Apartment Renters Insurance Kitsap WA: Smart Coverage For Tenants

Your landlord’s insurance doesn’t cover your belongings-that’s your responsibility. Most apartment renters in Kitsap County are underinsured, leaving thousands of dollars in personal property unprotected.

At H&K Insurance Agency, we’ve seen how quickly renters realize they need apartment renters insurance in Kitsap WA when disaster strikes. The good news is that coverage is affordable and straightforward once you understand what you actually need.

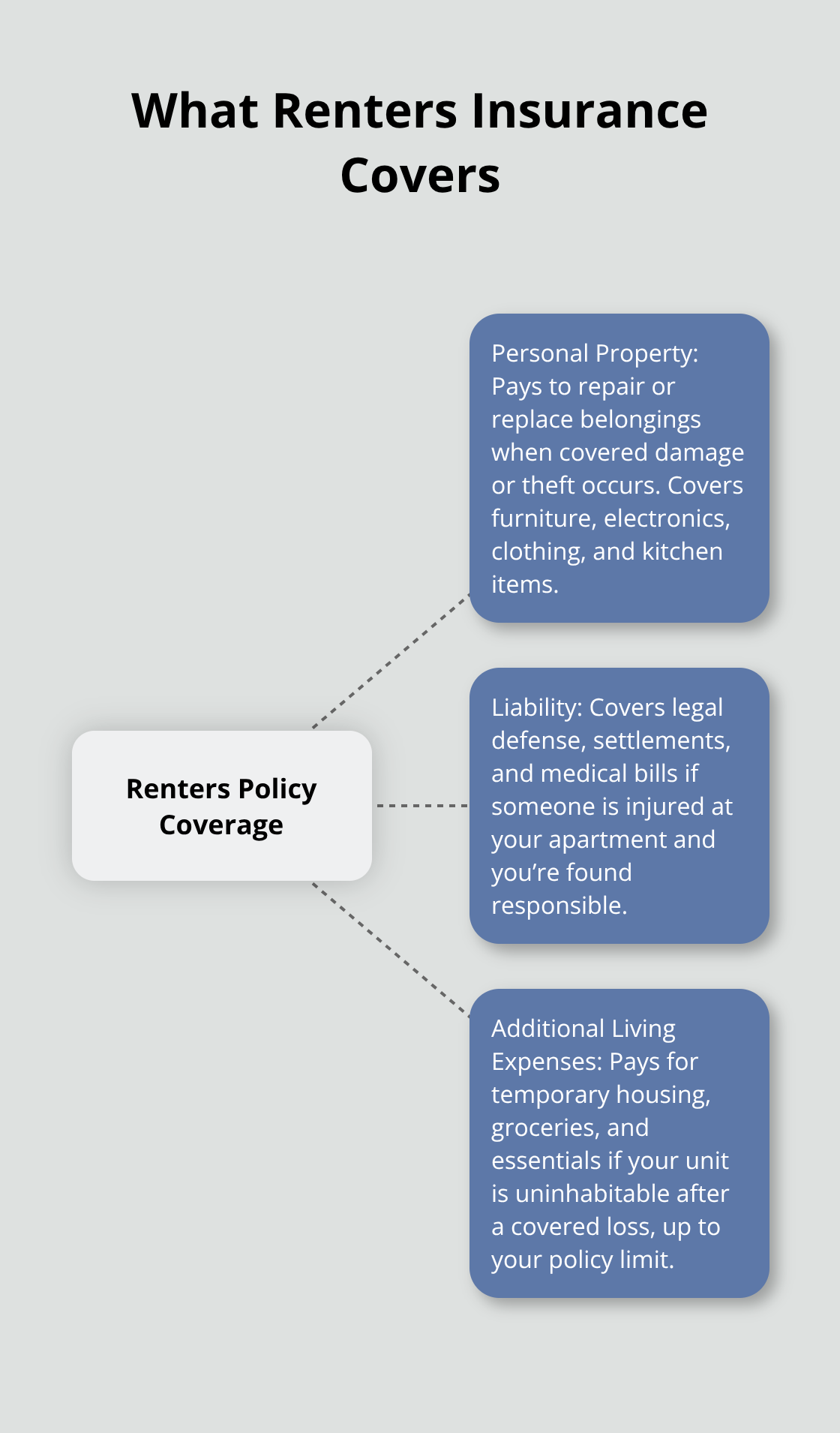

What Your Renters Policy Actually Covers

Renters insurance in Kitsap County protects three distinct areas of your financial life, and understanding each one matters because they work together to cover gaps your landlord’s policy completely ignores. Personal property coverage forms the foundation-it pays to replace or repair your belongings if damage or theft occurs, whether that’s your furniture, electronics, clothes, or kitchen items.

According to the Washington State Department of Insurance, personal property coverage typically pays actual cash value at the time of loss, which means older items are worth less than you might think. A home inventory now prevents disputes later.

Liability coverage is where renters insurance becomes serious. If someone is injured at your apartment and sues you for medical bills or damages, your policy covers legal fees and settlements up to your limit. The Washington State Department of Insurance notes that personal liability protection shields you from claims made against you for injuries or damages caused to others, and these claims escalate quickly-especially if a guest requires emergency surgery or you’re held responsible for property damage. Additional living expense coverage handles the costs you’d face if your unit becomes uninhabitable after a covered loss like fire or sudden water damage. Your policy pays for temporary housing, groceries, and other necessities while repairs happen, up to your policy limit.

Personal Property Limits Matter More Than You Think

Standard renters policies in Kitsap County often start with $25,000 in personal property coverage, but that number disappears fast when you add up a laptop ($1,500), a bedroom set ($3,000), kitchen appliances ($2,000), and clothes ($2,500). The Washington State Department of Insurance recommends using a personal property inventory calculator to estimate your belongings’ actual value before you choose coverage limits. High-value items like jewelry, watches, and collectibles have sub-limits built into standard policies, meaning they’re covered for far less than their worth. You’ll need scheduled item coverage or a Personal Articles Policy to protect valuables adequately, and this costs extra but prevents devastating gaps. Starting prices for renters insurance in Kitsap County run around $12 to $15 per month for basic coverage, making it realistic to increase your limits without breaking your budget.

Liability Limits Should Match Your Risk

Most renters choose $300,000 to $500,000 in liability coverage, and the higher end makes sense because medical costs and legal fees climb fast. A single hospital visit costs $50,000 or more, and if you’re found liable, your personal assets face risk without adequate coverage. The Washington State Department of Insurance explains that premises medical payments coverage helps pay the medical costs of others injured on your rental property regardless of fault, which is separate from your liability limit and typically covers $1,000 to $5,000 in immediate medical expenses for guests. This dual protection (liability plus medical payments) means you’re covered even when you’re not technically at fault.

How Coverage Limits Interact With Your Actual Needs

Your personal property limit and liability limit work together, not separately. If you own high-value items or frequently host guests, you need both limits to reflect that reality. The Washington State Department of Insurance recommends comparing your renter policy with your landlord’s coverage to avoid gaps in protection for both belongings and liability. Once you understand what these three coverage areas actually do, you’re ready to compare quotes from multiple carriers and find the right policy for your situation.

Why Renters in Kitsap County Underestimate Their Coverage Needs

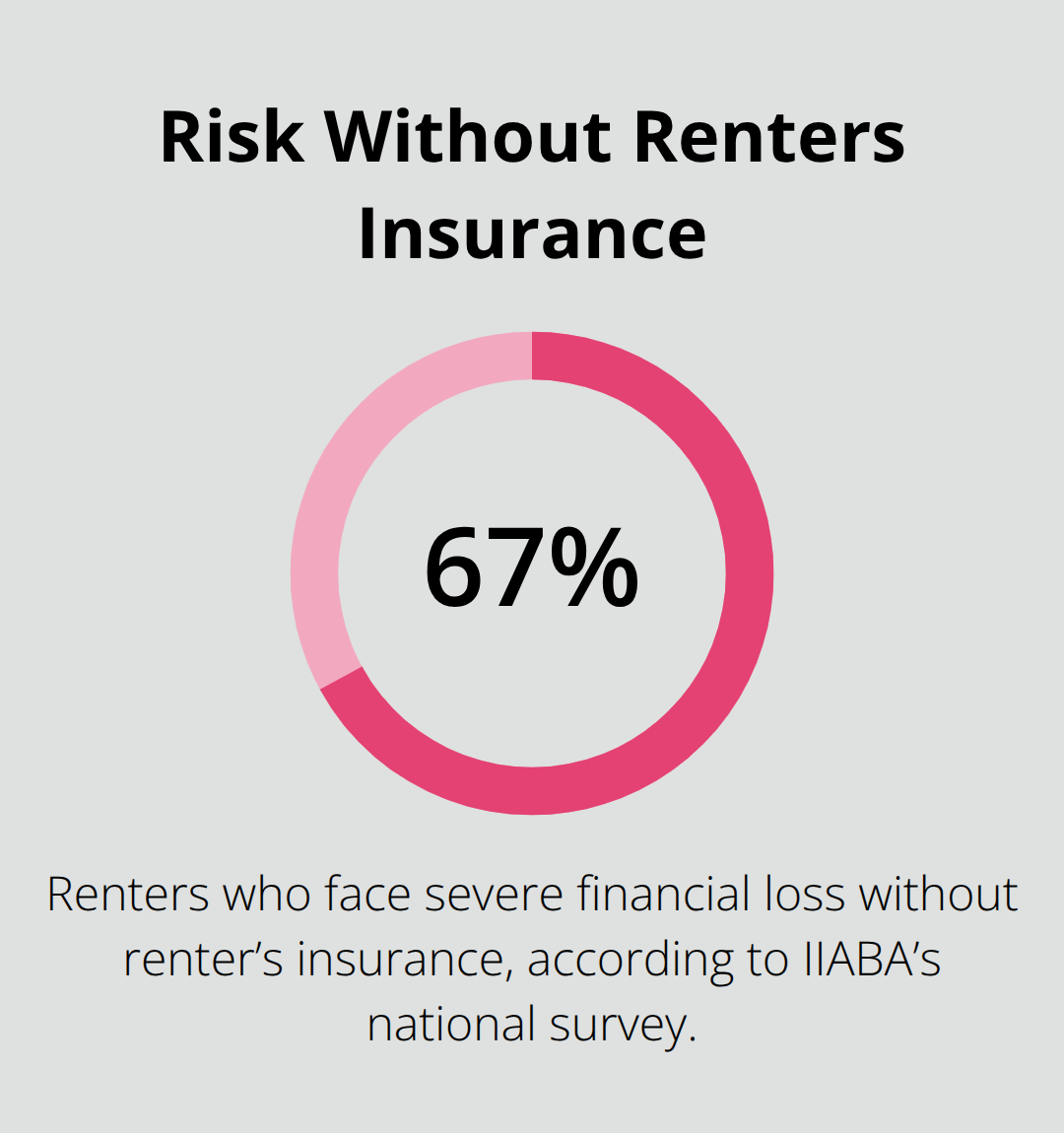

Your Landlord’s Insurance Protects the Building, Not Your Stuff

Landlords in Kitsap County have zero financial incentive to tell you about coverage gaps because landlord’s insurance protects the building, not your belongings. A kitchen fire damages the apartment structure, and the landlord’s policy covers repairs to walls, cabinets, and flooring. Your clothes, furniture, electronics, and food inside that kitchen remain your problem entirely. According to IIABA’s national survey, more than 67% of renters face severe financial loss without renter’s insurance, and Kitsap renters are no exception.

When the Chimacum-Kitsap Fire Rescue responded to apartment fires in their service area, investigators found that only one renter among those affected had any insurance to replace belongings. That’s not a rare scenario-it’s the norm. Most renters assume they’re covered because they’re paying rent and someone else owns the building, but that assumption costs thousands when disaster strikes.

Natural Disasters Expose Major Coverage Gaps

Standard renters policies cover fire, sudden water damage from burst pipes, theft, and windstorms, but earthquakes and flooding require separate add-on endorsements that many Kitsap tenants never purchase. Washington sits in an active seismic zone, and the Cascadia Subduction Zone poses genuine earthquake risk that standard policies explicitly exclude. Flood coverage requires a separate flood insurance policy entirely, not just an endorsement, because standard renters insurance won’t touch water damage from external sources like heavy rain or overflowing rivers. If you live near water or in an older building with foundation concerns, skipping these add-ons puts your finances at serious risk. The cost of earthquake and flood endorsements remains modest compared to the replacement costs you’d face after a major event.

Liability Claims Escalate Faster Than Most Renters Expect

A guest slips on your wet kitchen floor and breaks their leg-the hospital bills alone exceed $80,000, and if they hire a lawyer, you’re looking at a settlement that easily reaches $100,000 or more. Your landlord’s insurance doesn’t cover your liability because you caused the injury, not a building defect. Personal liability coverage on a renters policy covers legal fees and settlements up to your chosen limit, typically $300,000 to $500,000, but renters often choose $100,000 thinking that’s enough. It’s not. Medical costs have inflated dramatically, and juries award damages for pain and suffering on top of medical expenses. The cost difference between $300,000 and $500,000 in liability coverage is minimal-usually $2 to $5 per month-while the protection gap is substantial.

Why Higher Liability Limits Make Financial Sense

Carrying at least $500,000 in liability coverage protects your personal assets if a serious injury claim lands on your doorstep. A single hospital visit costs $50,000 or more, and legal fees add thousands more to your exposure. When you compare quotes from multiple carriers, you’ll notice that increasing your liability limit from $300,000 to $500,000 costs almost nothing, making it an easy decision once you understand the risk. The math is straightforward: a modest monthly increase prevents catastrophic financial loss. Understanding these three coverage gaps-landlord insurance limitations, natural disaster exclusions, and liability exposure-positions you to make informed decisions about the protection you actually need. The next step involves comparing quotes from multiple carriers to find the right policy at the right price for your Kitsap apartment.

How to Choose the Right Renters Policy for Your Kitsap Apartment

Comparing quotes from multiple carriers in Kitsap County reveals a frustrating truth: the same coverage costs wildly different amounts depending on which insurer you choose. A $25,000 personal property limit with $500,000 liability might cost $12 per month with one carrier and $18 with another, meaning you could waste $72 per year with the wrong company. Start with quotes from at least three different insurers before making any decision. State Farm, Progressive, and regional carriers all operate in Kitsap, and each prices risk differently based on their own claims data and underwriting models. Online quote tools let you customize coverage limits and compare costs in minutes, so you have no reason to accept the first price you receive. When you get quotes, keep the coverage limits identical across all carriers so you’re comparing apples to apples-same personal property amount, same liability limit, same deductible. This matters because changing even one variable makes the quotes meaningless for comparison purposes.

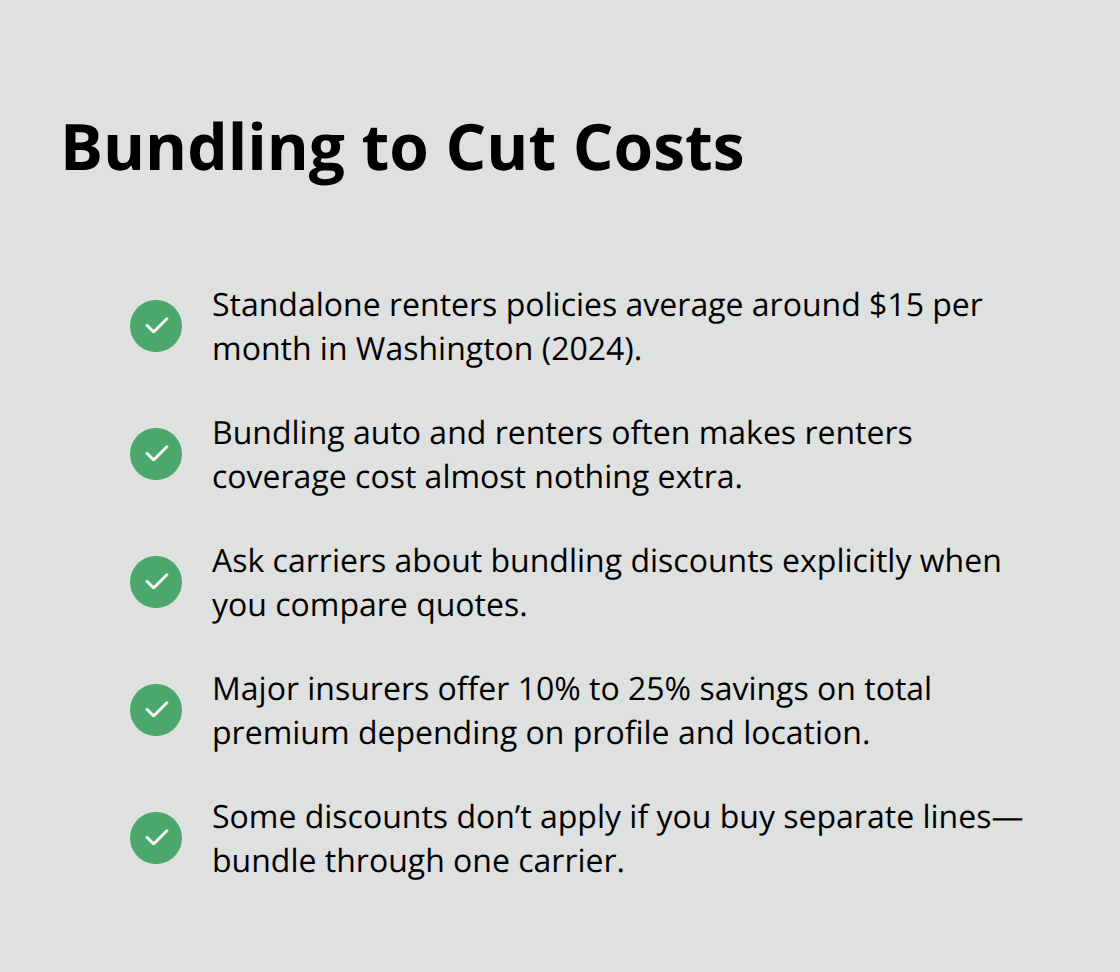

How Bundling Slashes Your Total Insurance Costs

If you own a car, bundling renters insurance with auto coverage produces the biggest savings available in the market. According to pricing data from 2024, renters policies in Washington averaged around $15 per month as standalone policies, but bundling auto and renters together often reduces your combined premium to where renters coverage costs almost nothing extra. State Farm markets this as their Personal Price Plan, allowing you to customize coverage and access safe driving rewards and other discounts that further reduce costs. Progressive and other major carriers offer similar bundling discounts, sometimes yielding savings of 10% to 25% on your total premium depending on your driving record and location within Kitsap County.

The catch is that some discounts don’t apply if you purchase different lines of insurance separately-bundling through one carrier matters. When comparing quotes, ask about bundling discounts explicitly and request a quote for auto plus renters together, then compare that bundled rate against standalone renters quotes from other carriers. A $5 monthly savings on renters insurance adds up to $60 per year, and bundling often delivers far more than that.

Matching Coverage Limits to Your Actual Possessions

The final step involves honest math about what you own. Walk through your apartment room by room and estimate replacement costs for everything you see. Your laptop costs $1,200, your bedroom furniture runs $3,500, kitchen appliances total $2,000, and clothes fill another $2,000-you’re already at $8,700 before touching your living room, bathroom, or anything else. The Washington State Department of Insurance recommends using a personal property inventory calculator to document belongings and their values, which prevents underestimating coverage needs and eliminates disputes with insurers after a loss. High-value items demand special attention because standard renters policies cap coverage for jewelry, watches, and collectibles at $500 to $2,500 total, far below actual replacement costs. If you own jewelry worth more than $1,000 or have collectibles, request quotes that include scheduled item coverage or a Personal Articles Policy rider-this costs extra but protects valuables at their full replacement value.

Setting Your Liability Limit to Protect Your Assets

For liability coverage, $500,000 should be your minimum in Kitsap County given medical cost inflation and legal exposure. A single hospital visit costs $50,000 or more, and legal fees add thousands more to your exposure. The price difference between $300,000 and $500,000 in liability coverage typically runs $2 to $5 monthly, making the higher limit an obvious choice. Once you know your actual belongings value and have compared quotes with matching coverage levels across multiple carriers, you’ll find the policy that protects what matters without wasting money on unnecessary coverage.

Final Thoughts

Apartment renters insurance in Kitsap WA protects what matters most because it covers the gap your landlord’s policy leaves wide open. Standard renters policies start around $12 to $15 per month, and bundling with auto insurance often reduces that cost further. For less than the price of a coffee subscription, you gain protection against theft, fire, water damage, and liability claims that could otherwise wipe out your savings.

You’ve learned that $25,000 in personal property coverage disappears quickly when you inventory your actual belongings, that $500,000 in liability protection costs only a few dollars more than inadequate limits, and that high-value items need scheduled coverage to avoid devastating gaps. Kitsap tenants have affordable options available from multiple carriers, and comparing quotes takes minutes online. The carriers operating in Kitsap County compete aggressively on price, which means shopping around pays real money.

Visit H&K Insurance Agency to compare quotes and find coverage that matches your actual belongings and liability exposure. We represent multiple top carriers and customize packages so you get the right protection at competitive prices. Don’t wait for disaster to realize you needed renters insurance yesterday.