Homeowners Insurance Puget Sound: Finding Local Protection For Your Home

The Puget Sound region faces unique weather challenges that can damage your home in ways other parts of the country don’t experience. Rising property values mean your replacement costs are climbing faster than ever before.

At H&K Insurance Agency, we know that homeowners insurance in the Puget Sound area requires more than a generic policy. This guide walks you through what coverage you actually need, how to compare providers, and how to protect your investment.

Why Your Puget Sound Home Needs Real Protection

The True Cost of Underinsurance in Washington

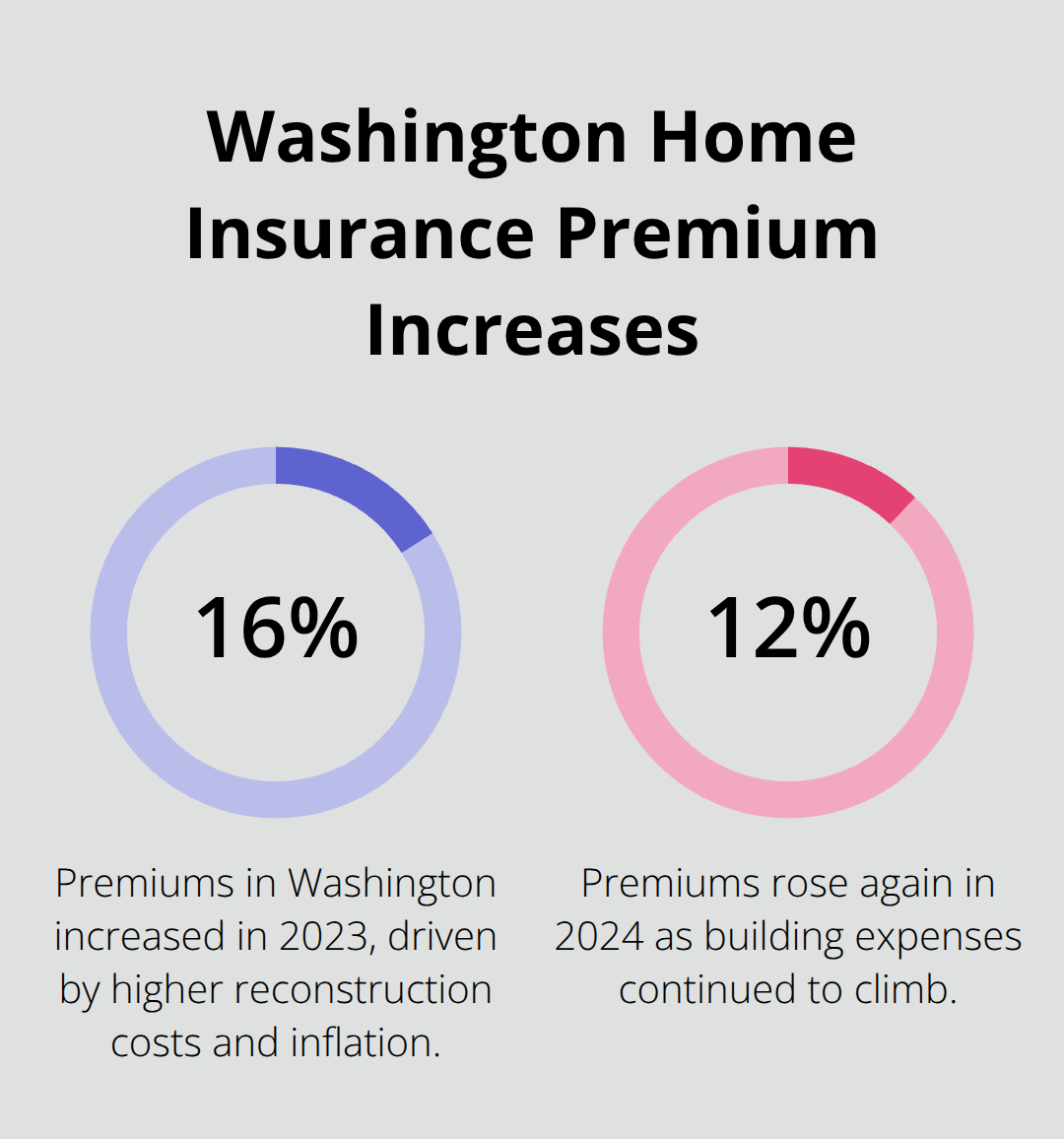

Washington homeowners paid an average of $1,410 annually for homeowners insurance in 2024, according to Quadrant Information Services, but that number masks a critical reality: the Puget Sound region’s specific risks demand far more than a standard policy. Premiums in Washington jumped 16% in 2023 and another 12% in 2024, driven by reconstruction costs and inflation that show no signs of slowing. Your replacement cost coverage must reflect current rebuilding expenses, not your purchase price from years ago.

If your dwelling coverage falls short, your insurer pays only what the policy limits allow, and you absorb the difference.

Water Damage: Your Most Frequent Threat

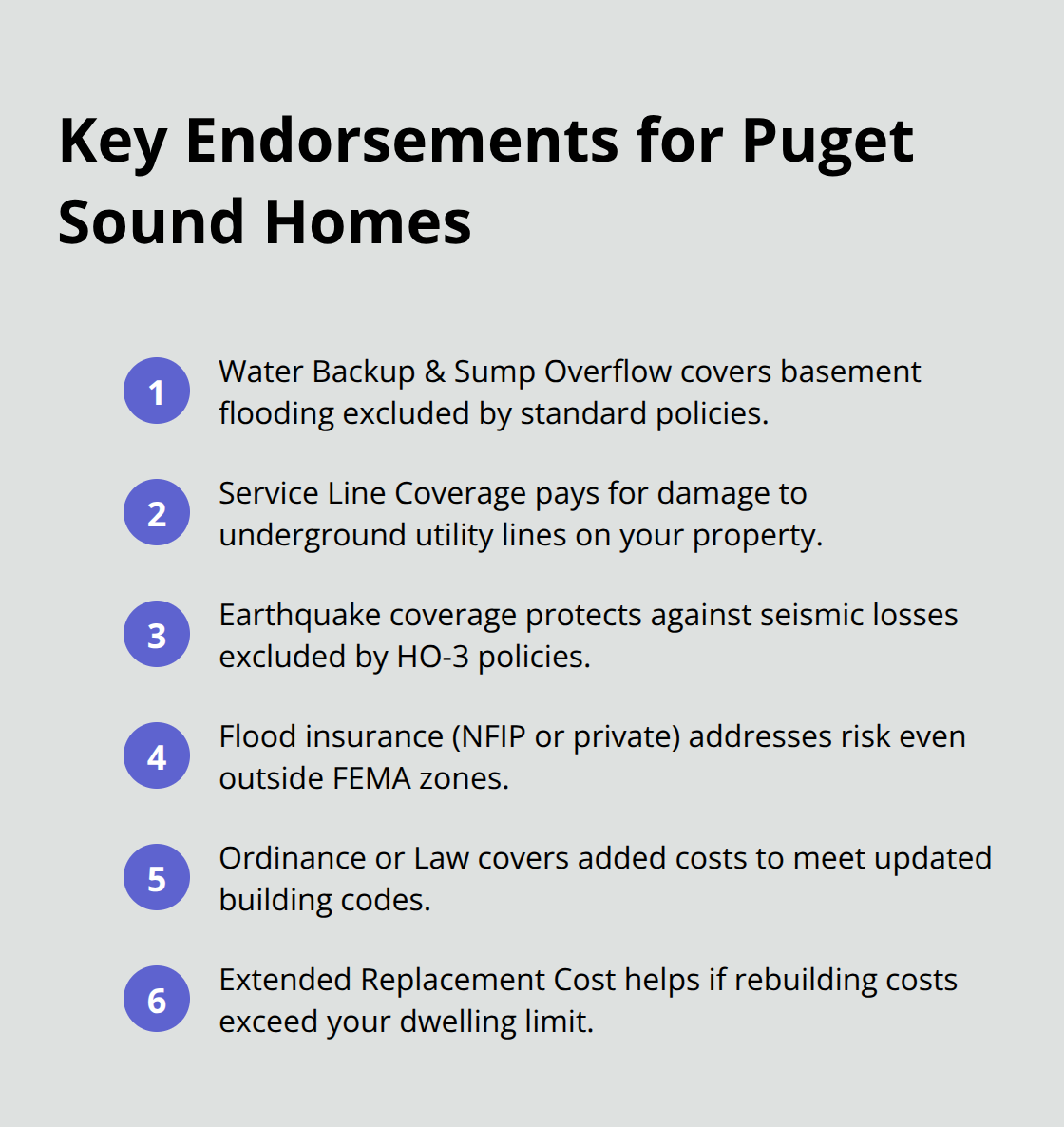

The wet climate here creates constant water damage exposure-your basement isn’t just a storage space, it’s a liability. Heavy rainfall, windstorms, and foundational moisture aren’t hypothetical concerns; they’re annual expenses for many homeowners who lack proper coverage. Water Backup and Sump Overflow coverage protects against costly basement flooding that standard policies exclude. Service Line Coverage handles underground damage from aging infrastructure, which affects many older Puget Sound homes. Properties outside official FEMA zones still flood regularly, and the National Flood Insurance Program or private flood insurance becomes necessary for real protection, not optional add-ons.

Earthquake Risk You Can’t Ignore

Standard HO-3 policies exclude earthquakes entirely, yet the Cascadia Subduction Zone sits directly beneath the Puget Sound, making seismic activity a genuine threat that most homeowners ignore until it’s too late. An earthquake endorsement or standalone policy addresses this gap that affects your entire region. Ordinance or Law coverage helps cover reconstruction costs tied to updated building codes after a seismic event. Extended Replacement Cost keeps pace with inflation and ensures your coverage doesn’t fall behind rising rebuilding expenses.

Wildfire and Liability Exposure

Eastern Washington faces rising wildfire exposure with carriers applying coverage limitations in high-risk areas. Liability protection matters equally-a lawsuit from someone injured at your property can devastate your finances without adequate limits. Washington’s new 60-day cancellation notice requirement starting July 2025 gives you more time to react, but only if you actively review coverage annually. Your policy should address your property’s actual risk profile rather than accept whatever a captive agent offers.

Finding Coverage That Matches Your Risks

The specific endorsements Washington homes actually need go far beyond standard policies. H&K Insurance Agency, a locally owned independent agency serving the Puget Sound region, represents multiple top carriers and compares rates to customize packages that address flood, earthquake, and other regional risks. Tailoring your protection to your property’s actual exposure-whether that means water backup coverage for a basement-prone home or earthquake protection for a coastal property-separates adequate coverage from real protection.

What Coverage Your Puget Sound Home Actually Needs

Dwelling and Personal Property Protection

Dwelling coverage must reflect your home’s current replacement cost, not what you paid for it five years ago. The Washington State Office of the Insurance Commissioner reports that reconstruction costs drove premiums up 16% in 2023 and 12% in 2024, meaning the value of your home to rebuild has shifted significantly. Your dwelling limit should cover the expense to reconstruct your entire structure from the ground up using current labor and material prices in the Puget Sound area. An HO-3 policy covers your home structure under named-perils protection, while an HO-5 offers broader open-perils coverage for both dwelling and personal property at a higher cost. Personal property coverage protects your belongings, but standard policies pay actual cash value, which means depreciation cuts into what you receive. Replacement cost coverage for personal property costs more but pays what you’d spend to replace items new, not worn.

Liability Protection and Umbrella Policies

Your liability limits protect you if someone sues after an injury at your property, and most mortgage lenders require minimum limits that frankly fall short of actual protection. A $300,000 liability limit sounds substantial until a serious injury case lands you in court, where medical expenses and legal fees mount quickly. Many Puget Sound homeowners carry $500,000 to $1,000,000 in liability protection through their homeowners policy combined with an umbrella policy, which costs far less than the exposure you’d face without it.

Deductibles and Premium Trade-Offs

Your deductible directly controls your premium, and choosing the wrong amount costs you money either way. A $500 deductible versus $1,000 might save you 10-15% on annual premiums, but if you file a water damage claim for $3,000, you’ll pay that deductible out of pocket regardless. Homeowners with emergency savings should accept higher deductibles to reduce premiums; those without should keep deductibles lower.

Water, Earthquake, and Flood Coverage

Water Backup and Sump Overflow coverage protects against basement flooding that standard policies exclude entirely, and in the Puget Sound’s wet climate, this protection addresses real exposure. Service Line Coverage handles damage from aging underground infrastructure affecting your home, a genuine concern in older neighborhoods throughout the region. Earthquake coverage remains separate from standard policies because the Cascadia Subduction Zone sits directly beneath you, making seismic risk genuine here, not theoretical. Flood insurance through the National Flood Insurance Program or private carriers becomes essential for properties within or near flood zones, and many homes outside official FEMA zones still experience flooding during heavy rainfall events.

Building Code and Cost Inflation Protection

Ordinance or Law coverage helps cover rebuilding costs tied to updated building codes after damage, particularly important after seismic events when code requirements jump significantly. Extended Replacement Cost ensures your dwelling coverage keeps pace with inflation and unexpected cost increases, protecting you if rebuilding expenses exceed your policy limit.

An independent agent can compare these specific endorsements across multiple carriers to build a package that addresses your property’s actual exposure rather than accepting a one-size-fits-all approach from a captive agent representing a single insurer. H&K Insurance Agency, a locally owned independent agency serving the Puget Sound region, represents multiple top carriers and customizes packages that address flood, earthquake, and other regional risks specific to your home.

Finding the Right Local Agent for Your Puget Sound Home

Why Independent Agents Outperform Captive Agents

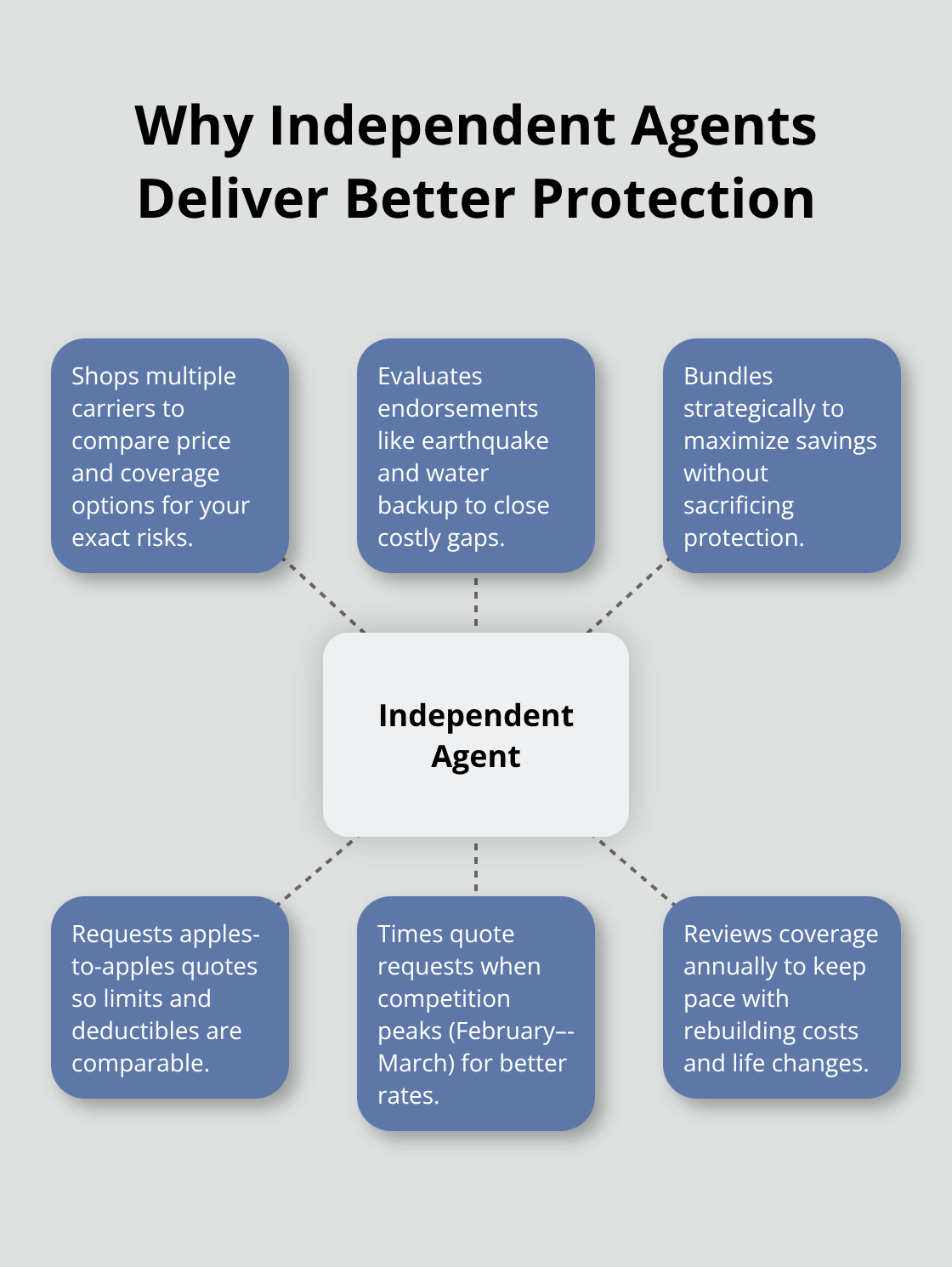

Independent agents represent multiple carriers, which means they can actually shop your coverage rather than lock you into one company’s offerings. Captive agents work for a single insurer and can only quote that company’s rates, leaving you blind to better options elsewhere.

When you contact an independent agent serving the Puget Sound, they pull quotes from several top carriers simultaneously, comparing not just price but the specific endorsements your property needs. This matters because a $50 annual savings means nothing if you’re missing earthquake coverage or water backup protection that costs $2,000 to claim later. An independent agent evaluates your complete risk profile and recommends which coverages to bundle for maximum savings without sacrificing protection.

Preparing Your Home Information for Accurate Quotes

Gathering your home details upfront speeds the quote process: square footage, roof type and age, construction quality, distance from fire services, claims history, and your desired deductible all influence pricing. Newer homes with impact-resistant roofing, monitored security systems, and updated electrical systems qualify for discounts that older properties don’t receive. The Washington State Office of the Insurance Commissioner now requires insurers to clearly explain why premiums increase, so you’ll see transparency that didn’t exist before. Start with three to five independent agents in your area and request quotes for the same coverage limits and deductibles to make apples-to-apples comparisons.

Bundling Strategies That Actually Save Money

Bundling auto and home insurance with one carrier typically yields 10-15% savings on both policies, which adds up quickly over time. If you own multiple vehicles or carry boat or RV coverage, consolidating everything amplifies your discount. However, bundling only makes financial sense if the bundled carrier’s rates remain competitive after the discount-some insurers offer steep discounts but start from higher base rates. Compare your total annual cost across all policies, not just the home insurance portion, to identify real savings. Properties in the Puget Sound region with multiple exposures benefit from independent agents who can bundle selectively: home and auto with one carrier, earthquake coverage with a specialist, and flood insurance through NFIP or a private carrier if your property sits in a flood zone.

Timing Your Quote Requests for Better Rates

The average cost of homeowners insurance in the U.S. is about $2,110 a year for $300,000 worth of dwelling coverage, but rates vary by state and depend entirely on your specific property, its location, age, and the endorsements you select. Request quotes in February or March when insurers compete most aggressively for new business, and don’t accept the first offer without shopping alternatives.

Final Thoughts

Protecting your Puget Sound home requires more than accepting whatever a single insurer offers. The region’s specific risks-water damage from constant rainfall, earthquake exposure from the Cascadia Subduction Zone, and rising reconstruction costs-demand coverage tailored to your property’s actual exposure. Standard policies leave gaps that cost thousands when claims happen, so your dwelling coverage must reflect current rebuilding expenses, not purchase price.

Finding the right homeowners insurance in the Puget Sound region means working with someone who represents multiple carriers and understands local risks. Independent agents compare quotes across several insurers simultaneously, identifying both competitive rates and the specific endorsements your home needs. Bundling auto and home policies typically saves 10-15% annually, but only if the bundled carrier remains competitive after discounts, so request quotes from three to five independent agents using identical coverage limits and deductibles to make fair comparisons.

Your next step is contacting a local independent agent who understands Puget Sound properties. H&K Insurance Agency serves the region as a locally owned agency representing multiple top carriers, customizing packages that address flood, earthquake, and other regional exposures while bundling coverages for maximum savings. Request quotes in February or March when insurers compete most aggressively for new business, and review your coverage annually as your home value and replacement costs change.