Do you know what to do in a driving emergency?

Driving hazards are a daily occurrence, and they can happen at any time of the year, regardless of the state you’re in. It’s crucial to know how to handle these hazards if they arise while you’re on the road.

Driving hazards are a daily occurrence, and they can happen at any time of the year, regardless of the state you’re in. It’s crucial to know how to handle these hazards if they arise while you’re on the road.

Let’s explore some common driving hazards and the actions you can take to mitigate their impact.

Here’s what you can do to prepare:

Wildlife encounters: Colliding with a deer or other wildlife on the road can be a frightening and potentially dangerous situation. According to the U.S. Department of Agriculture, there are approximately 2 million collisions with animals each year in the United States.

- Stay alert: When driving in rural areas, be mindful that wildlife is often present near roadways. Keep a vigilant eye on the sides of the road to spot any potential animals.

- Avoid swerving: Swerving to avoid hitting an animal can lead to more severe accidents and injuries. Additionally, your insurance company might deem you at fault if you swerve and end up colliding with a tree or guardrail. Instead, maintain your course and brake firmly to reduce the impact.

- Exercise caution at night: Animals tend to be more active during the evening, and some travel in groups. If you spot one animal, there’s a good chance there are more nearby. If there are two lanes, drive in the lane farthest away from the road’s edge.

Blown tires: Experiencing a blown tire can be startling, but knowing how to react can prevent accidents.

Consider the following steps:

- Avoid slamming on the brakes: Abruptly hitting the brakes when a tire blows can worsen the situation, causing your vehicle to pull in the direction of the flat tire. Instead, gradually decelerate and safely move to the side of the road, as far away from traffic as possible.

- Maintain steering control: A blown front tire can cause your vehicle to veer off course. Try to resist overreacting to the sudden jolt and swerving in the opposite direction, as this can lead to a loss of control.

- Use a safety precaution when changing a tire: When replacing a tire, place the blown tire and wheel under the car slightly. This step can provide protection in case the jack fails, preventing the car from falling directly onto you.

Bugs in the car: Dealing with unexpected insects or spiders inside your vehicle can be unnerving.

Follow these tips to handle the situation safely:

- Pull over safely: If you encounter a spider or bee in the car, it’s important to remain calm. Pull over to the side of the road carefully and allow the unwanted passenger to exit the vehicle.

- Focus on the road: Avoid the temptation to swat at the insect while driving, as it can divert your attention from the road and increase the risk of a more serious accident.

Black ice: During the colder months, black ice can form on road surfaces, posing a significant hazard.

If you find yourself sliding on ice, remember the following:

- Ease off the gas pedal: Many vehicles are equipped with stability control systems that can help correct sliding. Release the accelerator and allow your car to regain stability.

- Lightly apply the brakes: Applying brakes on icy surfaces can worsen the situation. Instead, gently and progressively apply the brakes to slow down. Avoid slamming the brakes, as it can cause a loss of control.

- Drive at a reduced speed: When temperatures start to drop, it’s advisable to drive more slowly. Keeping your speed under 45 mph during icy conditions can significantly reduce the chances of accidents.

While we cannot be physically present in your car to prevent hazards, we are here to assist you with any questions you may have about auto and home insurance. Your safety is our priority, and we want to ensure you have the protection you need in case of emergency. If you’d like to review your insurance coverage if the unavoidable happens, please reach out to our team.

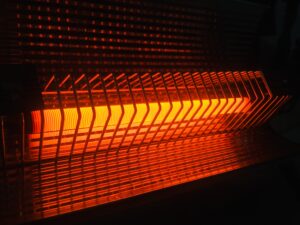

Space heaters offer a convenient and effective way to heat various areas such as garages, bedrooms, and workspaces like offices or shops. However, it is crucial not to overlook the potential dangers associated with these devices, particularly the risk of starting fires. Shockingly, the U.S. Consumer Product Safety Commission reveals that over 25,000 residential fires are caused annually by portable space heaters. Even more alarming, an estimated 300 individuals lose their lives each year due to fires caused by improper usage of space heaters. Additionally, thousands of people suffer from burn injuries that require hospital treatment, all stemming from the mishandling or improper use of these heating devices.

Space heaters offer a convenient and effective way to heat various areas such as garages, bedrooms, and workspaces like offices or shops. However, it is crucial not to overlook the potential dangers associated with these devices, particularly the risk of starting fires. Shockingly, the U.S. Consumer Product Safety Commission reveals that over 25,000 residential fires are caused annually by portable space heaters. Even more alarming, an estimated 300 individuals lose their lives each year due to fires caused by improper usage of space heaters. Additionally, thousands of people suffer from burn injuries that require hospital treatment, all stemming from the mishandling or improper use of these heating devices. The National Highway Traffic Safety Administration (NHTSA) states that auto accidents are the leading cause of death for teenagers aged 15-19 in the United States. To combat these statistics, parents should have open conversations with their children about the risks associated with driving and emphasize the “5 to Drive” rules.

The National Highway Traffic Safety Administration (NHTSA) states that auto accidents are the leading cause of death for teenagers aged 15-19 in the United States. To combat these statistics, parents should have open conversations with their children about the risks associated with driving and emphasize the “5 to Drive” rules.