Homeowners Insurance Bremerton WA: Trusted Local Coverage

Your home in Bremerton is likely one of your biggest investments. That’s why homeowners insurance in Bremerton, WA isn’t optional-it’s essential protection against real financial loss.

At H&K Insurance Agency, we know that standard policies often leave gaps that can cost you thousands. This guide walks you through what coverage actually protects you, where most homeowners fall short, and how to build a policy that matches your specific situation.

Why Your Bremerton Home Needs Real Protection

Your home in Bremerton represents one of your largest financial assets. When that property sits at $500,000 to $800,000 or more of your net worth, losing it to an uninsured peril isn’t just inconvenient-it’s financially devastating. Your mortgage lender won’t allow you to skip this protection either. Every loan agreement requires homeowners insurance as a condition of financing, which means you must buy coverage regardless. The real question is whether you’re buying enough of it.

The specific risks that make Bremerton different

Bremerton’s geography creates insurance challenges most homeowners underestimate. The region experiences heavy winter rainfall and occasional severe wind events that damage roofs and cause water intrusion. According to NerdWallet’s analysis, Washington’s average homeowners insurance cost sits around $1,415 annually, roughly 33% below the national average of $2,110-but this discount exists precisely because the state has organized risk data well. Bremerton residents also face earthquake risk from the Puget Sound fault system and nearby Cascadia subduction zone, threats that standard homeowners policies explicitly exclude. Flood risk varies dramatically by neighborhood; some areas near low-lying zones face genuine exposure, while others have minimal flood danger. The Washington Office of the Insurance Commissioner recommends checking FEMA flood maps, but also consulting private models like First Street for a more detailed hazard assessment specific to your property. Fire risk in your area depends on proximity to forested areas and local wildfire patterns. Western Washington’s wet climate means fire risk here is lower than in Eastern Washington, but it’s not zero. Winter weather damage-frozen pipes, ice dams, snow load issues-is typically covered, though insurers won’t pay if damage results from negligence like leaving thermostats too low during extended absences.

What your mortgage lender actually requires

Your lender demands dwelling coverage sufficient to rebuild your home in full. This isn’t a guideline-it’s a legal requirement embedded in your mortgage documents. Most lenders require coverage equal to at least 80% of your home’s replacement cost, though many demand 100%. If you underinsure and suffer a total loss, your lender can force you into a costly force-placed policy. The liability portion of your policy protects your personal assets if someone is injured on your property and sues. Most policies come with $100,000 to $300,000 in liability coverage, but if you have significant assets, that limit may be dangerously low.

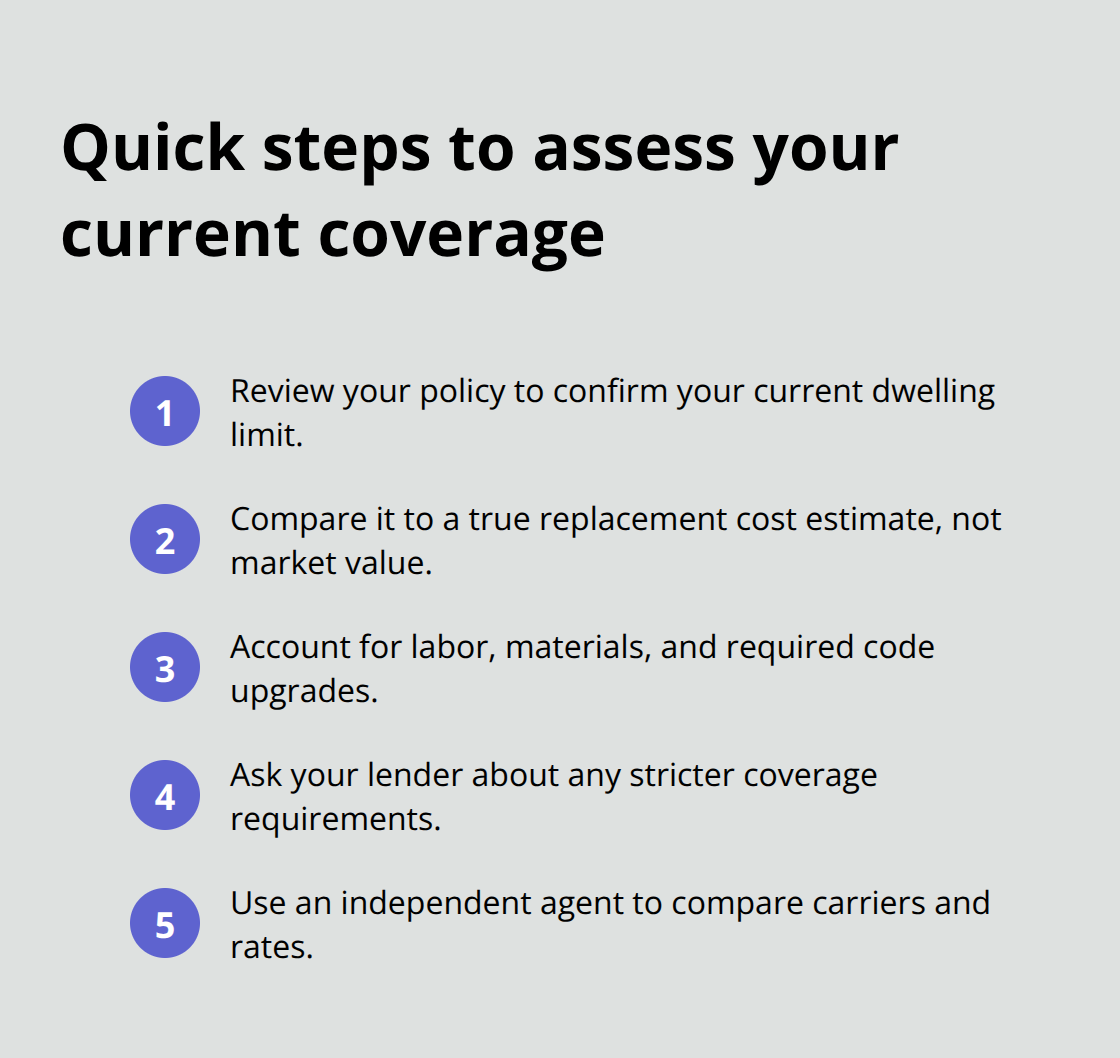

How to assess your current coverage

Start by reviewing your existing policy documents to identify what your current dwelling coverage actually covers. Compare that figure against your home’s true replacement cost-not its market value, which often differs significantly. Many homeowners underestimate replacement costs because they don’t account for labor, materials, and code upgrades required after a loss.

Talk with your lender about their specific requirements, as some impose stricter standards than others. An independent agent who represents multiple carriers can help you compare quotes and identify which insurers offer the best rates for your specific risk profile in the Bremerton area.

Understanding what your home actually costs to rebuild and what your lender legally requires sets the foundation for the next critical step: evaluating what your policy actually covers and where gaps might exist.

What Your Policy Actually Covers

Dwelling Coverage: The Foundation of Your Protection

Dwelling coverage forms the foundation of your homeowners policy, and most Bremerton homeowners miscalculate this number. Your dwelling limit should equal your home’s full replacement cost, not its market value. A 2,000-square-foot home in Bremerton might sell for $650,000 but cost $750,000 to rebuild after a total loss because reconstruction requires current labor rates, materials, and code-compliant upgrades. According to MoneyGeek’s analysis, Washington homeowners with a $250,000 dwelling limit pay roughly $1,380 annually on average, while those insuring to $1 million in dwelling coverage pay around $4,987 annually. The difference isn’t just about the number-it’s about whether you can actually rebuild.

Personal Property and High-Value Item Protection

Personal property coverage protects your belongings inside the home, typically at 50–70% of your dwelling limit. This covers furniture, electronics, clothing, and kitchen items. However, this coverage has sub-limits for specific categories. High-value items like jewelry, art, or collectibles hit their sub-limits fast. If you own a vintage motorcycle or fine art, standard personal property won’t cover the full replacement cost. You’ll need specialty endorsements to protect those assets adequately.

Liability Coverage and Additional Living Expenses

Liability coverage protects you when someone is injured on your property and sues. Most policies start at $100,000, but MoneyGeek’s data shows that adequate coverage often costs less than you’d expect when bundled strategically. Additional living expenses coverage pays for hotel, meals, and other costs if your home becomes uninhabitable after a covered loss. Most policies include this automatically, but verify your limit-$10,000 to $20,000 is standard, though some carriers offer higher limits for an additional premium.

Deductibles: The Hidden Cost in Your Premium

Deductibles matter more than most people realize when comparing quotes. A $500 deductible costs significantly less than a $1,000 deductible, but only if you’re willing to pay that amount out of pocket after a claim. Many Bremerton homeowners choose $1,000 or higher because they rarely file claims and want lower premiums, but this creates risk if you face water damage or weather loss. The trade-off between monthly savings and out-of-pocket exposure determines whether your deductible choice actually serves your financial situation.

Getting Real Numbers on Coverage Options

When you’re ready to compare coverage options, an independent agent representing multiple carriers shows you how different deductible and limit combinations affect your actual premium. You see the real cost of each option side by side, rather than guessing at numbers that sound reasonable. This comparison reveals whether a higher deductible truly saves money or whether a slightly higher premium buys you better protection. The next step involves identifying what your standard policy doesn’t cover-and those gaps can cost you far more than any premium difference.

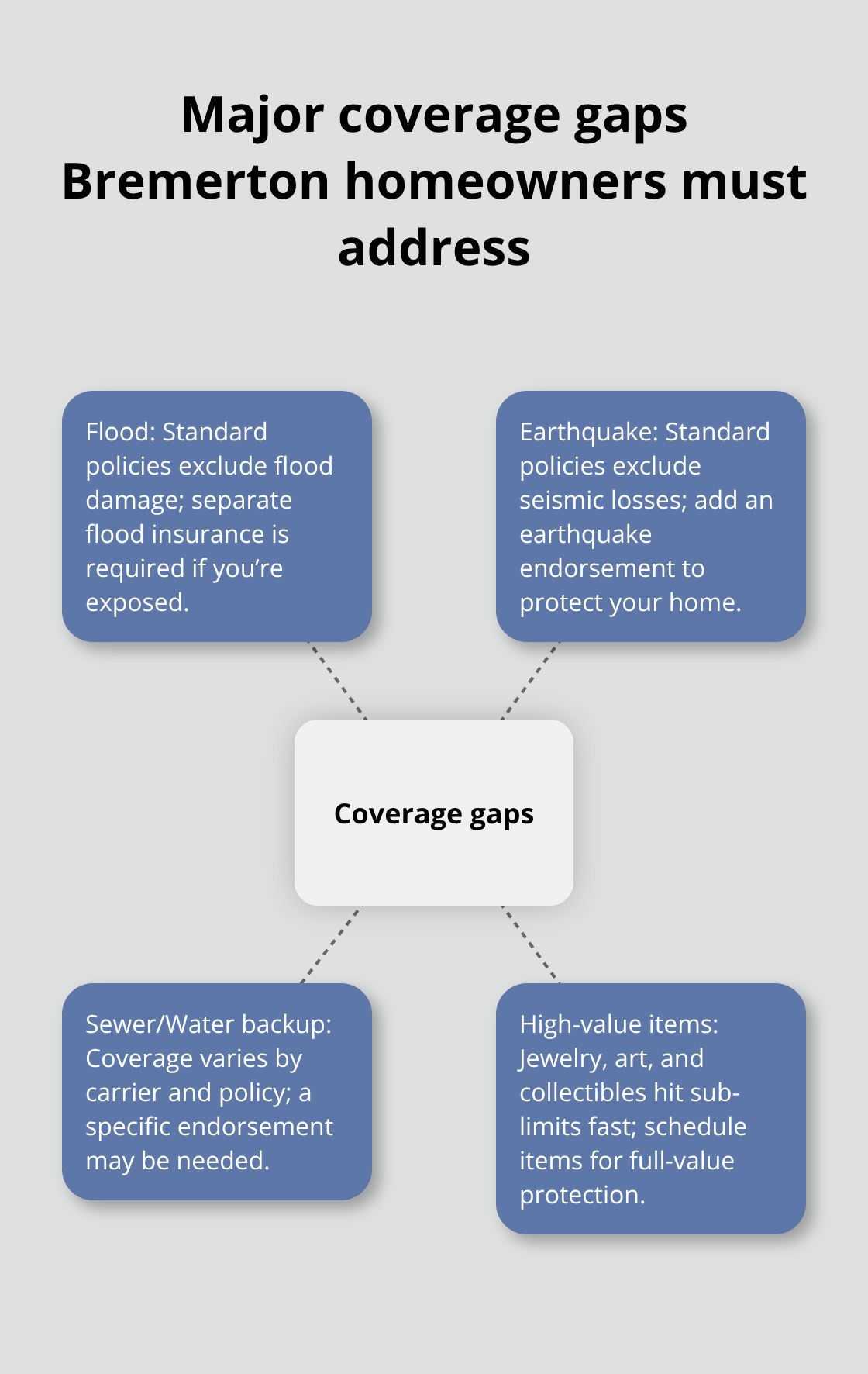

Common Gaps in Homeowners Policies and How to Address Them

Standard homeowners policies contain hard exclusions that leave Bremerton residents exposed to significant financial risk. Flood damage isn’t covered, period. Earthquake damage isn’t covered either. Water damage from backed-up sewers sits in a gray area depending on your carrier and specific policy language.

These aren’t minor gaps-they’re the difference between a manageable loss and financial ruin.

Flood Insurance: A Separate Policy You Actually Need

According to NerdWallet’s guidance, flood damage represents one of the most common homeowners claims nationwide, yet standard policies explicitly exclude it. If your Bremerton home sits in a flood-prone area near streams, low-lying zones, or areas with poor drainage, you need separate flood insurance. FEMA flood maps provide a baseline assessment, but First Street’s private risk models often reveal more detailed hazard ratings specific to your exact property.

Many homeowners discover they’re in a flood zone only after submitting a claim, which is too late. Flood insurance through the National Flood Insurance Program carries a mandatory 30-day waiting period before coverage activates, meaning you cannot buy it today and receive protection tomorrow. If you live in a high-risk flood zone, purchasing now protects you starting 30 days later, not immediately. The cost varies dramatically by risk level-properties in high-risk zones pay significantly more than those in moderate or low-risk areas. Your lender will require flood insurance if your home sits in a high-risk flood zone, so check your mortgage documents and contact your lender about their specific flood requirements for your property.

Earthquake Coverage for Pacific Northwest Exposure

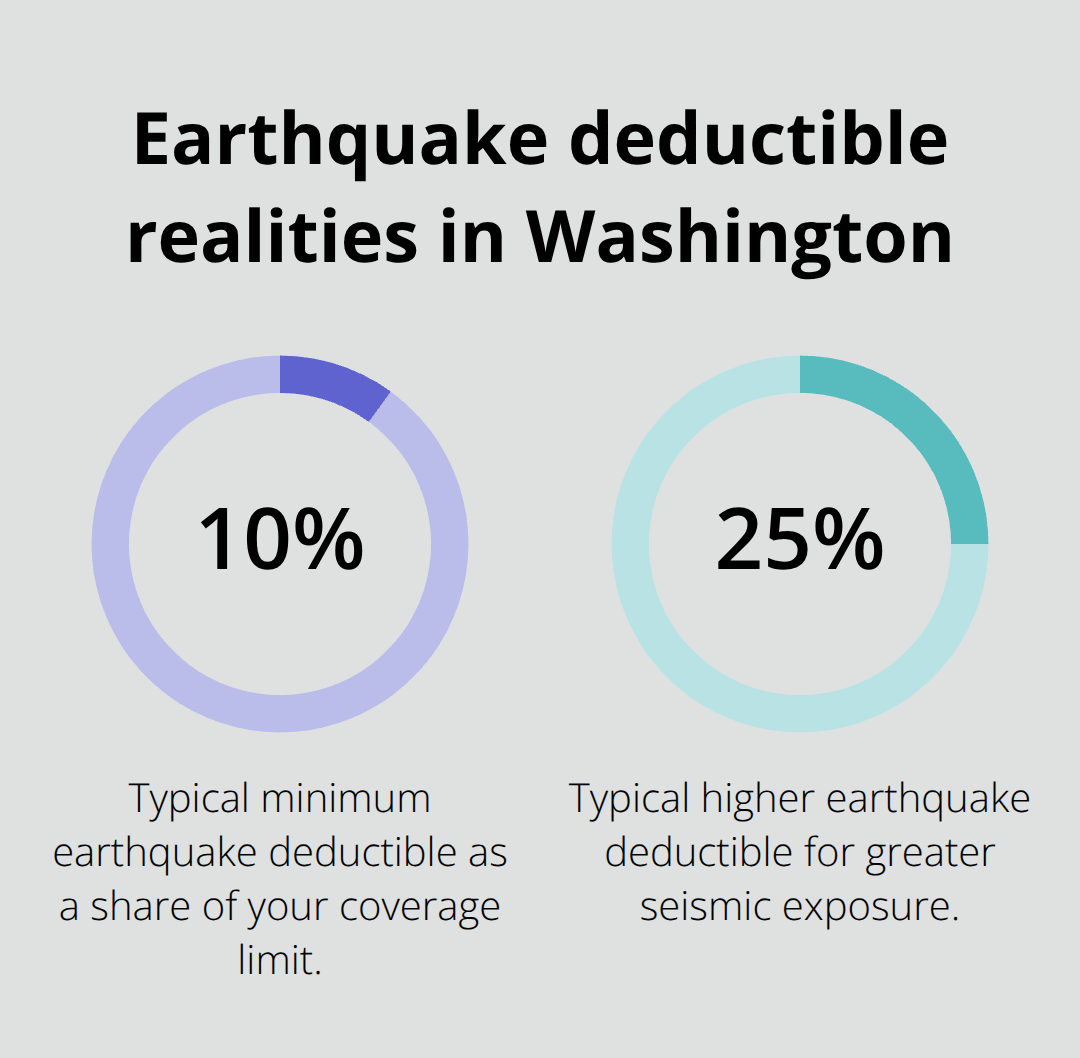

Earthquake coverage is equally critical in the Pacific Northwest, yet most Bremerton homeowners skip it because they underestimate the risk or assume standard coverage applies. The Puget Sound fault system and Cascadia subduction zone create genuine seismic exposure that standard policies exclude entirely. Earthquake insurance adds a separate endorsement to your homeowners policy, with deductibles typically ranging from 10 to 25 percent of your coverage limit rather than the $500 or $1,000 deductibles you see on standard policies.

This means if you have $300,000 in dwelling coverage and a 15 percent earthquake deductible, you would pay $45,000 out of pocket before earthquake coverage kicks in. The higher deductible reflects the catastrophic loss potential from a major seismic event. Earthquake premiums in Washington vary by location and home construction type, but they’re generally affordable enough that skipping coverage makes no financial sense.

Specialty Endorsements for Valuable Items

For valuable items like jewelry, art, collectibles, or specialty vehicles, standard personal property coverage won’t protect you adequately. Jewelry typically has a $1,500 to $2,500 sub-limit on standard policies, meaning a $15,000 engagement ring receives only partial coverage. Fine art, antique furniture, and classic vehicles need scheduled personal property endorsements that list items individually with their agreed values.

These endorsements cost extra but eliminate the guesswork about what you’ll actually receive after a loss. When you work with an independent agent who represents multiple carriers, you can compare costs for earthquake, flood, and specialty endorsements. This approach allows you to customize protection that actually matches your situation and assets rather than accepting standard limits that leave you underprotected.

Final Thoughts

Your Bremerton home deserves protection that matches its actual value and your family’s specific situation. Standard homeowners insurance provides a foundation, but gaps in flood coverage, earthquake protection, and high-value item limits leave most homeowners exposed to losses they didn’t anticipate. The cost of addressing these gaps upfront is far smaller than the financial devastation of discovering them after a claim.

Homeowners insurance in Bremerton, WA isn’t one-size-fits-all because your home’s age, construction type, location within the city, and the assets inside it all affect what coverage you actually need. A home near Puget Sound faces different risks than one in the foothills, and a property with a vintage art collection needs different protection than one without. Your mortgage lender’s specific requirements may exceed standard minimums, which means comparing quotes from multiple carriers reveals real differences in price and coverage options that matter to your situation.

At H&K Insurance Agency, we serve Bremerton and the surrounding Puget Sound region by comparing coverage options from multiple insurers so you get the right protection at competitive prices. We customize your policy to match your actual needs rather than selling you a single company’s standard package, and we bundle coverage with auto insurance to maximize your savings. Contact H&K Insurance Agency today to compare quotes and build a policy that protects what matters most.