Washington Earthquake Insurance: Safeguard Your Home Against Northwest Quakes

Washington sits on some of the most active fault lines in the country. A major earthquake could strike your home without warning, and standard homeowners insurance won’t cover the damage.

We at H&K Insurance Agency help Washington residents understand why Seattle earthquake insurance and statewide coverage are essential. The financial impact of an uninsured earthquake can be devastating, which is why taking action now matters.

Why Your Home Needs Earthquake Protection Now

Washington Sits on Active Fault Lines

Washington faces genuine seismic risk that most homeowners underestimate. The Cascadia Subduction Zone off the Pacific Northwest coast poses a megathreat, with expert estimates suggesting a 10–15% chance of a magnitude 9 rupture within the next 50 years. The Seattle Fault and southern Whidbey Island fault zone run directly under major population centers and could produce magnitude 6–7.5 earthquakes with significant damage potential. The Washington Geological Survey reports that populated areas of Washington have a 40–80% chance of experiencing at least one damaging earthquake in the next 50 years. This isn’t theoretical risk-it’s a measurable probability that affects your property value and financial security today.

Past Earthquakes Show Real Financial Impact

The 2001 Nisqually earthquake near Seattle, which registered magnitude 6.8, caused between $500 million and $4 billion in property losses. This demonstrates the real financial scale of what happens when buildings aren’t protected. A shallow Seattle Fault earthquake could require 30% of south Seattle single-family homes to need repairs exceeding 10% of replacement value, according to University of Washington engineers. For a $600,000 home, that means potential repair bills of $60,000 or more.

Standard Insurance Leaves You Exposed

Your homeowners policy almost certainly excludes earthquake damage. Standard homeowners, condo, and renter policies in Washington do not cover earthquakes by default, which means if an earthquake damages your foundation, walls, or roof, your insurer won’t pay for repairs. This gap exists because earthquake losses can be catastrophic and concentrated geographically, creating liability that standard policies are designed to avoid. You must purchase earthquake coverage separately through an endorsement or standalone policy. Without it, you absorb 100% of repair costs yourself.

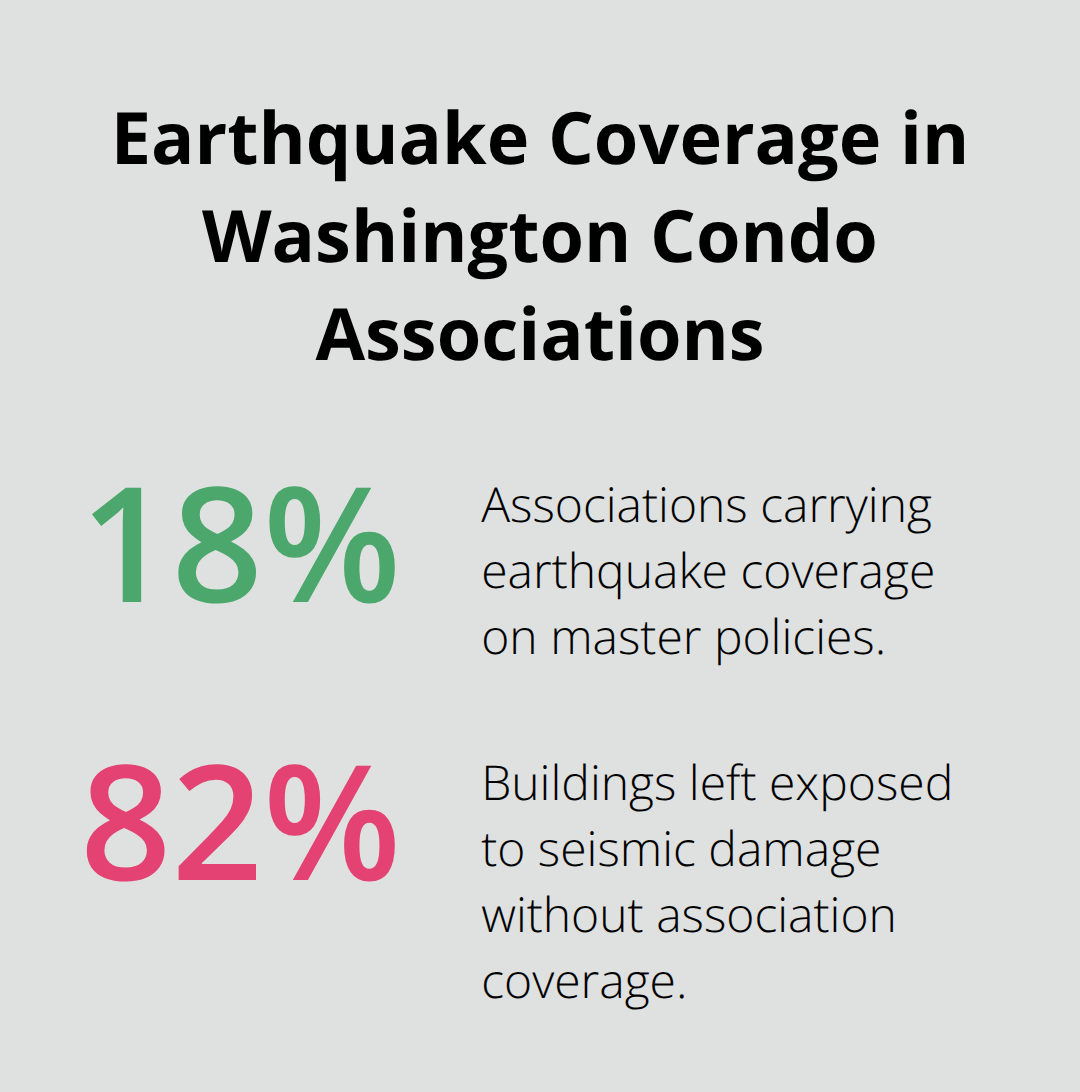

FEMA data shows only 11.3% of Washington residents carried earthquake coverage despite living in a major earthquake market in the United States. This indicates widespread underinsurance relative to actual risk.

Multiple Hazards Compound Earthquake Damage

Earthquake damage spreads beyond obvious structural harm. Ground shaking can trigger liquefaction in water-saturated soils, especially in low-lying or reclaimed land areas across the Puget Sound region, causing homes to settle unevenly and foundations to crack. Earthquakes also trigger landslides, a major threat in Washington that can occur even away from faults, as seen in historical events like the 1949 Tacoma quake. If a large quake strikes, you face not only repair costs but also displacement from your home while repairs happen, temporary housing expenses, and the challenge of finding contractors when demand spikes regionally.

Federal Assistance Won’t Cover Your Losses

Federal disaster assistance through FEMA exists but provides only limited grants that rarely cover large rebuilds. This leaves private earthquake insurance as your primary financial protection. Uninsured earthquake damage forces families to liquidate savings, take on debt, or abandon rebuilding plans entirely. The time to address this risk is now, before an earthquake strikes and eliminates your ability to purchase coverage. Understanding what earthquake insurance actually covers-and what it doesn’t-helps you make informed decisions about protecting your home and finances.

Understanding Earthquake Coverage and Your Options

What Earthquake Insurance Actually Covers

Earthquake insurance in Washington covers damage to your home’s structure, personal property inside, and additional living expenses if you’re displaced during repairs. The Washington State Department of Insurance specifies that policies reimburse repairs to walls, roofs, foundations, built-in appliances, and permanently installed fixtures. If an earthquake forces you out of your home while repairs happen, the policy covers temporary housing costs, food, and other necessary expenses up to your coverage limit. Debris removal and stabilization of land under your home are typically included, and many policies now cover the higher costs required to meet current building codes during reconstruction.

However, earthquake insurance explicitly does not cover earthquake-triggered fires, land itself, vehicles, water damage from outside your home, or damage that occurred before your policy started. Floods, tidal waves, and tsunamis may not be covered even if caused by an earthquake, so verify this with your agent before purchasing.

How Deductibles Shape Your Out-of-Pocket Costs

Earthquake deductibles in Washington work differently than standard homeowners deductibles. Instead of a fixed dollar amount, earthquake policies use percentage-based deductibles ranging from 10% to 25% of your home’s insured value. On a $600,000 home with a 15% deductible, you’d pay $90,000 before your insurer covers anything. This percentage structure means your out-of-pocket costs scale directly with your home’s value.

Moving from a 10% to a 20% deductible can reduce your annual premium by roughly half, according to the Washington State Department of Insurance. This strategy only works if you have liquid savings to cover the higher deductible at claim time. Many homeowners choose a 15% deductible as a middle ground, balancing manageable premiums with reasonable out-of-pocket exposure. You can have separate deductibles for your building, personal property, and unattached structures like garages or sheds, so review your specific policy language carefully.

Matching Coverage Limits to Actual Replacement Costs

Your coverage limit should reflect what it actually costs to rebuild your home today, not its market value or what you paid for it decades ago. The Washington State Department of Insurance recommends obtaining a professional replacement-cost estimate updated annually, since construction costs rise and previous estimates become outdated. For a $500,000 home in the Seattle area, earthquake premiums typically range from $750 to $1,625 annually depending on location, soil type, and your chosen deductible.

Homes on soft fill, tidal flats, or river deltas face higher premiums because soil amplifies earthquake shaking. Proximity to active faults like the Seattle Fault or southern Whidbey Island fault zone increases your rate substantially. If you’ve made major repairs or additions since buying your home, your replacement-cost estimate needs updating to avoid coverage gaps. University of Washington engineers estimate that a shallow Seattle Fault earthquake could require 30% of south Seattle homes to need repairs exceeding 10% of replacement value, making adequate limits essential rather than optional.

Understanding what your policy covers and what it costs sets the foundation for selecting the right protection. The next step involves finding carriers that offer competitive rates and comparing options that fit your specific situation and budget.

How to Get Earthquake Insurance in Washington

Work with an Independent Agent to Access Multiple Carriers

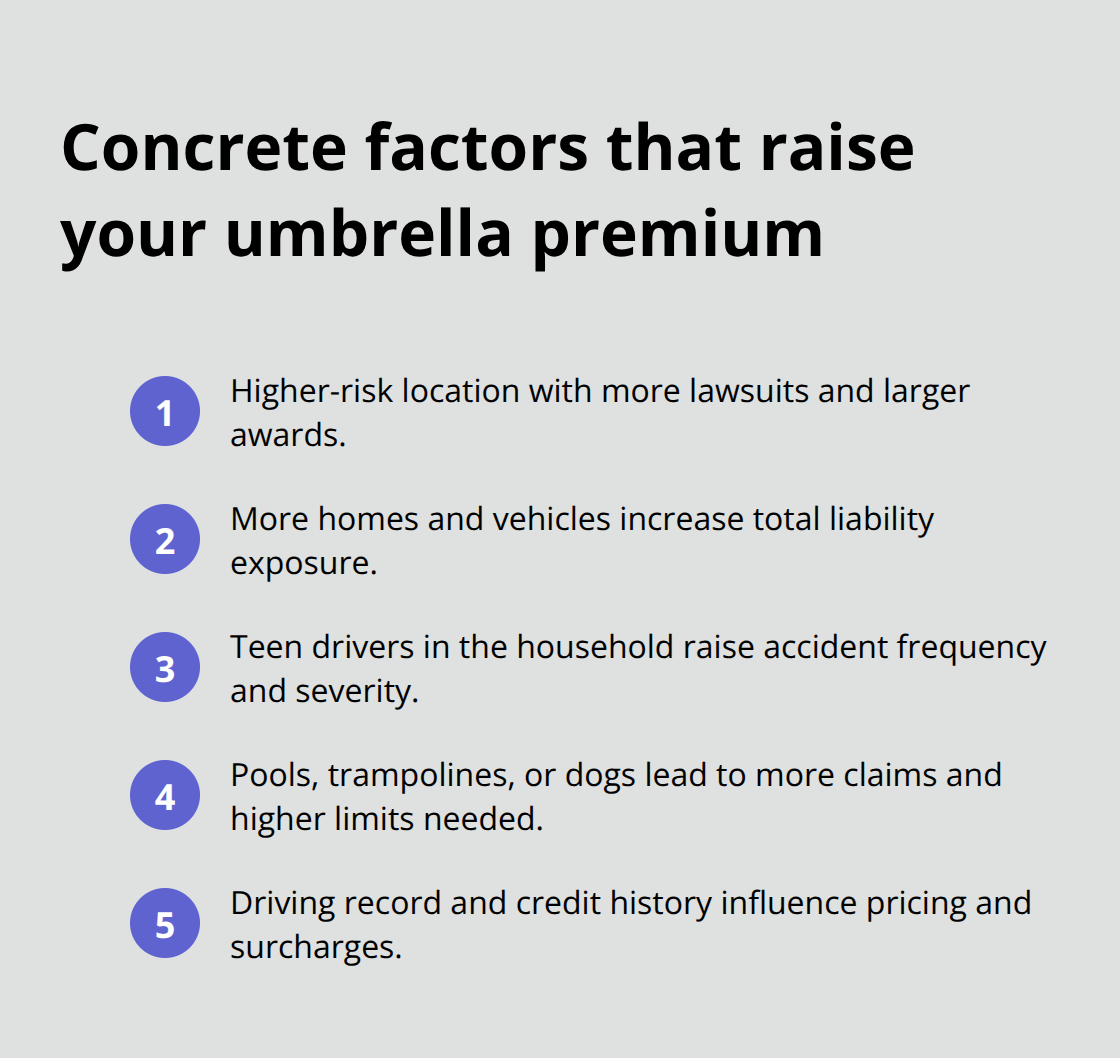

Obtaining earthquake coverage in Washington requires more than calling your current insurer and adding a rider. Most standard carriers either stopped underwriting earthquake policies in the 1990s due to catastrophic loss concerns or limit availability to existing customers with strong claims histories. This narrows your options quickly if you shop passively.

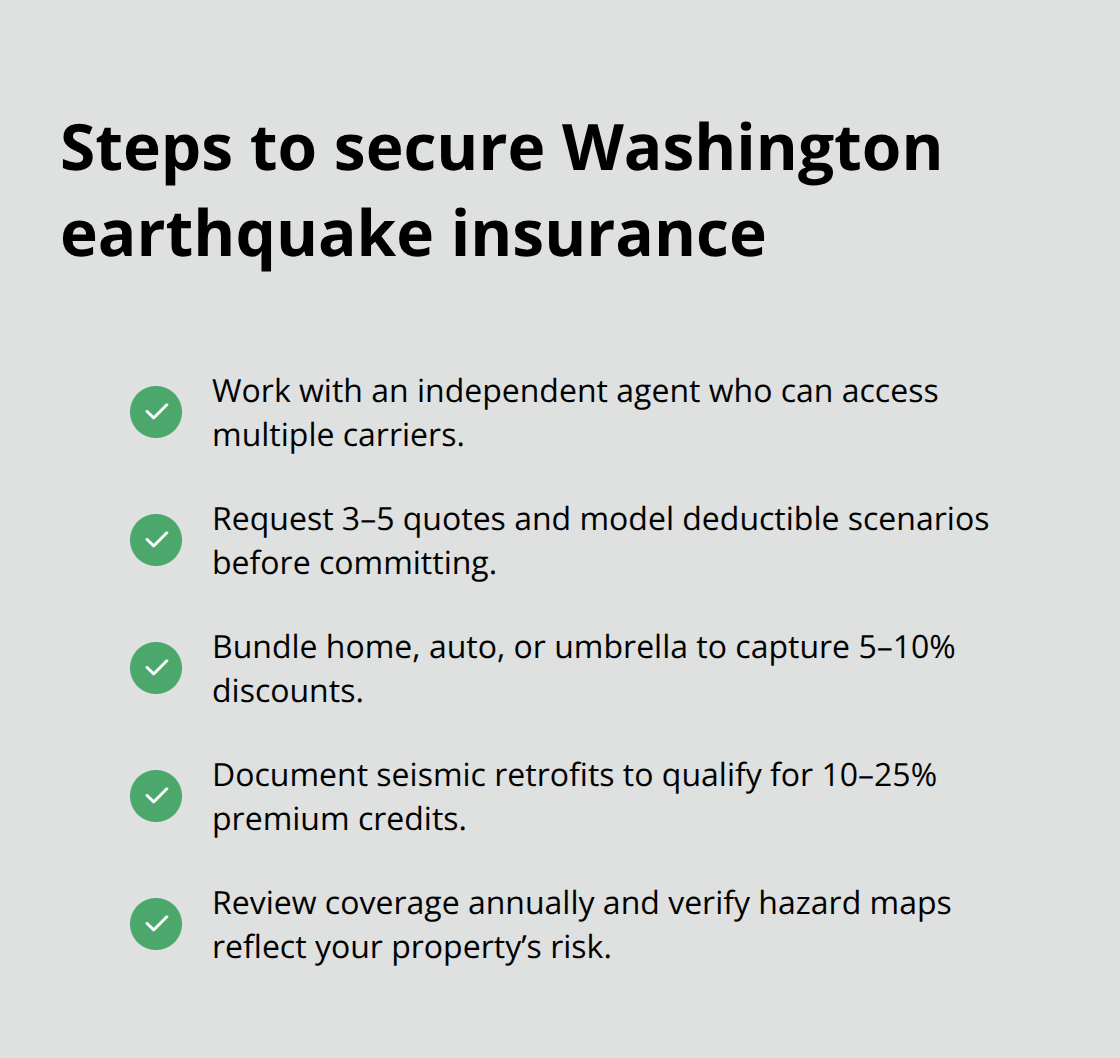

The most effective approach involves working with an independent agent who represents multiple carriers and can access policies you won’t find by calling insurers directly.

An independent agent knows which carriers actively write earthquake coverage in your county, what soil and fault-zone restrictions apply, and which companies offer the best rates for your specific property. When you obtain three to five quotes from different carriers, you’ll often discover premium variations of 30–50% for identical coverage, making comparison shopping financially worthwhile rather than optional. Your deductible choice and home’s replacement cost drive these differences more than anything else, so an agent who can model scenarios-such as moving from a 15% to a 20% deductible-helps you understand the true cost-benefit tradeoff before committing.

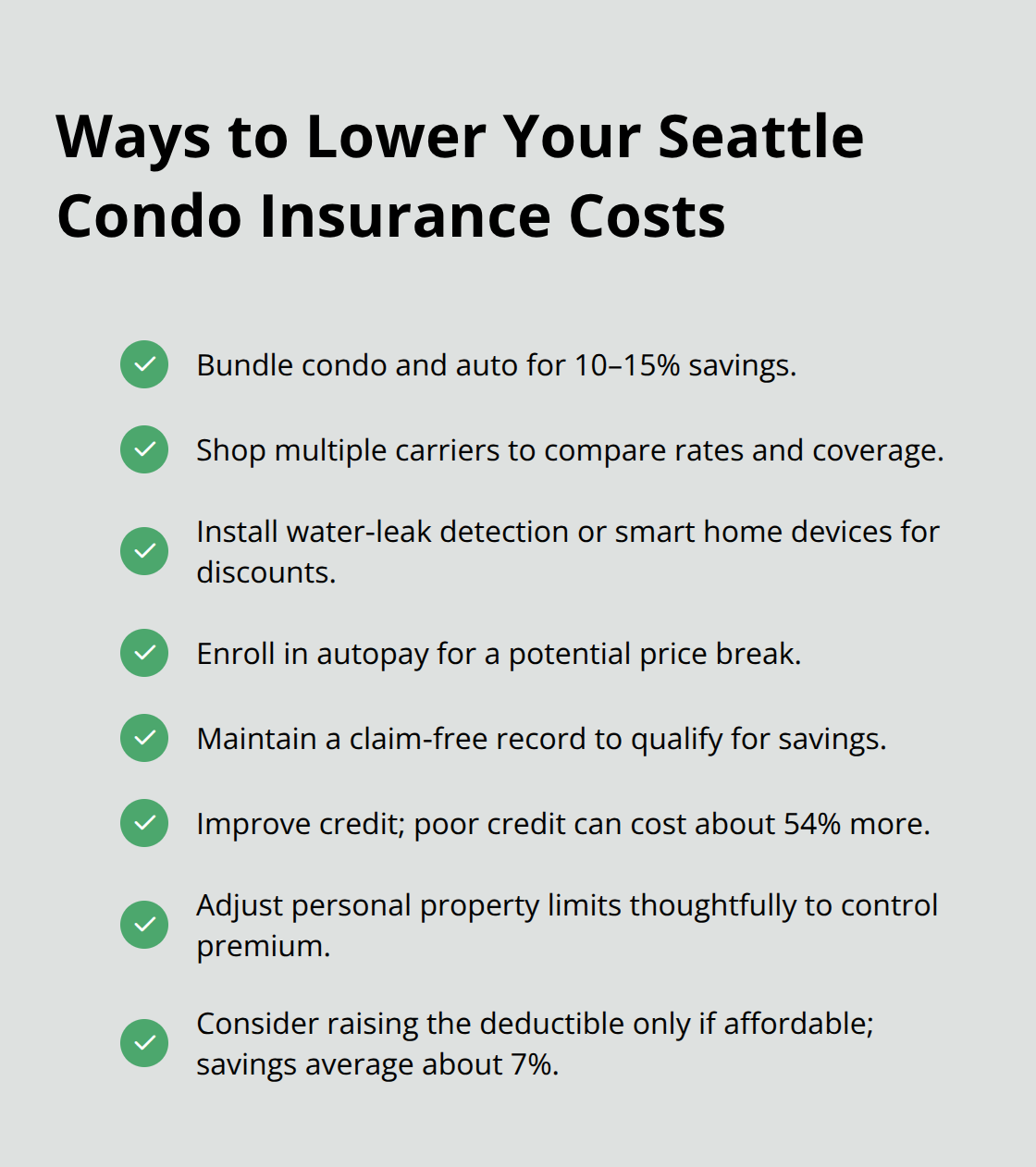

Bundle Coverage to Lower Your Premiums

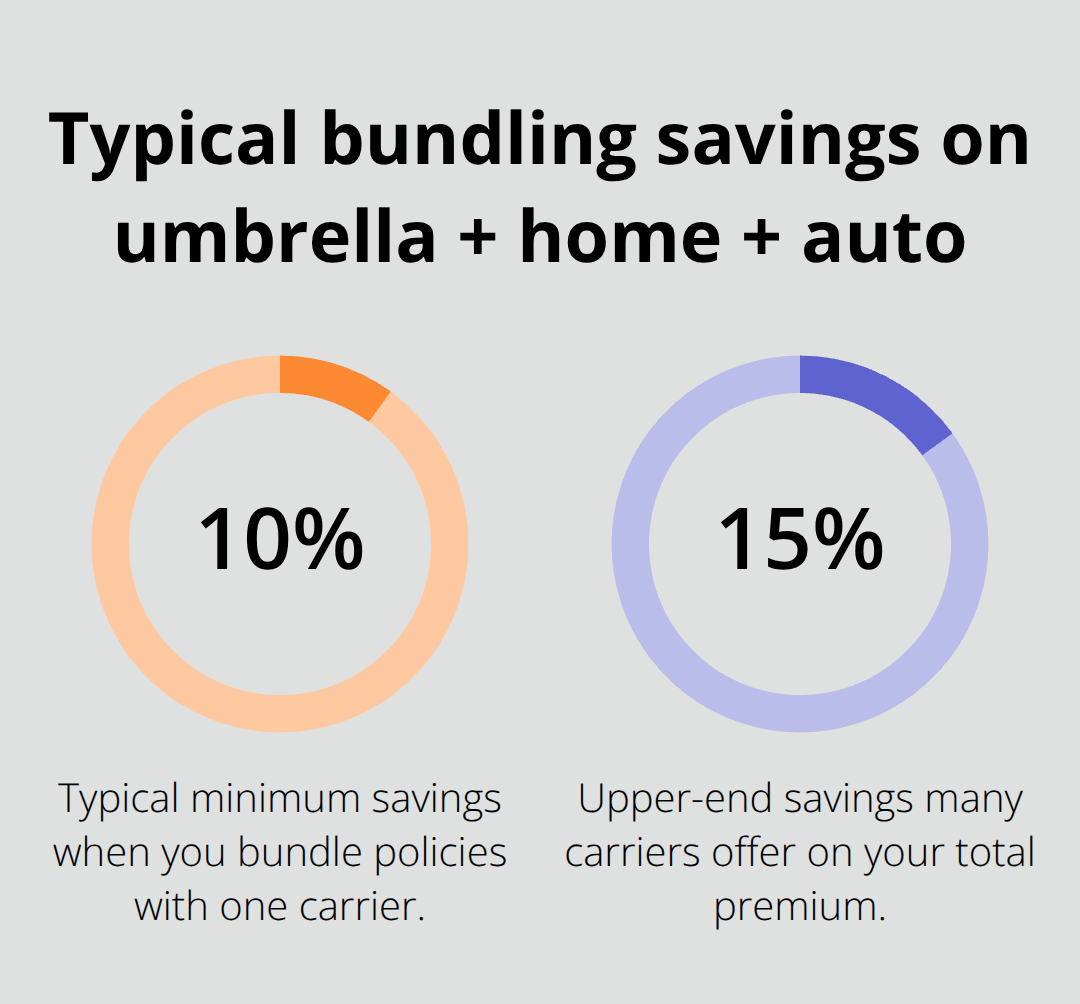

Bundling earthquake coverage with your auto, home, or umbrella policies typically yields discounts of 5–10% according to the Washington State Department of Insurance. Consolidating policies with one carrier simplifies renewals and communication. Many carriers offer loyalty programs that reward long-term customers, so ask your agent whether your relationship with an insurer qualifies you for additional savings beyond standard bundling discounts.

Document Retrofits to Qualify for Premium Credits

If you’ve completed seismic retrofits like foundation bolting or plywood shear panels, inform your agent immediately. Documented retrofits often qualify for premium credits of 10–25%, making the upfront investment pay for itself over several years. Your agent can help you prioritize which upgrades matter most for your property and verify that your insurer recognizes completed work before your policy renews.

Review and Adjust Your Coverage Annually

After you purchase coverage, review your policy annually because construction costs rise, your home may gain value through renovations, and your financial situation may shift enough to justify adjusting your deductible or limits. The Pacific Tsunami Warning Center and Washington Geological Survey provide hazard maps showing liquefaction risk and fault proximity, which your agent can use to verify your property’s risk classification and confirm your coverage reflects actual exposure.

Final Thoughts

Washington’s earthquake risk demands action today, not after the next quake strikes. A $600,000 home with a 15% deductible costs roughly $900–$1,500 annually for Seattle earthquake insurance in most counties, while uninsured damage could exceed $60,000 based on University of Washington engineering estimates. One moderate earthquake wipes out a decade of premium payments, making coverage a straightforward financial decision.

Seismic retrofits, policy bundling, and strategic deductible choices reduce your costs while strengthening your home’s actual resilience. Foundation bolting, plywood shear panels, and water heater strapping typically cost $4,000–$7,000 upfront but qualify for premium credits of 10–25% that pay dividends over time. Bundling earthquake coverage with auto or home policies yields discounts of 5–10%, and comparing three to five quotes often reveals premium variations of 30–50% for identical protection.

Contact H&K Insurance Agency to discuss your home’s earthquake protection and obtain multiple quotes that fit your budget and property risk. Your team will compare rates across carriers, model deductible scenarios, and confirm your coverage limits match actual replacement costs. Your home and financial security depend on decisions you make today.