Earthquake Coverage Homeowners WA: Strengthen Your Northwest Home

Washington sits on one of America’s most active seismic zones. The Cascadia Subduction Zone and other fault lines mean earthquakes aren’t a distant possibility-they’re a real threat to your home.

Here at H&K Insurance Agency, we know that standard homeowners insurance won’t protect you when the ground shakes. Earthquake coverage for homeowners in WA fills that critical gap, and understanding your options now could save you thousands in damage costs later.

Why Your Washington Home Faces Real Earthquake Risk

Washington sits directly in one of America’s most seismically active regions, and the numbers prove this isn’t overblown concern. The Cascadia Subduction Zone can produce magnitude 9 earthquakes, while the Puget Sound fault system generates frequent smaller quakes that still cause significant damage. According to the Washington Geological Survey, the state experiences hundreds of earthquakes annually, with many strong enough to shake buildings and crack foundations. The 2001 Nisqually earthquake near Seattle measured 6.8 in magnitude and caused millions in property damage, exposing how unprepared most homeowners were for seismic events. That quake happened two decades ago, yet only 11.3% of Washington homeowners carry earthquake coverage today, leaving the vast majority vulnerable to the same type of financial devastation.

Foundation and Structural Damage

The physical destruction from earthquakes extends far beyond what most people imagine. A moderate earthquake can crack foundations, shift homes off their bases, collapse chimneys, and rupture water and gas lines inside your walls. Soil liquefaction-where saturated soil loses strength during shaking and behaves like liquid-causes structures to tilt and sink unevenly, creating permanent damage that costs thousands to repair. Homes built before 1980 face particular risk, as older construction methods lack the seismic reinforcement that modern building codes require.

Volcanic and Coastal Hazards

In areas near Mount Rainier and other volcanic zones, lahars (volcanic mudflows) travel at speeds up to 30 kilometers per hour during seismic events and destroy everything in their path. The 1980 Mount St. Helens eruption produced lahar flows reaching 100 kilometers per hour, destroying hundreds of homes and miles of roads. Coastal properties face tsunami risk as well, with Washington state modeling showing that tsunamis can inundate even inland cities like Seattle and Olympia.

Why Coverage Matters Now

These aren’t theoretical risks-they’re documented hazards that have caused measurable destruction in Washington’s recent past and will strike again. Your standard homeowners policy won’t cover any of this damage, which means the financial burden falls entirely on you. Understanding what earthquake coverage actually protects (and what it doesn’t) becomes your first step toward real protection.

What Standard Homeowners Insurance Excludes

Why Insurers Won’t Cover Earthquake Damage

Your homeowners insurance policy covers fire, theft, windstorms, and dozens of other perils, but earthquake damage sits in a category all by itself-completely excluded. Insurers treat earthquakes as uninsurable under standard policies because seismic events pose catastrophic risk across entire regions simultaneously, unlike a house fire that affects one property. When the ground shakes, thousands of homes suffer damage at once, which drains insurer reserves faster than any other single event. This isn’t a loophole or oversight; every standard homeowners policy sold in Washington contains this deliberate exclusion. According to the Washington State Department of Insurance, only 11.3% of homeowners in our state carry earthquake coverage, which means roughly nine out of ten families bet their financial security on the ground never moving.

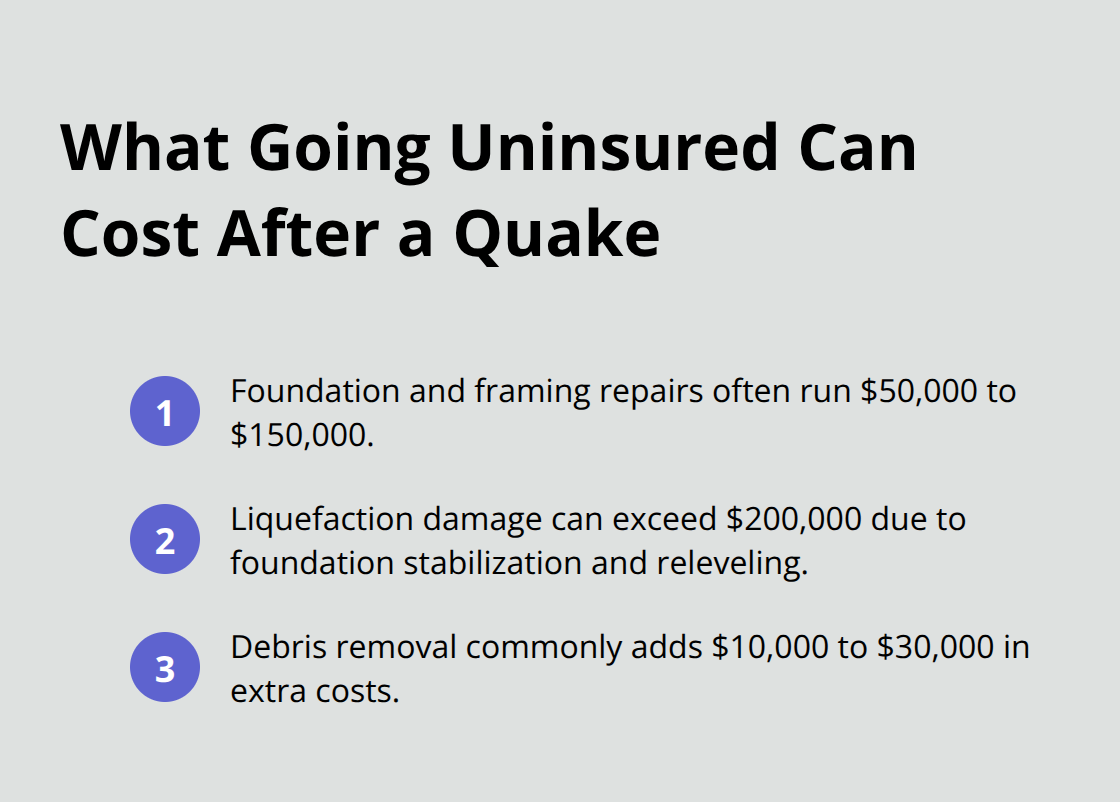

The Real Cost of Being Uninsured

The gap between what you’re covered for and what actually happens during a seismic event creates serious financial exposure. A moderate earthquake causes foundation cracks, shifted framing, or ruptured utilities that easily cost $50,000 to $150,000 in repairs-amounts that destroy family finances when no insurance applies. Soil liquefaction, where saturated soil loses strength and causes homes to sink unevenly, can push repair costs above $200,000 because the foundation itself requires stabilization and releveling. Water damage from broken pipes, gas line ruptures requiring system replacement, and chimney collapse all fall outside standard coverage. Debris removal alone can run $10,000 to $30,000 after a significant quake and comes entirely out of your pocket.

How Earthquake Coverage Changes the Picture

Earthquake coverage fills this protection gap with deductibles that typically range from 10% to 25% of your dwelling limit (according to the Washington State Department of Insurance). This means you absorb substantial costs upfront-but that’s far better than absorbing the entire bill yourself. A $300,000 home suffering moderate earthquake damage leaves you responsible for tens of thousands in repairs without coverage. With earthquake insurance in place, you shift that financial burden to your carrier and protect your family’s long-term stability. The question shifts from “Can I afford to rebuild?” to “What deductible makes sense for my situation?”-a much more manageable decision.

Understanding what your standard policy excludes sets the stage for evaluating what earthquake coverage actually provides and how it fits into your overall protection strategy.

How Earthquake Coverage Works in Washington

Understanding Your Coverage Options

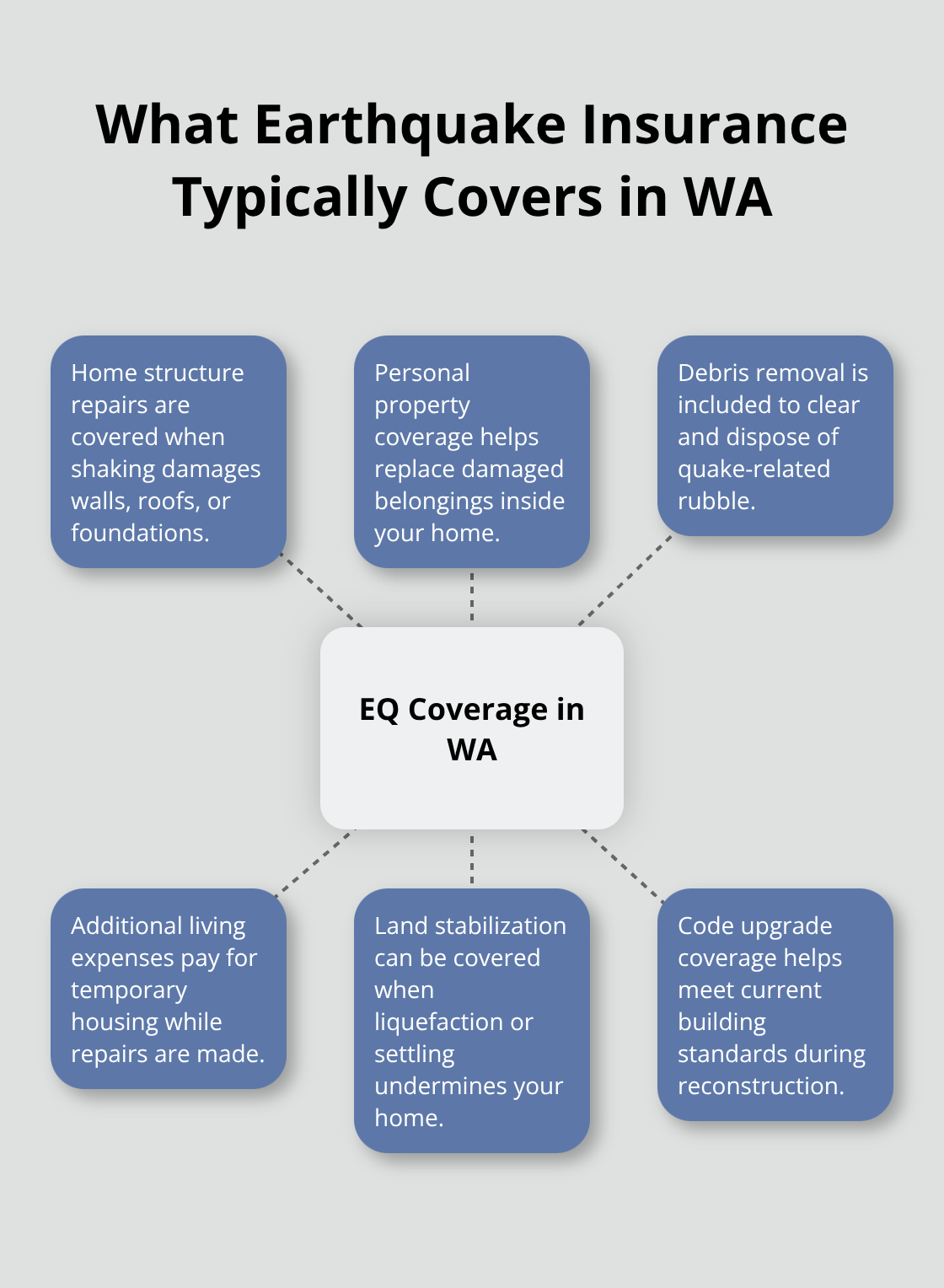

Earthquake coverage in Washington operates differently than the standard homeowners protection you already carry, and understanding those differences matters before you buy. You can add earthquake insurance to your existing homeowners policy or purchase it as a standalone policy, depending on which option fits your situation and budget. According to the Washington State Department of Insurance, coverage pays for repairs to your home’s structure, damage to personal property inside, debris removal costs, and extra living expenses while repairs happen. The policy also covers costs to stabilize land under your home if soil liquefaction or settling occurs, and it can help cover upgrades to meet current building codes during reconstruction, which often costs more than original construction. Coverage extends to unattached structures like detached garages or sheds, though you’ll want to verify exactly what’s included since policies vary between insurers.

What Your Policy Won’t Cover

What earthquake coverage explicitly does not cover matters just as much as what it does. Your policy won’t pay for fire damage that results from an earthquake, land itself, vehicles, water damage from outside sources, landslides, mudflows, or tsunamis-even if an earthquake triggered them. Understanding these exclusions prevents costly surprises after a seismic event and helps you plan additional protection if needed.

Deductibles and How They Work

Deductibles typically run between 10% and 25% of your dwelling coverage limit, according to the Washington State Department of Insurance, which means you absorb substantial out-of-pocket costs before insurance contributes anything. For a $300,000 home with a 15% deductible, you’re responsible for $45,000 in damage before the policy kicks in. This structure protects insurers from small claims while keeping premiums manageable for homeowners who can absorb moderate losses.

Premium Costs and Location Factors

Premiums in Washington generally cost $3 to $15 per $1,000 of coverage annually, though location drives huge variation-homes near the Puget Sound fault system pay significantly more than properties in Eastern Washington. A $300,000 Seattle home with a $1,000 deductible might cost $900 to $2,250 per year, while that same home in a lower-risk county could run $600 to $1,500. Newer homes built to current earthquake codes often qualify for 20% to 30% premium discounts compared to older construction, which rewards compliance with modern standards.

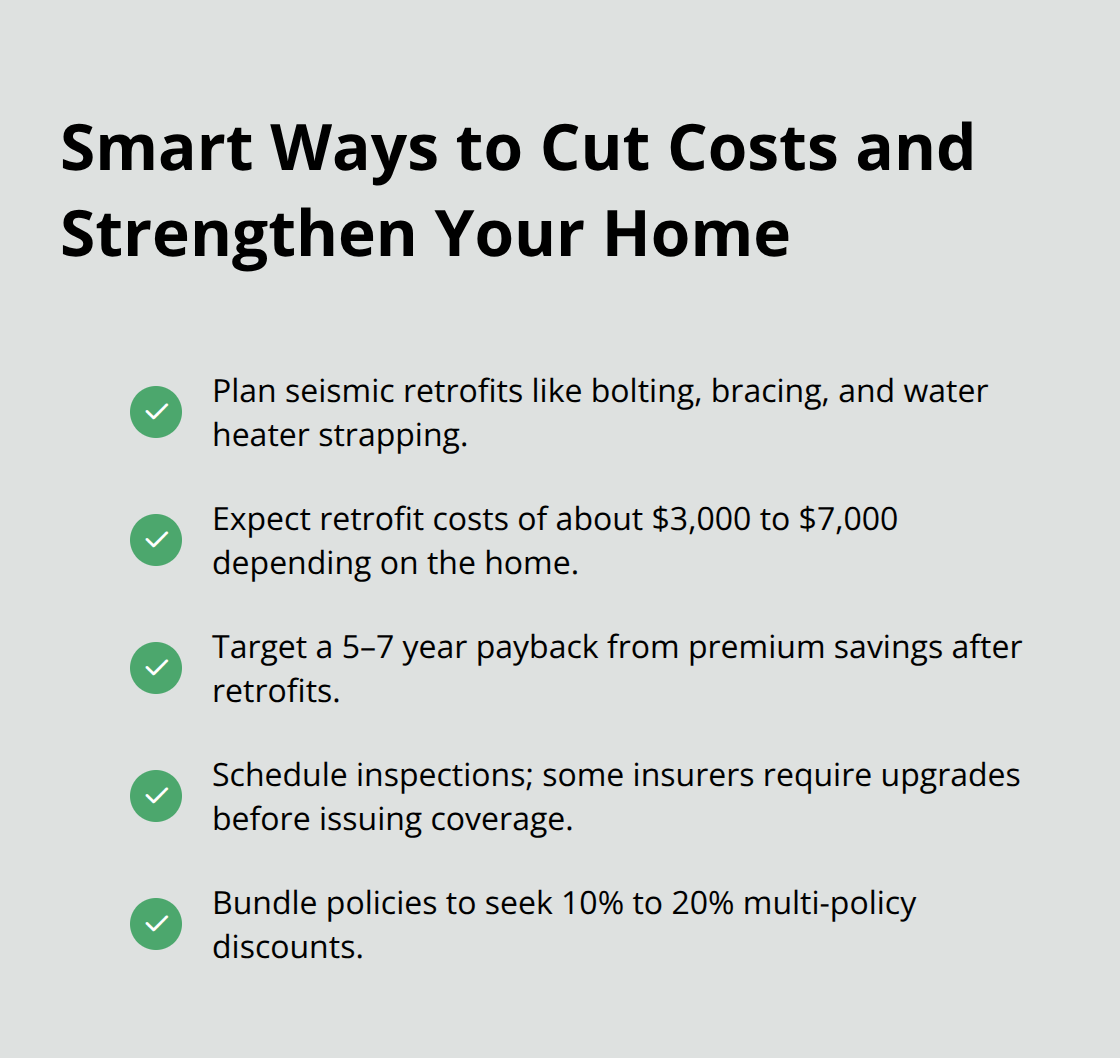

Retrofits, Inspections, and Bundling Strategies

Seismic retrofits-foundation bolting, interior wall bracing, and water heater strapping-typically cost $3,000 to $7,000 depending on your home’s age and construction type, and the premium savings from these improvements pay back over five to seven years in most cases. Many insurers require property inspections before issuing coverage and may mandate specific retrofits as conditions of your policy, so you should budget for those upgrades when calculating total protection costs. Bundling earthquake coverage with your homeowners policy and other insurance through the same carrier often generates 10% to 20% multi-policy discounts while simplifying renewal management, making this approach worth exploring when you shop for quotes.

Final Thoughts

Your address through QuakeScout reveals your specific risk profile in minutes, showing Modified Mercalli Intensity ratings, lahar presence, liquefaction susceptibility, and tsunami risk rather than relying on guesses about fault line distance. Comparing three to five quotes from different insurers exposes significant price variations for earthquake coverage homeowners WA can access, and mentioning any seismic retrofits you’ve completed or plan to complete often unlocks premium discounts that pay back within five to seven years. Foundation bolting, wall bracing, and water heater strapping address the structural vulnerabilities that earthquakes exploit while your insurance handles the financial impact when shaking occurs.

Contact H&K Insurance Agency to discuss your earthquake coverage options and compare rates across multiple carriers serving the Puget Sound region. We represent top local and national insurers and tailor coverage to match your home’s specific risk profile and your budget. Our independent agency approach means you get personalized protection at competitive prices rather than settling for one-size-fits-all solutions.