Personal Umbrella Insurance WA: Extra Liability Protection For You And Your Family

Your homeowners and auto insurance policies have limits. If someone sues you for more than those limits cover, your personal assets are at risk.

Personal umbrella insurance in Washington fills those gaps with extra liability protection that starts where your standard policies end. At H&K Insurance Agency, we help families understand when this coverage makes sense and how it works with their existing policies.

When You Need Umbrella Insurance in Washington

Your standard homeowners policy typically caps liability at $300,000 to $500,000, and auto policies often max out around $500,000 per incident. A single serious accident or injury claim can easily exceed these limits. If someone sues you for $750,000 and your auto policy only covers $500,000, you’re personally responsible for that $250,000 gap. Washington courts have awarded settlements well beyond standard policy limits, especially in cases involving permanent disabilities or multiple injured parties. Umbrella insurance exists specifically to cover these gaps, stepping in after your underlying policies hit their limits and protecting your savings, home equity, and future earnings from being seized to pay a judgment.

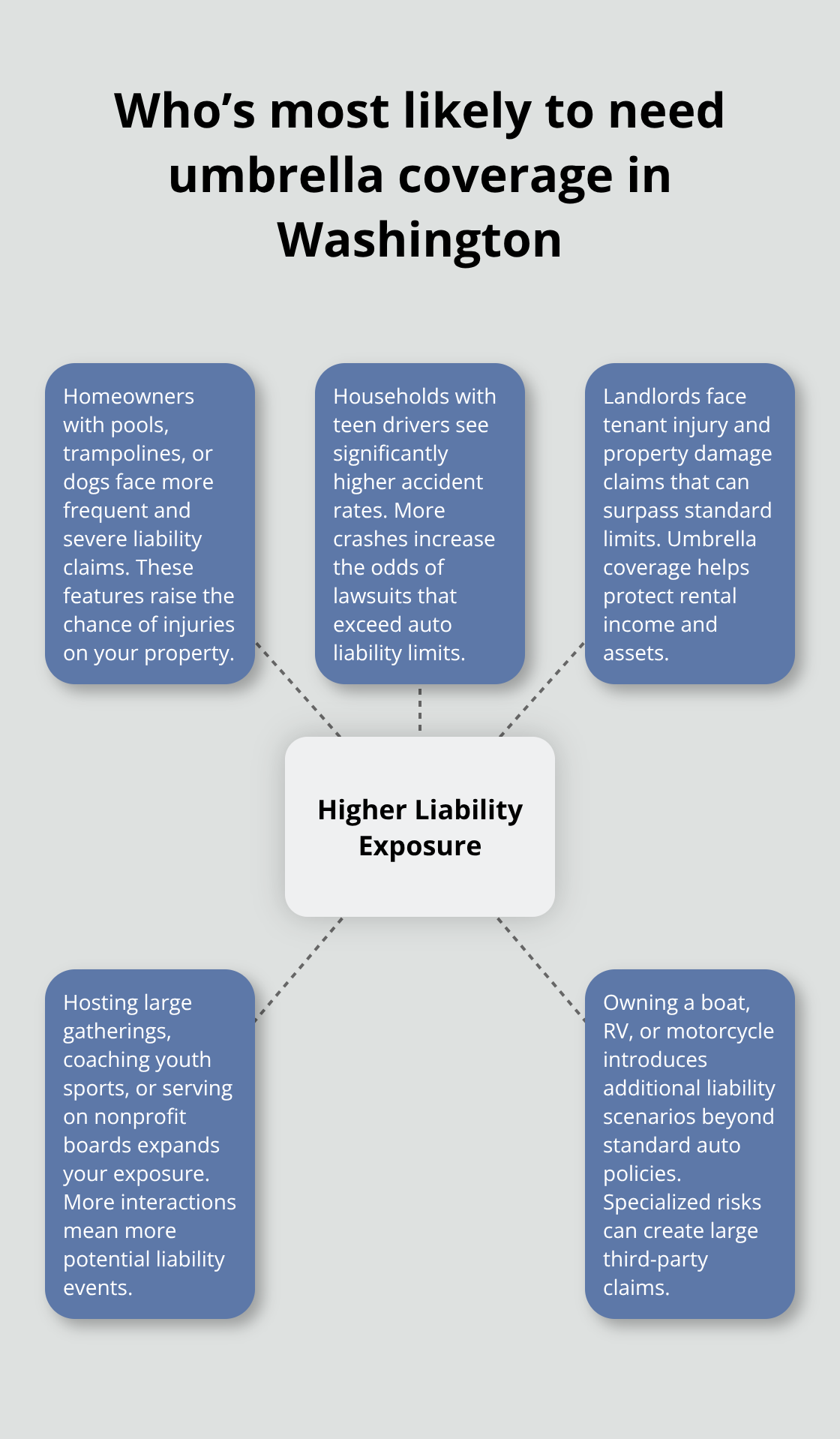

Who Actually Needs This Coverage

Homeowners with pools, trampolines, or dogs face significantly higher liability risk than average. If your dog bites a neighbor and causes $400,000 in medical bills, your homeowners policy might cover only $100,000 to $300,000. You’d be liable for the rest. Teen drivers in your household multiply your risk substantially-younger drivers are statistically involved in more accidents.

Landlords need umbrella coverage because tenant injuries, property damage claims, and liability incidents on rental properties often exceed standard limits. Hosting large gatherings, coaching youth sports, or serving on nonprofit boards also increases your exposure. If you own a boat, RV, or motorcycle, those vehicles create additional liability scenarios that standard auto policies may not fully address.

Real Claims That Exceed Standard Coverage

A dog bite that requires reconstructive facial surgery can cost $500,000 or more in medical bills and ongoing care. A multi-car accident where your teenager is at fault could result in $1 million in combined injuries across three vehicles. A guest falls on your icy driveway and requires long-term care for a spinal injury-medical costs plus pain-and-suffering damages can reach $2 million. A trampoline accident in your backyard leaves a friend permanently disabled. These scenarios happen in Washington regularly. According to NerdWallet, umbrella policies typically start at $1 million in coverage and cost around $200 to $380 annually for that protection. That affordable premium makes the difference between keeping your assets intact and losing everything in a lawsuit. If your net worth exceeds $500,000, umbrella insurance becomes a practical necessity rather than an optional upgrade.

Why Your Current Policies Fall Short

Standard homeowners and auto policies protect you up to a point, but that point stops well short of what a serious lawsuit can cost. Medical expenses, pain-and-suffering awards, and legal fees add up fast. Your liability limits don’t stretch to cover the full damage when injuries are severe or multiple people are involved. Umbrella coverage fills that gap without forcing you to pay thousands more in premiums for higher underlying limits. Instead, you add one affordable policy that covers everything your homeowners and auto policies don’t. This approach costs far less than raising your standard policy limits to $1 million or $2 million across the board.

What Happens When You Get Sued

A lawsuit doesn’t just cost money in damages-it costs money in legal defense. Umbrella policies typically cover your legal defense costs in addition to damages, which means you’re not paying out of pocket for attorneys while the case proceeds. Once your underlying policies pay out their limits, your umbrella policy takes over and covers the rest up to your chosen limit. Without that protection, creditors can pursue your bank accounts, garnish your wages, and place liens on your home. For Washington families with meaningful assets, that risk is real and worth addressing now rather than after a judgment arrives.

How Umbrella Insurance Actually Works

The Layered Protection Structure

Umbrella insurance operates as a secondary layer that activates only after your primary homeowners or auto policies exhaust their limits. Your homeowners policy covers up to $500,000 in liability, your auto policy covers up to $500,000 per incident, and then your umbrella policy takes over. If a lawsuit results in $1.2 million in damages, your homeowners policy pays its $500,000 maximum, your auto policy pays its $500,000 maximum, and your umbrella policy covers the remaining $200,000.

This structure keeps umbrella premiums low because insurers know they’re paying only the excess amounts. According to NerdWallet, a $1 million umbrella policy costs around $200 annually for standard situations, with an additional $75 roughly per million in coverage if you need more protection. The affordability works because you’re not duplicating coverage-your umbrella sits on top of existing policies rather than replacing them.

Minimum Requirements Before You Qualify

Most insurers require minimum underlying liability limits before approving umbrella coverage, typically around $300,000 on homeowners policies and similar amounts on auto policies. This requirement ensures you’ve already maximized your base protection before the umbrella kicks in. Washington residents should verify their current limits match these minimums; if your homeowners policy maxes out at $100,000 in liability, you’ll need to increase it to qualify for umbrella coverage.

What Umbrella Policies Actually Cover

Bodily injury claims like dog bites or trampoline accidents fall under umbrella protection once underlying limits are exhausted. Property damage claims also qualify-if your teenager causes $800,000 in damages to multiple vehicles in an accident, the umbrella covers amounts beyond your auto policy limit. Personal injury claims involving defamation, slander, or libel receive coverage from umbrella policies when standard homeowners policies exclude them entirely.

Legal defense costs accumulate quickly in serious lawsuits, and umbrella policies typically cover attorney fees, court costs, and expert witness expenses in addition to damages. Some umbrella policies extend coverage to landlord liability if you rent out property, addressing tenant injuries or property damage claims that exceed your rental coverage limits.

Critical Coverage Gaps and Exclusions

Umbrella insurance explicitly does not cover your own injuries, damage to your own property, business liability without a business umbrella rider, intentional acts, criminal activities, or contract breaches. Read your specific policy exclusions carefully because coverage varies significantly between insurers. The coordination between your umbrella and underlying policies means you cannot collect twice for the same claim-the umbrella fills only the gap between what your base policies paid and what the total judgment requires.

For Washington families with boats, RVs, or motorcycles, those vehicles may require separate liability coverage before umbrella protection applies. Inventory all your insured assets when discussing umbrella needs with an agent, as this information directly shapes your coverage requirements and costs.

Umbrella Insurance Costs in Washington

What You’ll Actually Pay for Coverage

A $1 million umbrella policy costs around $200 to $380 annually according to NerdWallet data, making it one of the cheapest insurance upgrades available to Washington families. Most people pay closer to $300 per year for standard $1 million coverage, which breaks down to roughly $25 monthly. If you need $2 million in protection instead, you’ll add approximately $75 more per year, bringing your total to around $375 to $455 annually. This affordability exists because umbrella policies activate only after your underlying homeowners and auto policies exhaust their limits, so insurers rarely pay claims. The premium reflects this reality: you’re buying protection for catastrophic scenarios, not everyday incidents.

Washington residents with $500,000 or more in assets should seriously consider this coverage because the cost-to-benefit ratio strongly favors protection. Without umbrella coverage, a single lawsuit can wipe out decades of savings and force wage garnishment for years afterward.

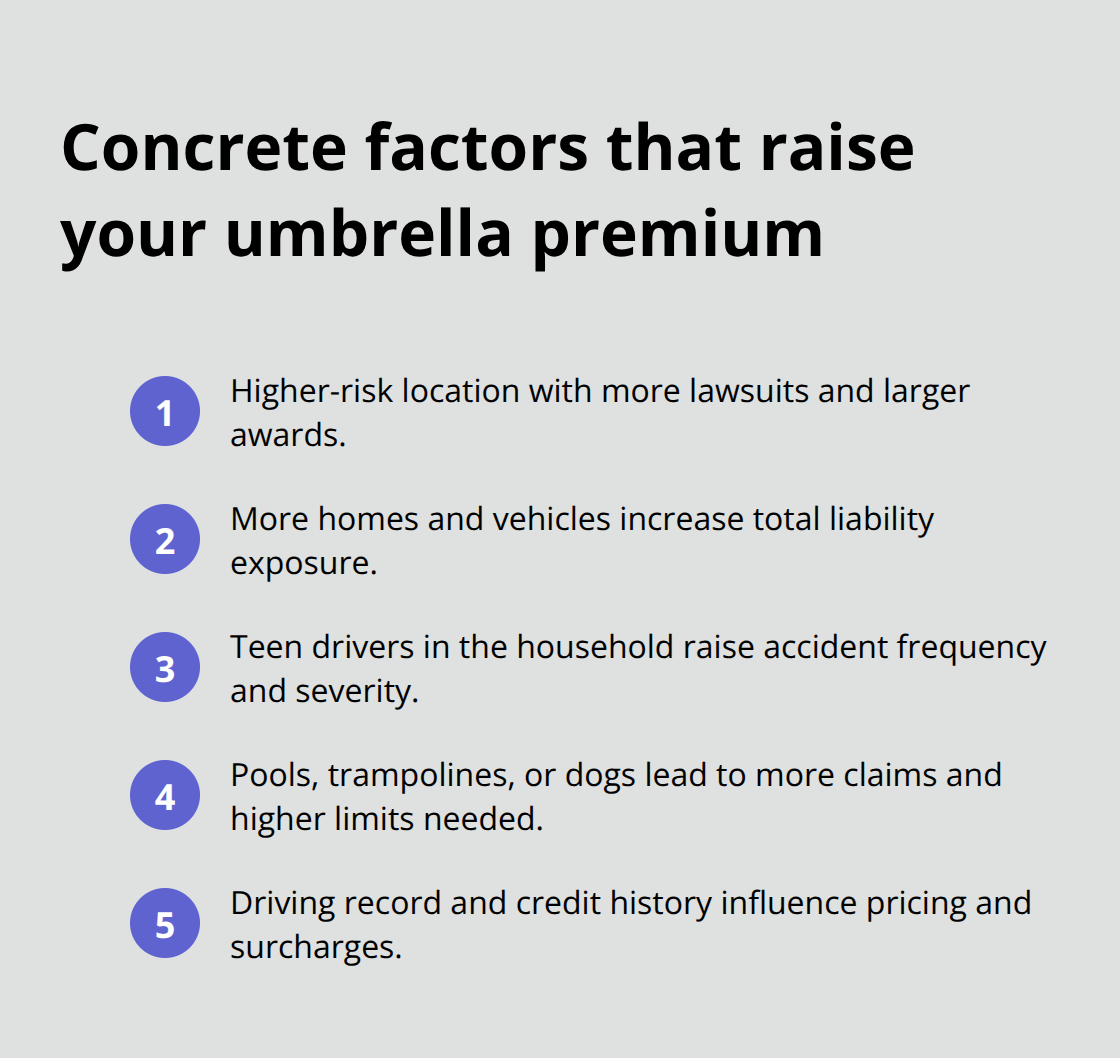

Factors That Directly Impact Your Rate

Your actual rate depends on several concrete factors that directly impact what insurers charge. Location matters significantly because some Washington neighborhoods have higher lawsuit frequency and larger damage awards than others. The number of homes and vehicles you own increases your premium because each property creates additional liability exposure.

Teen drivers in your household raise rates substantially since younger drivers cause more accidents and more severe accidents statistically. Homeowners with pools, trampolines, or dogs pay more because these features generate frequent claims. Your driving record and credit history influence pricing, with accidents and late payments increasing your umbrella cost.

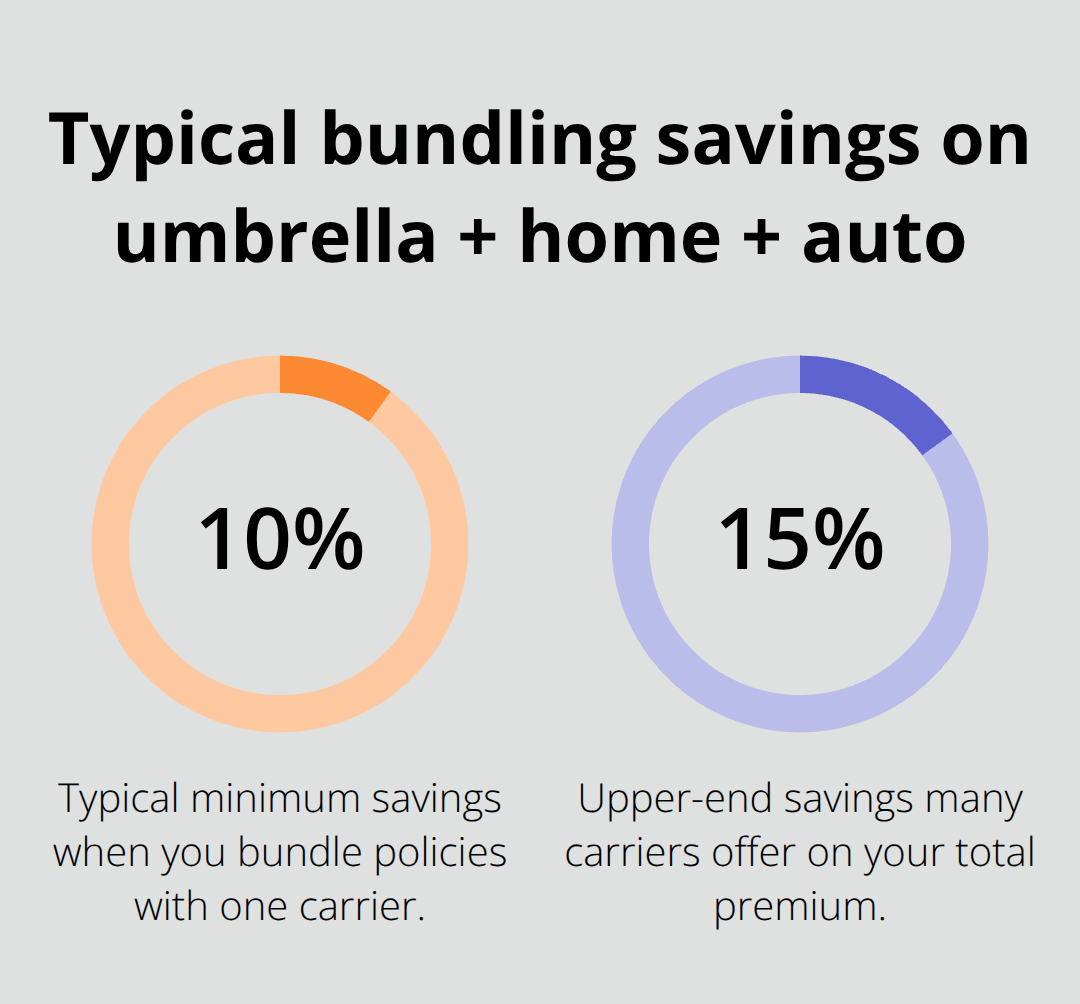

How Bundling Reduces Your Total Cost

The most effective way to reduce your overall insurance spending is bundling your umbrella with auto and homeowners policies from the same carrier, which typically saves 10 to 15 percent on your total premium. Many insurers require you to purchase underlying policies from them before adding umbrella coverage, so consolidating with one carrier becomes both necessary and financially advantageous.

As an independent agency serving the Puget Sound region, H&K Insurance Agency represents multiple top carriers, which allows us to compare umbrella rates from different companies and identify which bundled package delivers the lowest total cost for your specific situation rather than locking you into one insurer’s pricing.

Final Thoughts

A single lawsuit can exceed your standard homeowners and auto policy limits by hundreds of thousands of dollars, leaving your savings, home equity, and future earnings vulnerable to judgment creditors. Personal umbrella insurance in Washington protects what you’ve built when liability claims threaten to destroy it, and the math makes this decision straightforward-a $1 million umbrella policy costs around $300 annually yet protects assets worth far more. If your net worth exceeds $500,000, that premium represents exceptional value for the protection it delivers.

Start by reviewing your current homeowners and auto policy limits, then calculate your total assets and compare that number against your current liability coverage. The gap between what you’re covered for and what you could lose is your umbrella insurance need, and most Washington residents carry $300,000 to $500,000 in liability coverage per policy-which sounds substantial until you face a serious injury claim. Even families with moderate assets benefit from the peace of mind that comes with knowing a catastrophic lawsuit won’t destroy their financial security.

Contact H&K Insurance Agency to discuss your liability exposure and receive quotes for personal umbrella insurance in Washington that fits your family’s needs. As an independent agency representing multiple top carriers, we compare umbrella rates from different companies to find the coverage and price that matches your liability risk and budget. We handle the complexity of coordinating umbrella policies with your existing auto, home, and specialty coverage, ensuring no gaps exist in your protection.