Classic Car Auto Insurance: Protecting Your Collector On The Road

Your classic car represents years of passion and investment. Standard auto insurance policies simply don’t account for the unique value and specialized needs of collector vehicles.

At H&K Insurance Agency, we understand that classic car auto insurance requires a completely different approach than protecting everyday cars. This guide walks you through the coverage options, valuation methods, and policy choices that actually protect what you’ve built.

Why Your Classic Car Needs Different Protection

Classic cars appreciate in value, but standard auto insurance treats them like depreciating daily drivers. The Insurance Information Institute confirms that classic cars are typically at least 25 years old and require fundamentally different coverage than regular vehicles. A 1972 Chevrolet Chevelle worth $45,000 today will likely be worth more in five years, yet a standard policy would pay you based on depreciated actual cash value if it were totaled tomorrow. This gap between what your car is actually worth and what you’d receive is why classic car insurance exists.

How Appreciation Changes Everything

Your collector vehicle probably appreciates 5-10% annually depending on condition and market demand, according to Hagerty’s market data. Standard insurance uses actual cash value, which assumes depreciation-the opposite of what happens with classics. Agreed value coverage locks in a specific payout amount before you file a claim. This matters enormously because if your 1965 Ford Mustang receives an appraisal of $38,000 and you agree to that value with your insurer, that’s exactly what you receive if it’s declared a total loss, regardless of market fluctuations. A standard policy would instead calculate what similar Mustangs sold for recently, subtract depreciation factors, and likely pay significantly less. Classic car owners who’ve experienced total losses report receiving 30-50% less than their vehicle’s true collector value under standard policies.

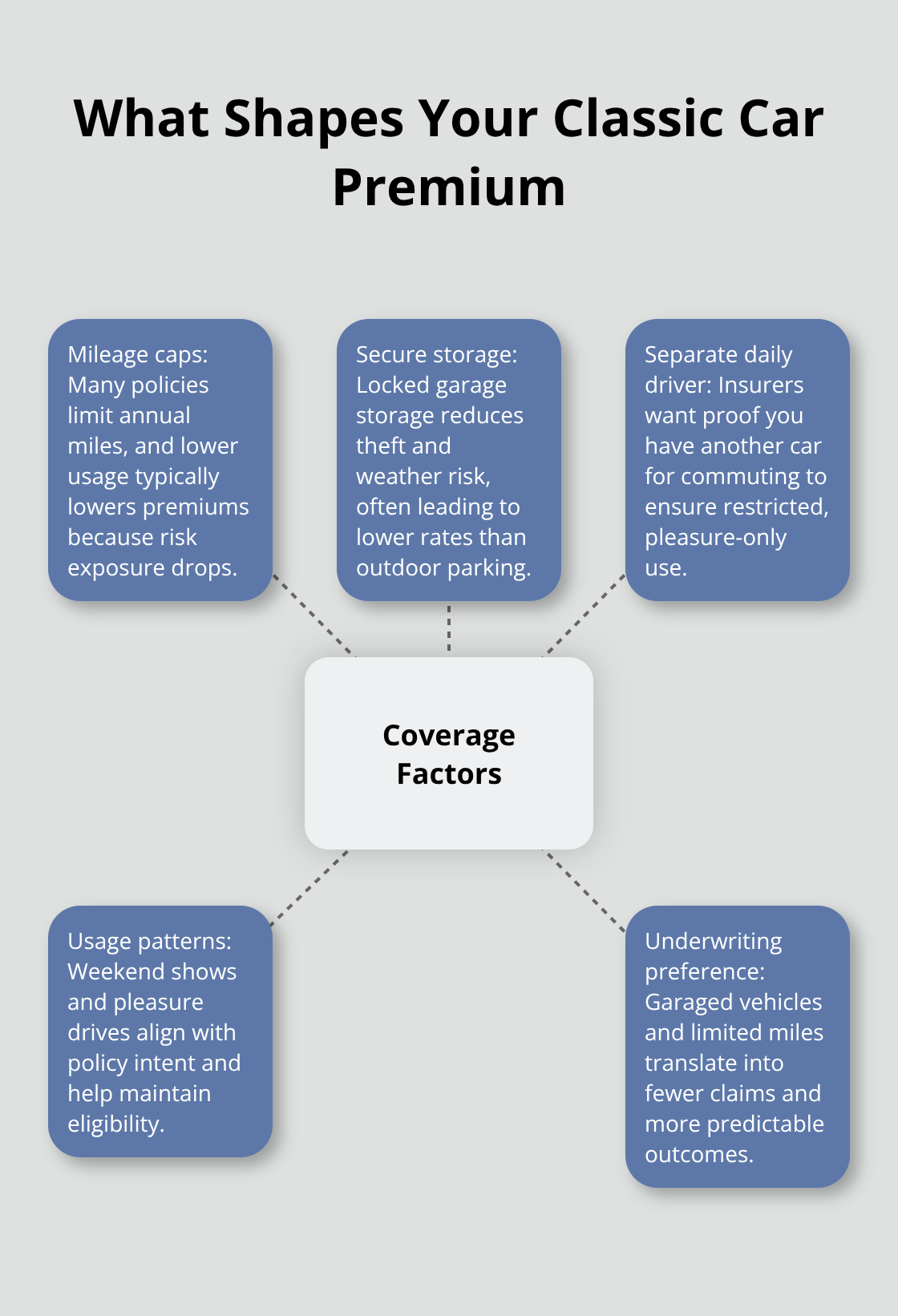

Storage and Mileage Shape Your Coverage

Classic cars aren’t commuter vehicles, and insurers price them accordingly. Most policies cap annual mileage at 7,500 miles, though some allow up to 10,000. American Modern Collector Vehicle Insurance, for example, offers flexible mileage options of 1,000, 3,000, 6,000, or unlimited miles, letting you match coverage to your actual driving. Storage location dramatically affects premiums-a car kept in a locked garage costs significantly less to insure than one stored outside. Underwriters favor garage storage because it reduces theft and weather damage risk. Your driving patterns also determine eligibility; most carriers require proof that you own a separate daily-driver vehicle and maintain a regular auto policy alongside your classic coverage.

This requirement exists because classic car policies aren’t designed for regular commuting, and insurers want confirmation you use the car for weekend shows, pleasure drives, and collector events rather than daily transportation.

What Separates Agreed Value From Standard Payouts

When you select agreed value coverage, you and your insurer establish a specific amount that you’ll receive in a total loss scenario. This approach differs fundamentally from actual cash value, which accounts for depreciation and market conditions at the time of loss. An appraisal typically supports the agreed value, and many insurers require a re-appraisal at the start of each policy term to reflect any changes in your vehicle’s condition or market value. If your classic car has undergone restoration work or received upgrades, agreed value coverage can reflect those improvements-something standard policies won’t do. The predictability of agreed value appeals to collectors because it removes uncertainty; you know exactly what you’ll receive, and that amount won’t shrink due to market shifts or depreciation assumptions.

Eligibility Requirements Protect Both You and Your Insurer

Most classic car policies establish clear eligibility criteria to ensure the vehicle receives appropriate coverage. Insurers typically require that your classic car be at least 25 years old, stored in a locked garage or secure facility, and maintained in good working condition. The requirement for a separate daily-driver vehicle isn’t arbitrary-it confirms that you’re using your collector car for its intended purpose: weekend cruising, shows, and pleasure driving rather than commuting. A clean driving record strengthens your application and helps keep premiums lower. These standards exist because classic cars present lower risk when used appropriately; fewer miles and restricted usage translate into fewer claims and more predictable outcomes for insurers.

Understanding these differences positions you to select coverage that actually protects your investment. The next section explores the specific coverage options available and how to match them to your collector vehicle’s needs.

What Coverage Actually Protects Your Collector Car

Agreed Value Coverage Locks In Your Vehicle’s Worth

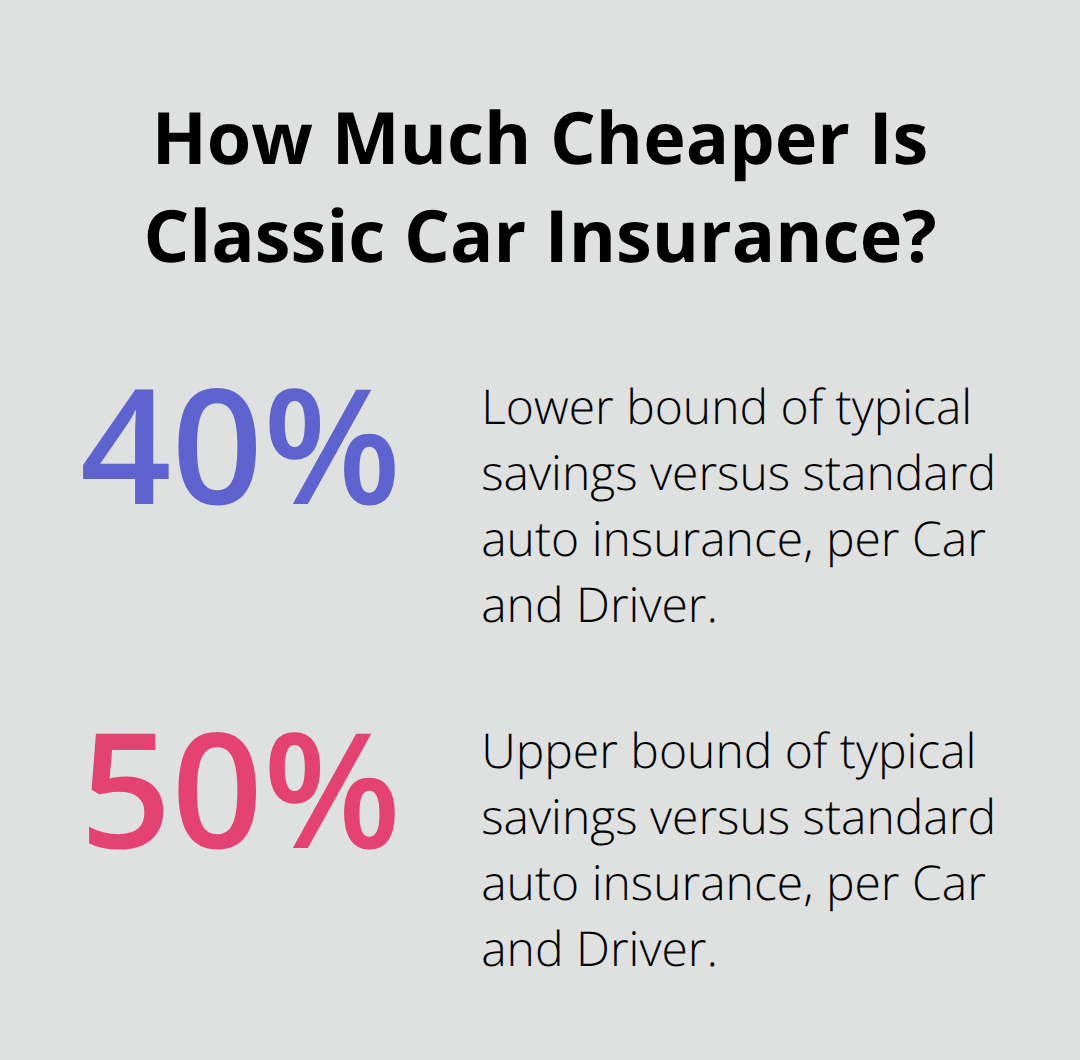

Agreed value coverage guarantees a specific payout amount established before any loss occurs. You and your insurer work together to set this value, typically supported by documentation like a professional appraisal, restoration receipts, or a detailed bill of sale. According to Car and Driver, classic car insurance generally costs between $200 and $600 per year-about 40% to 50% cheaper than standard auto insurance-precisely because agreed value removes the depreciation calculation that standard policies apply. The insurer pays that pre-set amount if your car is declared a total loss, regardless of market shifts or condition changes during the policy term. This approach protects you from scenarios where market values drop unexpectedly or where an adjuster disputes your vehicle’s actual cash value.

Many insurers require re-appraisal at policy renewal to reflect any restoration work, upgrades, or changes in market conditions, keeping your coverage aligned with your car’s real value. Hagerty’s data shows that classic cars appreciate 5% to 10% annually, and agreed value coverage captures those gains by allowing you to increase your coverage amount as your investment grows.

Specialized Parts Coverage Reflects Your Investment

Your collector vehicle likely contains original components or custom work that standard policies won’t adequately cover. American Modern Collector Vehicle Insurance offers up to $2,000 in spare parts coverage, while Hagerty includes $750 in tool coverage, protecting equipment and components you’ve accumulated for maintenance and restoration projects. If your classic car undergoes restoration work, many insurers allow you to increase agreed value by 10% per quarter up to specified limits, directly reflecting your investment in the vehicle. Chubb’s approach stands out by covering original equipment manufacturer parts or fabricated alternatives if originals aren’t available, recognizing that sourcing authentic components for older vehicles can be impossible. When selecting your policy, confirm whether the claims team will use original parts appropriate to your vehicle’s year and model rather than substituting cheaper aftermarket alternatives that diminish authenticity and resale value.

Roadside Assistance Tailored to Collector Vehicles

Standard towing services may not understand the specialized handling your vehicle requires, making specialized roadside assistance a valuable addition to your policy. Hagerty and other specialty carriers provide towing that respects original parts and restoration work, with coverage limits ranging from $250 to higher amounts depending on your policy tier. Transportation coverage during restoration-reimbursing you for rental or alternative transportation while your car receives work-is available from some carriers and proves valuable if your restoration timeline extends beyond a few weeks. These specialized services recognize that your collector car demands different treatment than everyday vehicles, protecting both the physical integrity of your investment and your peace of mind when unexpected situations arise.

The specific coverage options you select should match your vehicle’s condition, restoration status, and how you actually use your classic car. The next section walks you through comparing quotes from multiple carriers to find the policy that aligns with your collector’s needs and your budget.

Selecting the Right Policy for Your Collector

Document Your Vehicle’s Condition and History

Start by assembling photos of your classic car from multiple angles, restoration receipts, bills of sale, and maintenance records. If professionals completed work on your vehicle, organize those invoices carefully. This documentation forms your foundation when requesting quotes because insurers need concrete evidence to set agreed value. Take your vehicle to a professional appraiser who specializes in collector cars-not a general mechanic. A proper appraisal costs between $300 and $500 but directly influences your coverage amount and premium accuracy. During the appraisal, the specialist examines originality, condition, any upgrades or restoration work, and market comparables to establish fair value. Once you have that appraisal in hand, you’ll know the number to discuss with insurers.

Provide Accurate Information About Your Driving Habits

Be honest about annual mileage; if you drive your classic 5,000 miles yearly to shows and pleasure drives, state that clearly. Overstating mileage inflates your premium unnecessarily, while understating it creates coverage gaps if you’re ever in an accident. Your storage situation also matters significantly-confirm whether your vehicle sits in a climate-controlled garage, an unheated garage, or outdoor storage, because each scenario affects pricing differently. Insurers price policies based on actual usage patterns, so accuracy here prevents both overpaying and underinsuring your collector.

Request Quotes From Multiple Specialized Carriers

Comparing quotes requires reaching out to at least three carriers that specialize in collector vehicles rather than contacting only your current auto insurer. Hagerty, American Modern, Grundy, American Collectors, and Chubb each bring different strengths to the table. Hagerty excels for vehicles undergoing restoration with their quarterly value increases up to $25,000, while American Modern shines if you want flexible mileage options and lower spare parts coverage limits. Request identical coverage scenarios from each carrier-same agreed value amount, same deductible, same mileage limit-so you’re genuinely comparing apples to apples. One carrier might quote $280 annually while another quotes $450 for identical protection, and those differences matter when you’re protecting a five or six-figure asset.

Identify Discounts and Bundling Opportunities

Ask each insurer about discounts you actually qualify for: clean driving records, completing a defensive driving course, multiple policies bundled together, or membership in car clubs can reduce premiums by 10-25 percent depending on the carrier. Some insurers reward you for installing anti-theft devices or GPS tracking, which costs $200-400 upfront but might reduce annual premiums enough to pay for itself in two years. Bundling your classic car insurance with homeowners or renters coverage frequently yields better overall pricing than insuring them separately, though confirm that bundling doesn’t compromise the specialized coverage your collector vehicle needs. As an independent agency serving the Puget Sound region, H&K Insurance Agency represents multiple carriers and can help you compare these options to find the right fit for your classic car and budget.

Final Thoughts

Your classic car represents a financial and emotional investment that deserves protection matching its actual value. Standard auto insurance fails because it treats your collector vehicle like a depreciating daily driver, calculating payouts based on depreciation rather than appreciation. Classic car auto insurance solves this problem by using agreed value coverage, which locks in a specific payout amount before any loss occurs and protects you from market fluctuations.

Getting the right coverage requires three concrete steps. First, assemble your vehicle’s documentation: appraisal, restoration receipts, photos, and maintenance records. Second, request quotes from multiple specialized carriers using identical coverage parameters so you can compare pricing and features. Third, explore bundling opportunities and available discounts that reduce your overall insurance costs while maintaining the protection your collector deserves.

H&K Insurance Agency can guide you through this process as an independent agency serving the Puget Sound region. We represent multiple top carriers and specialize in classic car policies alongside auto, home, and specialty coverage. Contact us to request a custom quote tailored to your classic car’s value, usage patterns, and restoration status, and we’ll help you navigate agreed value coverage, specialized parts protection, and bundling options.