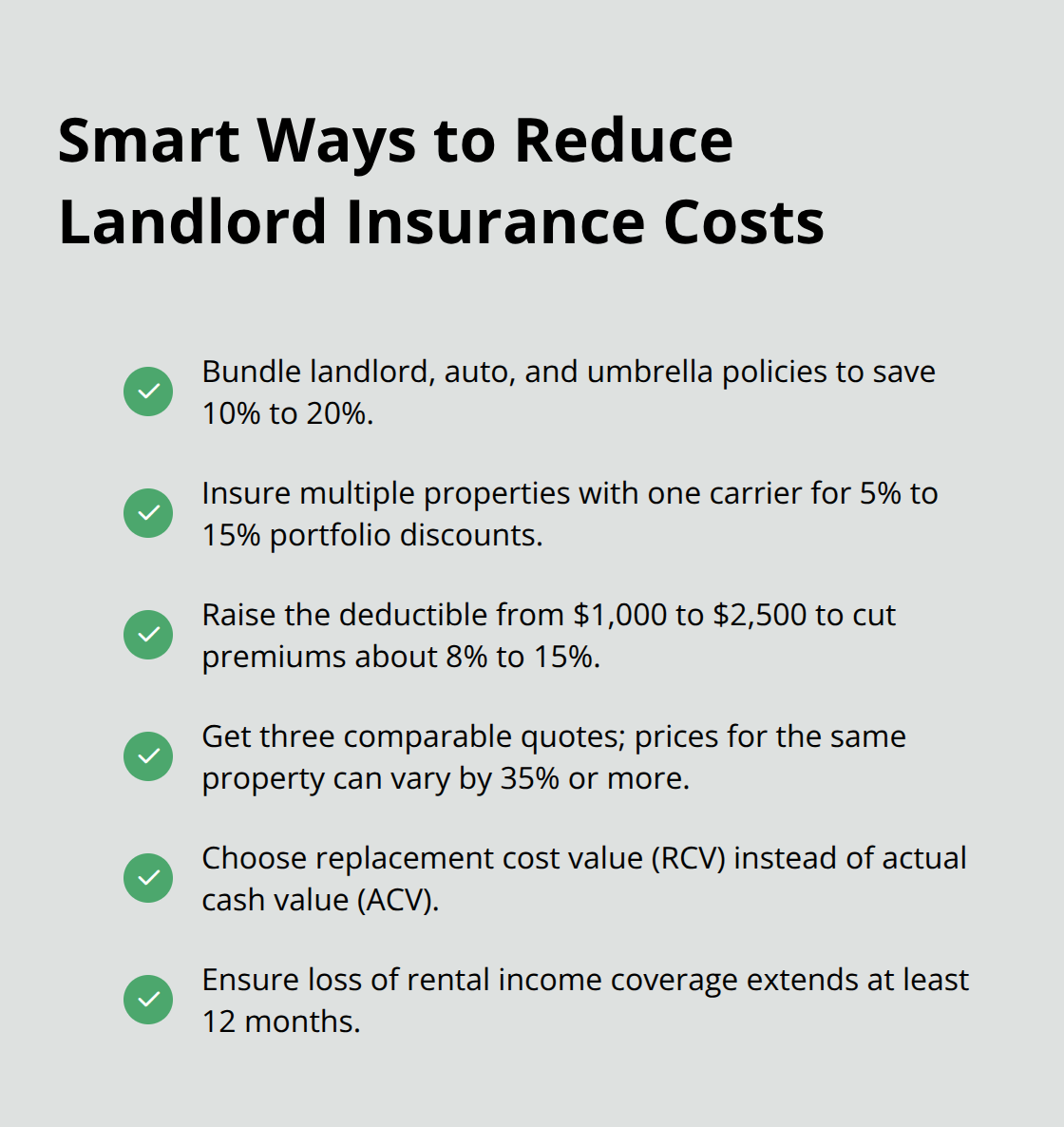

If you insure a $300,000 property with replacement cost value at actual replacement cost, you receive full protection if a fire destroys the building. But if you underestimate and carry only $250,000 in dwelling coverage, you’ll personally fund the $50,000 gap-a costly mistake that happens regularly. The Washington State Office of the Insurance Commissioner reported that average property damage claims by landlords exceeded $9,800 in 2022, meaning most claims fall within typical dwelling limits but the tail risk of major losses remains real. Choose DP-3 policies with replacement cost value, not actual cash value, because ACV depreciates your building protection year over year and leaves you severely underinsured after just a few years of ownership.

Liability Coverage Addresses Washington’s Comparative Negligence Exposure

Liability coverage protects you when a tenant or guest suffers injury on your property, and Washington’s comparative negligence laws make this far more expensive than most landlords expect. Liability covers bodily injury or property damage alleged to be the landlord’s fault. Start with at least $500,000 per occurrence in landlord liability, then layer an umbrella policy for $1 million or more if you own multiple properties or have high-risk features like decks or pools.

Loss of Rents Coverage Protects Your Income Stream

Loss of rents coverage reimburses actual lost rent when a covered peril renders units uninhabitable, protecting the income stream that justifies your entire investment. In Seattle’s market, losing six months of rent on a typical unit erases over $13,000 in gross income, so insure this coverage for at least 12 months of potential loss.

Flood and Earthquake Endorsements Fill Critical Gaps

Flood and earthquake coverage require separate endorsements or standalone policies because standard landlord policies exclude both perils entirely. The Cascadia Subduction Zone carries a 10 to 15 percent probability of a magnitude 9.0 earthquake in the next 50 years, and seismic endorsements typically cost $0.50 to $0.75 per $1,000 of insured dwelling value. Flood coverage through the National Flood Insurance Program costs between $900 and over $4,000 annually depending on elevation and foundation type, but FEMA maps identify more than 175,000 structures in mapped Washington floodplains where coverage becomes mandatory if you carry a mortgage. Water backup and sump pump failure endorsements add another layer of protection since standard policies exclude sewer backups-a critical gap in Puget Sound where heavy rainfall and aging infrastructure create frequent claims. Ordinance or law coverage pays for demolition, debris removal, and code-upgrade costs during rebuilding, typically running 10 to 25 percent of your dwelling limit depending on the age of your building. These specialized endorsements transform a basic landlord policy into comprehensive protection that actually covers the perils most likely to strike Puget Sound properties.

Selecting the Right Policy for Your Puget Sound Rental

Assess Your Property Type and Tenant Situation

Property type and tenant situation drive everything in landlord insurance selection, so start by honestly assessing what you actually own and who occupies it. A single-family home rented long-term requires different coverage than a multi-unit building or a short-term rental property. Short-term rentals like Airbnb units carry premiums 20 to 40 percent higher than long-term rentals, and many standard carriers exclude them entirely unless you purchase specialized riders. If you rent to long-term tenants, a DP-3 policy with replacement cost value forms your foundation. If you own multiple properties across King, Snohomish, or Pierce counties, you face different earthquake and flood risk profiles that affect both coverage needs and pricing. General Liability insurance shields the property owner from claims of bodily injury or property damage brought by third parties, including tenants, so your coverage limits must reflect realistic claim amounts plus inflation.

Obtain Multiple Quotes for Accurate Price Comparison

Obtain three separate quotes from different carriers using identical property information, because premium variation for the same property can exceed 35 percent depending on underwriting approach and regional surcharges. One carrier might charge $1,300 annually for a $300,000 dwelling while another quotes $1,750 for identical coverage, so shopping matters financially. Comparing coverage limits across carriers requires more than just looking at the dwelling amount. Check whether each quote includes replacement cost value or actual cash value for the building, verify liability limits start at $500,000 minimum, and confirm loss of rental income coverage extends for at least 12 months.

Leverage Bundling and Deductible Strategies to Cut Costs

Bundling your landlord policy with auto, umbrella, or other policies typically reduces your overall premium by 10 to 20 percent, and portfolio discounts apply when you insure multiple properties with the same carrier, often reducing costs by 5 to 15 percent. Raising your deductible from $1,000 to $2,500 cuts premiums roughly 8 to 15 percent, but only do this if you maintain adequate cash reserves to cover larger out-of-pocket losses. These strategies work together to lower your total insurance expense without sacrificing essential protection.

Prioritize Carrier Strength and Regional Expertise

When you select a carrier, verify they hold an AM Best rating of A- or higher and review their claim satisfaction scores through JD Power, because the cheapest quote means nothing if the insurer denies your claim or delays payment for months. Specialized landlord insurers understand Puget Sound-specific risks like earthquake and flood exposure better than generalist homeowners carriers, so prioritize agencies familiar with regional hazards when making your final selection. An independent agency representing multiple top local and national carriers can compare options and find coverage that matches both your risk profile and budget without forcing you into overpriced standard programs.

Final Thoughts

Landlord insurance in the Puget Sound region protects your rental income when standard homeowners coverage fails you completely. Washington’s comparative negligence laws, the Cascadia Subduction Zone’s earthquake threat, and flooding across 175,000 mapped structures mean disaster strikes without warning, and the right policy stands between financial recovery and catastrophic loss. A DP-3 policy with replacement cost value, liability limits starting at $500,000, loss of rental income coverage for at least 12 months, and specialized endorsements for flood and earthquake form the foundation every Puget Sound landlord needs.

Selecting that foundation requires more than reading policy documents alone-you need someone who understands regional hazards, knows which carriers deliver reliable claims service, and compares quotes across multiple providers to match your specific property and budget. An independent agency representing multiple top carriers assesses your property type, tenant situation, and risk profile, then presents options that address Puget Sound-specific exposures rather than pushing generic programs. They know which carriers excel at earthquake claims in King County, which ones handle flood losses efficiently, and where bundling opportunities exist to lower your total premium.

We at H&K Insurance Agency serve Puget Sound landlords with personalized landlord insurance that compares rates across multiple carriers and customizes packages including flood and earthquake coverage. Our team understands the region’s unique risks and helps you build a policy that protects your rental income without overpaying for unnecessary coverage. Protecting your rental income starts with the right policy, and the right policy starts with a conversation with someone who knows your market.