Your apartment is filled with belongings you’ve worked hard to acquire. Without renters insurance in Bremerton, WA, you’re financially exposed if theft, fire, or another disaster strikes.

Most renters assume their landlord’s insurance covers their possessions. It doesn’t. At H&K Insurance Agency, we help Bremerton renters understand what protection they actually need and how to get it affordably.

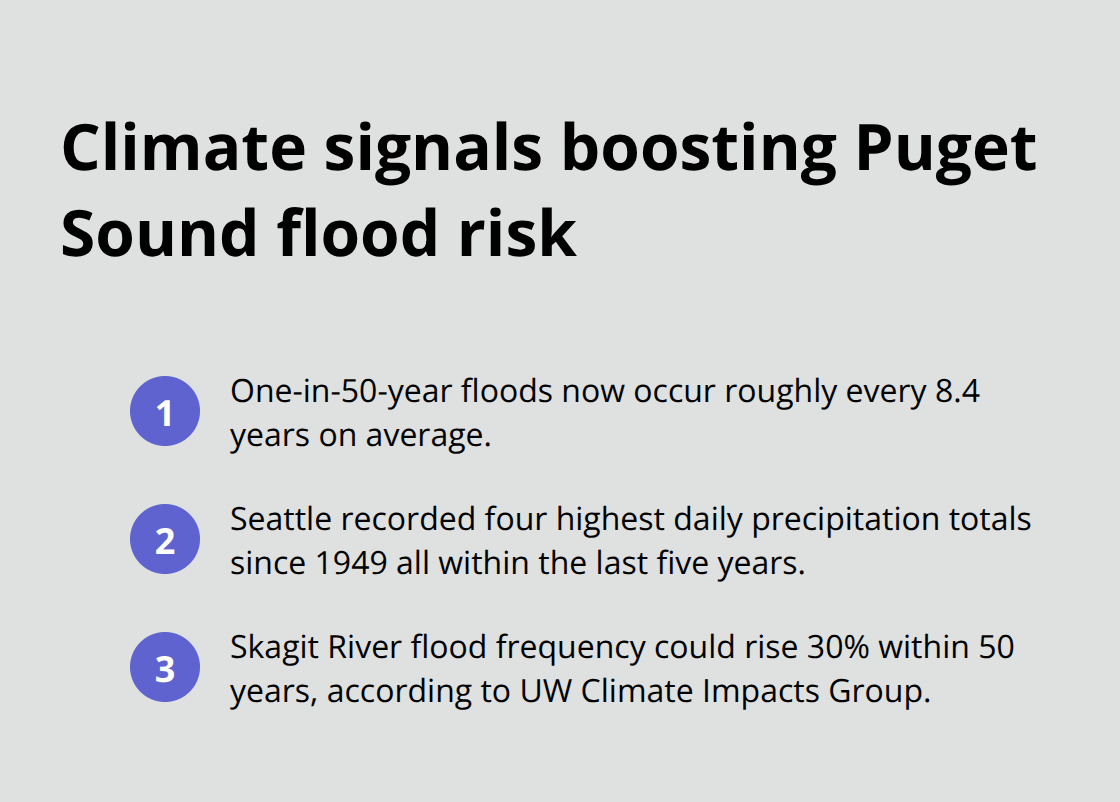

What Renters Insurance Actually Covers

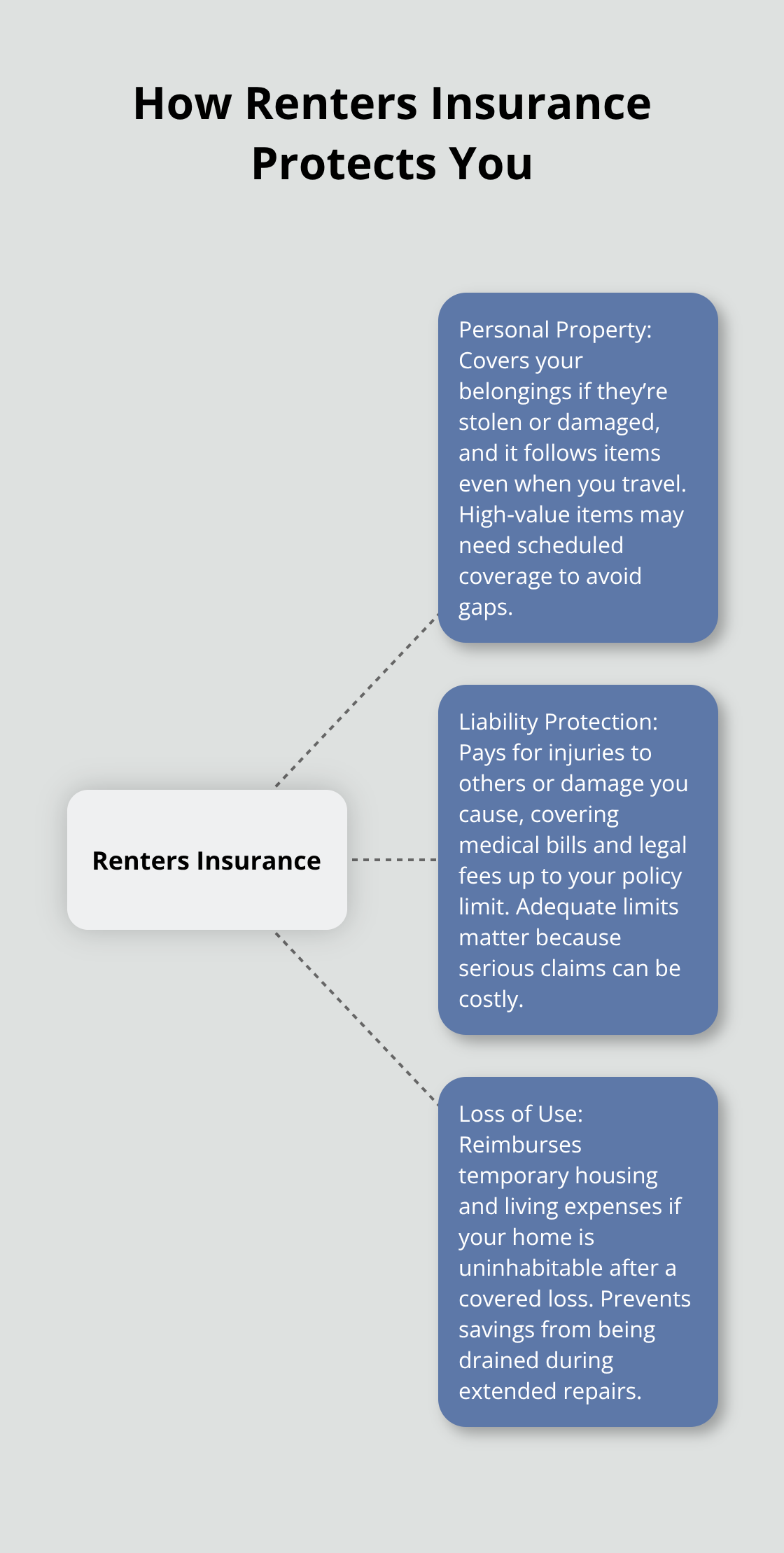

Renters insurance in Bremerton protects three critical areas of your financial life, and understanding each one prevents costly mistakes when you file a claim.

Personal Property Coverage Follows Your Possessions

Personal property coverage reimburses you for belongings damaged or stolen, including clothes, furniture, electronics, and jewelry. This protection extends beyond your apartment walls-personal property coverage follows your possessions when you travel, so a phone stolen during a trip or a laptop damaged at a coffee shop stays protected. Most policies pay actual cash value rather than replacement cost, meaning you receive what the item was worth at the time of loss, not what it costs to replace today. For high-value items like engagement rings or professional cameras, scheduled personal property coverage (an add-on) prevents significant gaps in protection.

Liability Protection Shields Your Finances

Liability coverage protects you from claims other people make against you. If someone is injured at your apartment and holds you responsible, or if you accidentally damage someone else’s property, liability coverage pays for medical expenses and legal fees up to your policy limit. Washington renters face real exposure here, especially in shared living spaces where accidents happen frequently. Medical payments coverage, an optional add-on, covers medical bills for guests injured at your home without requiring you to prove fault-this matters because someone could sue you even if you weren’t negligent. Typical liability claims range from $5,000 to $100,000 depending on injury severity and legal complexity, which is why selecting adequate limits during signup matters far more than defaulting to minimum coverage.

Loss of Use Covers Temporary Housing Costs

Additional living expense coverage, often called loss of use, reimburses temporary housing, food, laundry, and other costs if your apartment becomes uninhabitable after a covered loss like fire or water damage. A hotel stay lasting weeks while repairs happen drains your savings without this coverage to absorb those costs. Water damage claims in Washington typically range from $2,000 to $10,000, and fire damage claims can reach $50,000, making displacement a genuine financial threat. This coverage applies only to covered losses, so you need to understand what your specific policy considers a covered peril before disaster strikes.

Understanding these three protection areas positions you to make informed decisions about coverage limits and add-ons that match your actual situation.

Why Renters Insurance Protects You in Bremerton

Property Crime Creates Real Financial Exposure

Property crime in Washington State exposes renters to genuine financial risk. According to FBI crime statistics for Washington State property crimes, Washington experiences theft and burglary rates that significantly exceed the national average, with property crimes affecting thousands of residents annually. In Bremerton specifically, renters face real danger from theft, break-ins, and damage to personal belongings. These losses happen to actual people, not hypothetical scenarios, which is why protection matters.

Your Landlord’s Policy Leaves You Unprotected

Your landlord’s insurance policy covers the building structure and their liability exposure-not your clothes, electronics, furniture, or other possessions you own. This gap exists because landlord policies protect the property owner’s investment in the building itself, not tenant belongings. If a fire damages your apartment, the landlord’s insurance rebuilds the structure; it does not replace your laptop, wardrobe, or furniture. Many Bremerton renters discover this too late, after losing thousands in uninsured possessions.

Shared Living Spaces Amplify Liability Risks

Shared living spaces in apartments amplify liability risks that renters often overlook. When a guest trips on your stairs and breaks their leg, or when your dog injures a visitor, you face potential lawsuits for medical bills and legal fees. These claims regularly exceed $5,000 and can climb toward $100,000 depending on injury severity and legal costs involved. Without liability coverage, you personally pay these expenses from your own bank account.

Affordable Protection Fills the Gap

Washington state does not require renters insurance, but this absence of a legal mandate does not reflect the actual need for protection-it simply means landlords cannot force you to buy coverage. However, most landlords do require it as a condition of your lease, recognizing that renters insurance protects both parties by clarifying who pays for what after a loss. The financial reality is straightforward: renters insurance costs roughly $10–$15 per month in Washington according to January 2026 pricing data, making it one of the most affordable forms of protection available.

Adequate coverage limits for personal property, liability, and loss of use prevent catastrophic financial loss when disaster strikes your Bremerton apartment. The next step involves understanding how to select the right policy limits and coverage options that match your specific situation and belongings.

How to Choose the Right Renters Policy for Your Situation

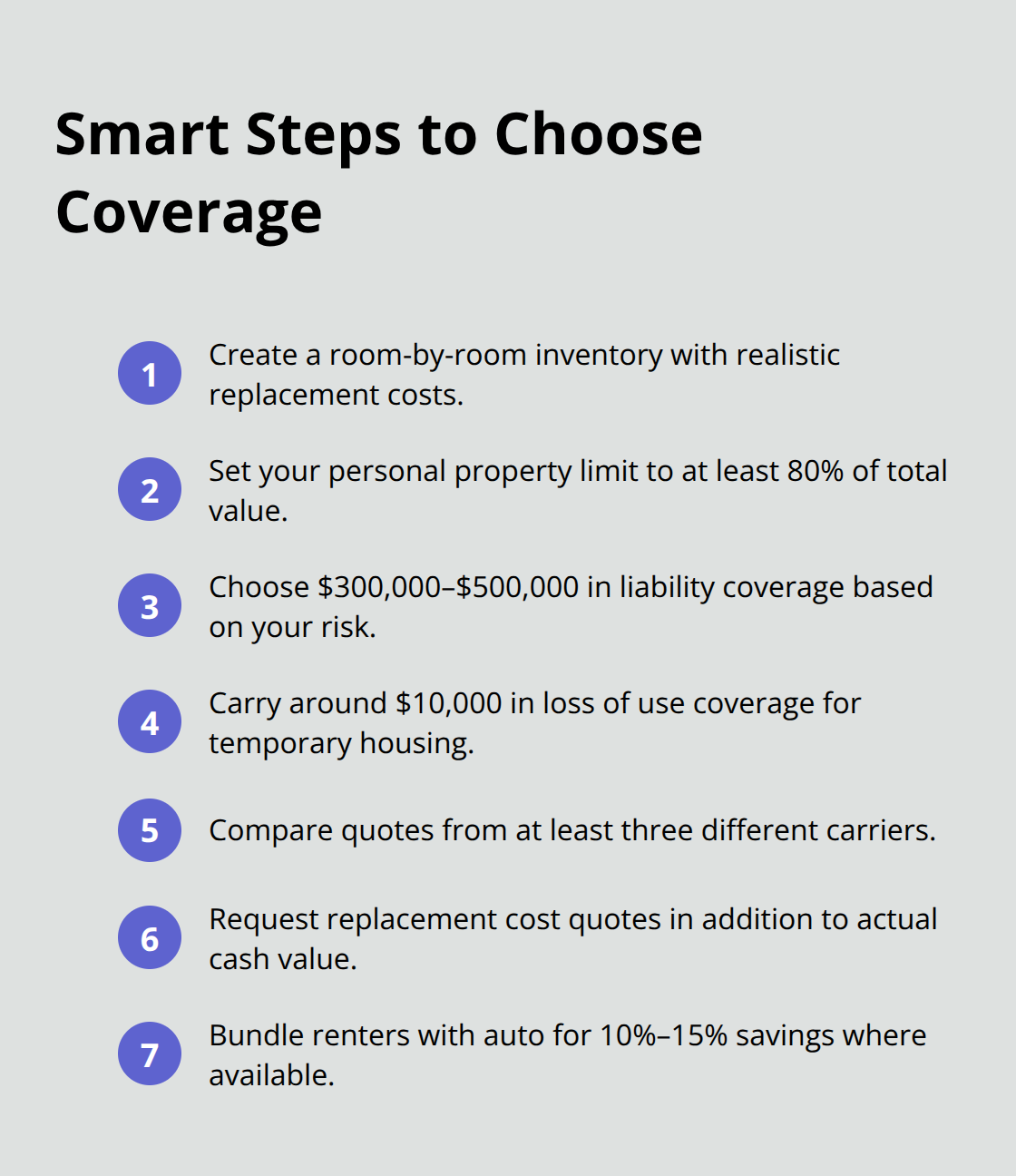

Assess the Value of Your Personal Items

Start by listing everything you own and assign realistic replacement costs to each category. Walk through your apartment room by room and write down major items: furniture, electronics, clothing, kitchen appliances, tools, sports equipment, and anything else with monetary value. This inventory becomes your baseline for determining personal property coverage limits. Most Bremerton renters underestimate what they own until they actually count it up.

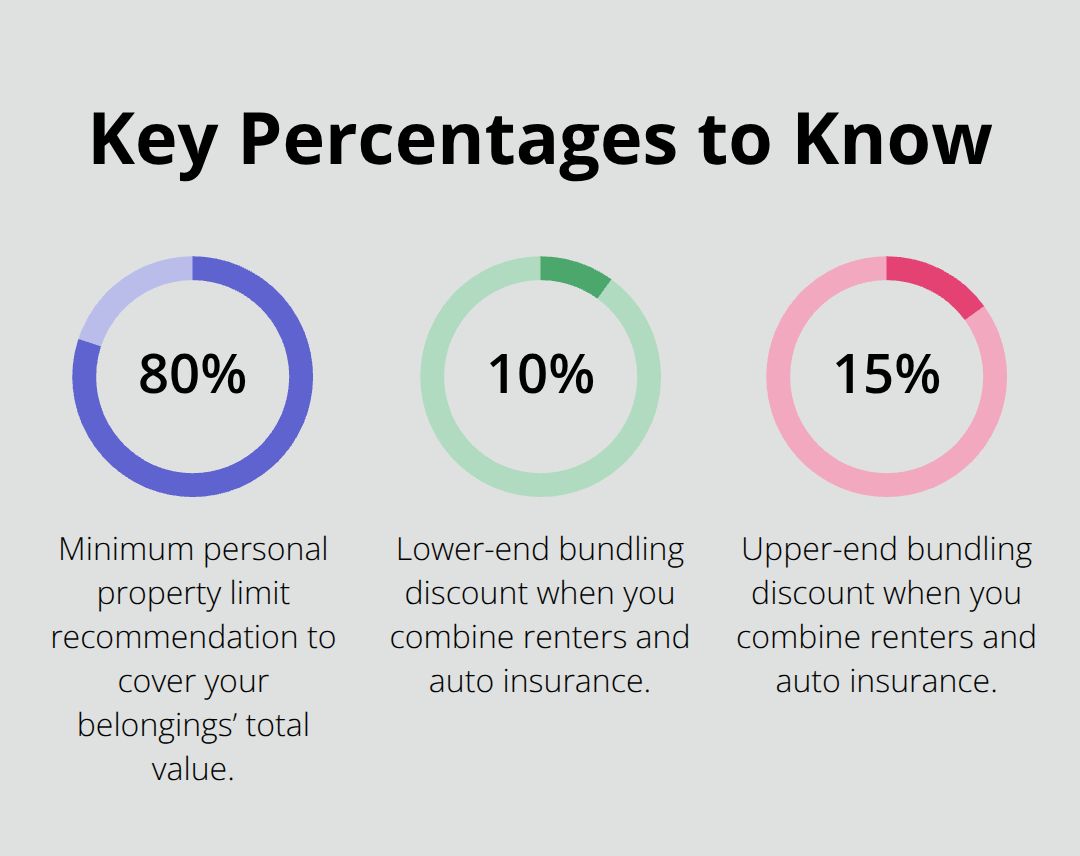

A typical one-bedroom apartment contains $15,000 to $25,000 worth of belongings when you include clothes, a laptop, a television, bedroom furniture, and kitchen items. If you own jewelry, musical instruments, or camera equipment, add another $5,000 to $10,000 or more depending on what you have. Once you know your total, select a personal property limit that covers at least 80 percent of that value. Many renters choose limits that leave them underinsured, which means they absorb losses that exceed their coverage ceiling when a disaster happens.

For liability coverage, most renters choose $300,000 to $500,000 in limits, and the higher end makes sense because medical costs and legal fees climb fast. Select $300,000 if you have any savings or assets worth protecting, because liability claims from serious injuries regularly exceed $50,000 in legal fees and medical expenses combined. Loss of use coverage should reflect your local rental market; in Bremerton, temporary housing during repairs costs roughly $1,500 to $2,000 per month, so carry at least $10,000 in loss of use coverage to prevent a housing crisis if your apartment becomes uninhabitable.

Compare Quotes from Multiple Carriers

Contact at least three insurers representing different carriers to see how rates vary based on your specific situation. Some carriers offer 10 to 15 percent discounts for bundling renters insurance with auto insurance, which makes the combined cost substantially lower than purchasing policies separately. Discounts also apply if you install burglar alarms, fire alarms, or deadbolts, so mention these safety features during your quote request.

Read the policy language carefully before committing, because actual cash value versus replacement cost coverage creates significant differences in what you receive after a claim. A television purchased three years ago might have cost $800 but pays only $300 under actual cash value coverage, whereas replacement cost coverage would reimburse close to what a new television costs today. Request quotes that include both options so you understand the premium difference and can decide whether replacement cost protection justifies the extra cost for your high-value items.

Bundle with Auto Insurance for Discounts

Bundling renters insurance with auto insurance produces substantial savings on your total premium. Most carriers reduce rates when you consolidate multiple policies with them, sometimes offering discounts between 10 and 15 percent on your combined bill. This approach simplifies your coverage management since one agent handles all your policies and renewal dates align across your protection portfolio.

H&K Insurance Agency represents multiple top local and national carriers, which allows them to compare rates and customize packages that include bundling options. This approach helps you find competitive pricing while maintaining the coverage levels your situation requires.

Final Thoughts

Renters insurance in Bremerton, WA protects your financial stability when theft, fire, water damage, or accidents threaten your apartment and belongings. The three-part protection system-personal property coverage, liability protection, and loss of use-addresses real risks that renters face daily in shared living spaces. Without this coverage, a single disaster costs you thousands of dollars from your own pocket, wiping out savings and creating debt that takes years to recover from.

Your landlord’s policy will not replace your possessions, and Washington state does not require renters insurance, leaving the decision entirely in your hands. This gap between what you assume is covered and what actually is covered creates financial exposure that affordable monthly premiums eliminate. At roughly $10–$15 per month, renters insurance costs less than most people spend on coffee, yet it stands between financial stability and catastrophic loss.

Contact H&K Insurance Agency for a personalized quote that shows you exactly what coverage costs and what protection you receive. Call 360-377-7645, visit our office at 3105 Wheaton Way in Bremerton during business hours Monday through Friday from 9:30 am to 5:30 pm, or request a quote online. We represent multiple top local and national carriers, which means we compare rates across different companies to find you competitive pricing and customized packages that match your actual situation and budget.

Jewelry holds not only aesthetic value but also sentimental significance. Whether it symbolizes decades of marriage, has been passed down through generations, or commemorates a special occasion, its worth goes beyond monetary value. With this in mind, our local insurance agency aims to ensure that you have comprehensive protection for your precious pieces.

Jewelry holds not only aesthetic value but also sentimental significance. Whether it symbolizes decades of marriage, has been passed down through generations, or commemorates a special occasion, its worth goes beyond monetary value. With this in mind, our local insurance agency aims to ensure that you have comprehensive protection for your precious pieces.