Flood Insurance Puget Sound: Are You Fully Protected Against Northwest Flood Risk

The Puget Sound region faces serious flood risks that most homeowners underestimate. Standard homeowners insurance won’t protect you when floodwaters rise, leaving your property and finances vulnerable.

At H&K Insurance Agency, we’ve helped countless families in Western Washington understand their flood insurance options. This guide walks you through your flood risk, coverage gaps, and the steps needed to get proper protection.

How Bad Is Flooding Really in the Puget Sound?

Climate Change Accelerates Flood Frequency

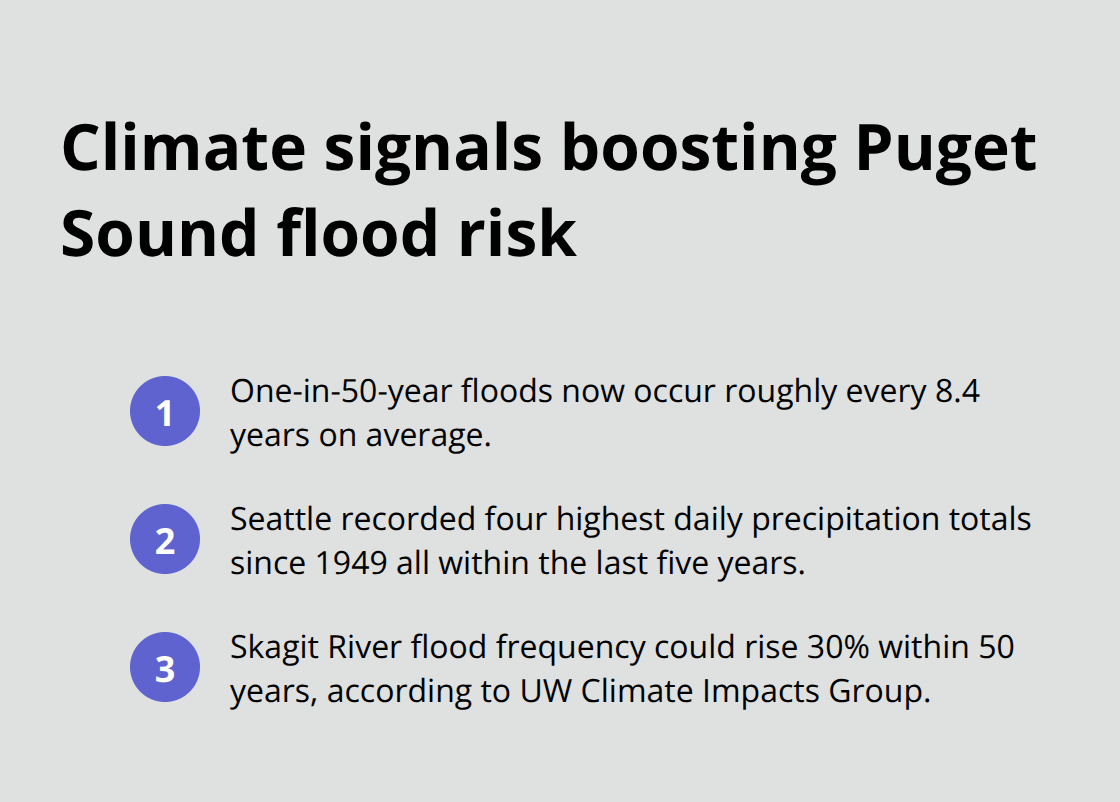

The Puget Sound region sits on a climate collision course. What used to be a one-in-50-year flood event now occurs roughly every 8.4 years on average, according to the National Wildlife Federation. That shift isn’t theoretical-it reshapes how you need to think about property protection.

Seattle recorded its four highest daily precipitation totals since 1949 all within the last five years. The University of Washington Climate Impacts Group projects that Skagit River flood frequency could rise 30% within 50 years. These numbers matter because they translate directly to your insurance decisions and property vulnerability.

Regional Risk Varies Significantly

Pierce County faces the highest flood risk scores in the region at 1.9 on the First Street Foundation Flood Model scale, followed by King, Kitsap, and Snohomish counties around 1.5 each. The five rivers draining into Puget Sound-Duwamish, Nisqually, Puyallup, Snohomish, and Stillaguamish-shape regional flood patterns and create predictable danger zones. Puyallup and Kent along the Green River Natural Resources Area rank highest, with risk scores exceeding 7. These geographic variations mean your location determines your actual exposure level far more than most homeowners realize.

The Damage Toll Keeps Rising

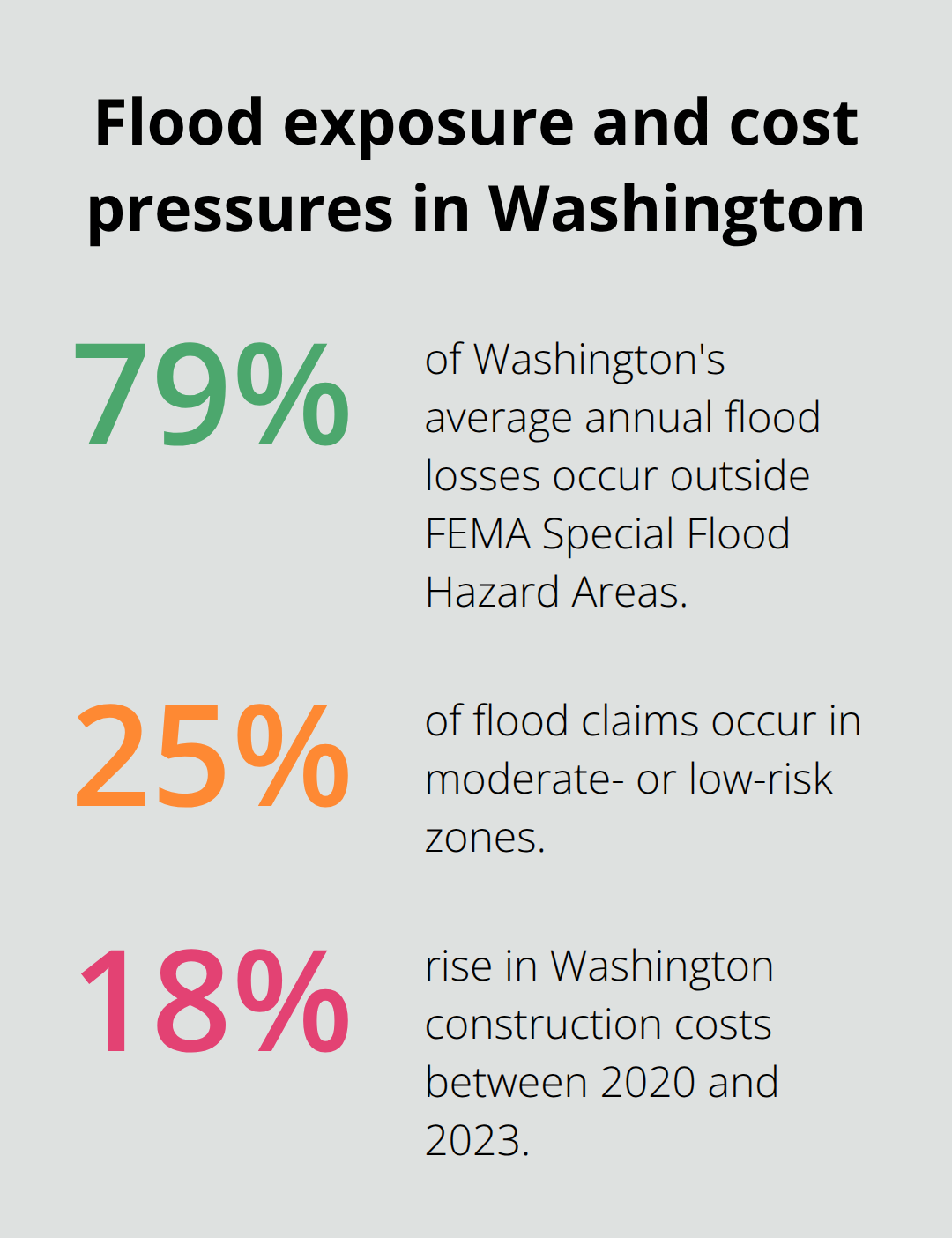

Since 1990, western Washington paid over $1.37 billion in flood damages through taxpayers, with 58 lives lost across 15 federally declared flood disasters. Interstate 5 alone closed four times due to floods, costing more than $181 million in losses. In the Puget Sound area specifically, 833 homes flooded three or more times, generating about $71 million in insurance claims. The problem compounds because roughly 79.1% of Washington’s average annual flood losses occur outside FEMA’s designated Special Flood Hazard Areas, meaning most properties sit unprotected by standard federal requirements.

Population Exposure Will Worsen Significantly

The state will see a 66% increase in flood-exposed residents by 2050, jumping from 129,200 today to approximately 214,000. This population surge (driven partly by the roughly 700,000 new residents who moved to Puget Sound between 2010 and 2020) expands exposure across the region. More people in flood-prone areas means more properties at risk and more families facing potential financial devastation. Understanding your specific flood risk becomes essential before the next major event strikes your neighborhood.

Why Your Homeowners Policy Leaves You Exposed to Floods

Your homeowners insurance policy almost certainly excludes flood damage. Standard policies cover wind, hail, lightning, and theft, but water damage from rising rivers, overflowing streams, or heavy rainfall sits outside standard coverage.

About 25% of flood claims occur in moderate- or low-risk zones, meaning homeowners who thought they were safe discovered otherwise during a loss. The National Flood Insurance Program exists precisely because private insurers refuse to cover flood risk at any price. This isn’t a gap you can patch with a rider or endorsement to your existing homeowners policy. Flood coverage requires a separate insurance product, and understanding why matters when you assess your true protection level in the Puget Sound region.

The Federal Program Sets Hard Limits on Protection

The National Flood Insurance Program caps residential building coverage at $250,000 and contents at $100,000, according to FEMA. Commercial buildings max out at $500,000 with $500,000 contents coverage. Construction costs in Washington rose approximately 18% between 2020 and 2023, which means many homes now cost far more to rebuild than these limits allow. A $400,000 home in Puyallup or Kent could easily exceed replacement value when you add the actual cost of labor, materials, and modern building code upgrades required after a flood. The NFIP doesn’t cover business interruption, additional living expenses for extended displacement, or high-value items that fall outside standard definitions. This structural limitation explains why roughly 79.1% of Washington’s average annual flood losses occur outside areas where the NFIP even applies.

Why NFIP Coverage Falls Short

You cannot rely on federal flood insurance alone if you want financial protection that matches your actual property value and recovery needs. The gap between what NFIP covers and what your property actually costs to rebuild creates serious exposure. Excess flood insurance sits above the NFIP, offering higher limits (often millions) and may include business interruption or loss-of-use coverage. Residential excess flood policies commonly offer limits up to around $5 million for building coverage, with corresponding contents coverage and options for loss-of-use. Commercial excess flood coverage can exceed $20 million in building value and may be purchased in multiple layers, with many options including optional business interruption endorsements.

Uninsured Flood Losses Create Financial Devastation

The 833 homes in the Puget Sound area that flooded three or more times generated approximately $71 million in insurance claims, yet that figure represents only the insured portion of damage. Since 1990, western Washington paid over $1.37 billion in flood damages overall, with taxpayers absorbing costs when insurance gaps leave families stranded. A single major flood event can wipe out years of equity, force a sale at a loss, or trigger foreclosure if your mortgage lender requires proof of flood coverage. Without adequate insurance, you become personally liable for every dollar of damage, plus the cost of temporary housing, business closure, or lost income during recovery. The financial consequences of underinsurance extend far beyond the initial loss-they reshape your financial future for years.

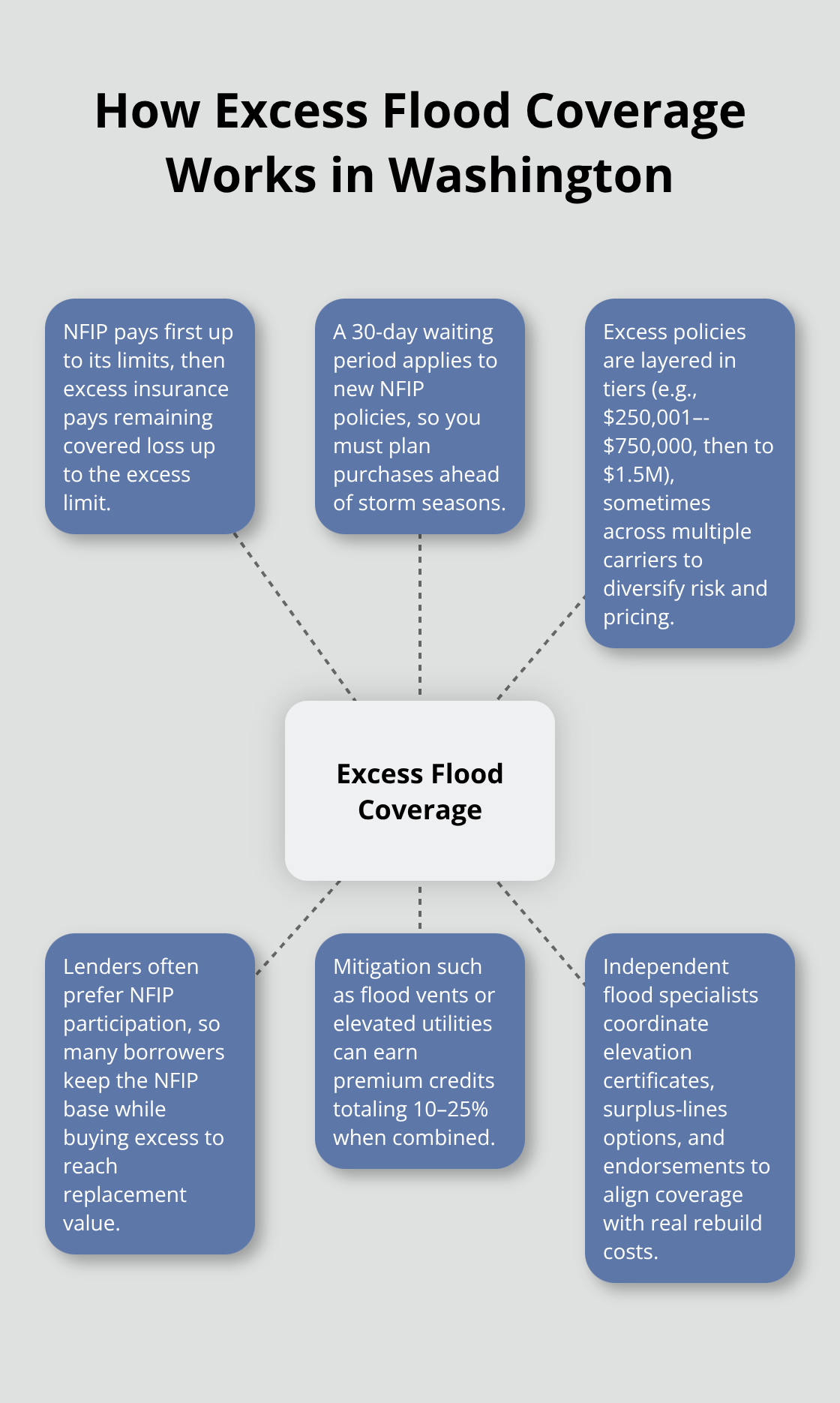

How Excess Flood Works in Washington

The NFIP pays first up to its limits, then the excess carrier pays the remaining loss up to the excess limit. A 30-day waiting period applies to new NFIP policies, so timing matters when you purchase coverage. Carriers layer excess coverage in tiers (for example, first layer from about $250,001 to $750,000, next layer to $1.5 million), sometimes using multiple carriers to diversify risk and pricing.

Lenders generally prefer NFIP participation for the federal guarantees, so many borrowers maintain the NFIP layer while purchasing excess coverage to reach full replacement value. Mitigation measures like flood vents, elevated utilities, or relocated electrical panels can earn premium credits that may total 10–25% when combined. An independent agent who understands Washington flood maps and surplus-lines markets can coordinate elevation certificates, navigate commercial needs, and help you compare options beyond price alone-checking for exclusions, finished basement coverage, and available endorsements.

How to Know Your Flood Risk and Secure Proper Coverage

Check Your Flood Risk Beyond Standard Maps

Start with FEMA’s Flood Insurance Rate Map, but understand its limitations immediately. The map shows Special Flood Hazard Areas where lenders require flood insurance, yet roughly 79.1% of Washington’s average annual flood losses occur outside these designated zones. Pierce County carries the highest flood risk scores at 1.9, followed by King, Kitsap, and Snohomish counties around 1.5 each. Your census tract matters more than you think-areas with high concentrations of people with disabilities show roughly a 30% higher average flood risk score than areas with fewer people with disabilities. The Puget Sound Regional Council’s Flood Risk Map tool lets you view your specific tract’s projected flood likelihood, which incorporates the First Street Foundation Flood Model’s 30-year projections. This data combines hydraulic and hydrology models with climate change projections rather than just historical flood history, so older neighborhood flood records won’t predict your actual current risk.

Identify High-Risk River Corridors

If you live near the Puyallup River in Puyallup, Green River Natural Resources Area in Kent, or along the Duwamish, Nisqually, Snohomish, or Stillaguamish rivers, your risk score likely exceeds 7. These five river systems drain into Puget Sound and create predictable danger zones across the region. Properties in these corridors face immediate pressure to secure adequate flood coverage before the next major event strikes.

Review Your Current Coverage Gaps

Pull your current homeowners policy and contact your agent to confirm what flood coverage you actually have-you probably have none. The NFIP caps residential building coverage at $250,000 and contents at $100,000, which falls drastically short when Washington construction costs rose 18% between 2020 and 2023. A $400,000 home requires excess flood insurance to bridge the gap, with residential policies commonly offering limits up to $5 million for building coverage plus loss-of-use protections that the NFIP excludes entirely. Commercial properties face even steeper gaps, with NFIP maxing out at $500,000 for buildings and $500,000 for contents while excess coverage can exceed $20 million in building value.

Work with a Specialized Agent

An independent agent who specializes in flood insurance becomes essential-they can coordinate elevation certificates, navigate Washington’s surplus-lines markets, and compare options across multiple carriers rather than locking you into a single insurer’s limitations. H&K Insurance Agency represents multiple top carriers, which means we can layer excess flood coverage in tiers and identify premium credits from mitigation measures like flood vents or elevated utilities that can total 10–25% when combined. Gather your NFIP declarations, elevation certificate if available, property photos, and a contents inventory before meeting with an agent. The NFIP requires a 30-day waiting period on new policies, so timing your purchase strategically prevents coverage gaps during high-risk seasons.

Final Thoughts

Flood insurance in the Puget Sound region isn’t optional anymore. Climate change has transformed what was once a rare event into a regular threat, with one-in-50-year floods now occurring every 8.4 years on average. Your standard homeowners policy won’t protect you, and federal flood insurance alone leaves massive gaps between what you’re covered for and what your property actually costs to rebuild.

Determine your actual flood risk using the Puget Sound Regional Council’s Flood Risk Map tool, which incorporates 30-year climate projections rather than outdated historical data. If you live near the Puyallup, Duwamish, Nisqually, Snohomish, or Stillaguamish rivers, or in Pierce or King counties, your risk score likely demands immediate action. Pull your current homeowners policy and confirm you have zero flood coverage.

Contact an independent agent who understands Washington’s surplus-lines markets and can layer excess flood insurance above your NFIP base policy. We at H&K Insurance Agency serve the Puget Sound region and compare rates across multiple top carriers to customize packages that combine NFIP and excess flood coverage, plus identify premium credits from mitigation measures that can reduce your costs by 10–25%. Contact us today to discuss your specific flood insurance Puget Sound needs and get a quote that matches your actual property value and recovery requirements.