NW Homeowners Insurance Quotes: Compare Top Local Carriers

Finding the right homeowners insurance in the Pacific Northwest means understanding what coverage you actually need and comparing options that fit your home’s unique risks. At H&K Insurance Agency, we help homeowners navigate NW homeowners insurance quotes to find policies that protect their investment without overpaying.

This guide walks you through coverage types, how to evaluate quotes from different carriers, and the regional factors that shape your rates.

What Coverage Do You Actually Need for Your NW Home

Dwelling Coverage Starts with Replacement Cost

Dwelling coverage forms the foundation of any homeowners policy, and it must match your home’s replacement cost, not its market value. In Washington, homes cost between $400,000 and $600,000 to rebuild, depending on location and construction materials. If you insure for only $300,000 on a home that costs $500,000 to rebuild, an underinsurance penalty will reduce claim payouts by 20 to 30 percent. You should insure at least 80 percent of your home’s replacement cost to avoid this penalty. Hire a local contractor or appraiser to estimate what it would cost to rebuild your specific home from the ground up, accounting for current labor and material costs in the Puget Sound region.

Many NW homeowners underestimate these costs and regret it after a loss.

Personal Property Coverage Reflects What You Own

Personal property coverage typically covers 50 to 70 percent of your dwelling limit, which means a $500,000 home receives $250,000 to $350,000 in personal property protection. This covers furniture, electronics, clothing, and household items at actual cash value, which applies depreciation. A five-year-old television worth $800 new gets valued at $200 under actual cash value, which frustrates homeowners after a total loss. Replacement cost coverage for personal property costs more but reimburses you at today’s replacement price without depreciation. High-value items like jewelry, watches, firearms, or art require separate endorsements because standard policies cap coverage on these items at $1,500 to $2,500 each. If you own a $5,000 engagement ring or a $3,000 firearm collection, you need specific coverage for those items or you’ll face significant gaps.

Liability Coverage Protects Your Financial Future

Personal liability coverage starts at $100,000 on most standard policies, but this amount proves dangerously low if you have meaningful assets. If someone gets injured on your property and sues you for $250,000, your $100,000 liability limit leaves you personally responsible for the remaining $150,000. You should carry liability limits equal to your household net worth. If you own a home worth $500,000 with savings and investments totaling another $300,000, try $500,000 in liability coverage. This costs only $15 to $25 more per year than the basic $100,000 limit, making it an affordable way to protect your financial security.

Loss of Use Coverage Covers Temporary Housing

Loss of use coverage reimburses temporary living expenses if your home becomes uninhabitable, typically covering 20 to 30 percent of your dwelling limit. For a $500,000 home, that equals $100,000 to $150,000 in living expense coverage. In the Puget Sound region, temporary housing during a major rebuild costs $3,000 to $5,000 monthly, so adequate loss of use coverage prevents financial strain while your home undergoes repairs. This coverage activates when a covered loss makes your home unlivable, and it pays for hotel stays, rental housing, and other necessary living expenses until you can return home.

Now that you understand what coverage protects your home and finances, the next step involves comparing how different carriers structure these protections and what rates they charge for similar coverage levels.

Comparing Quotes from NW Carriers Side by Side

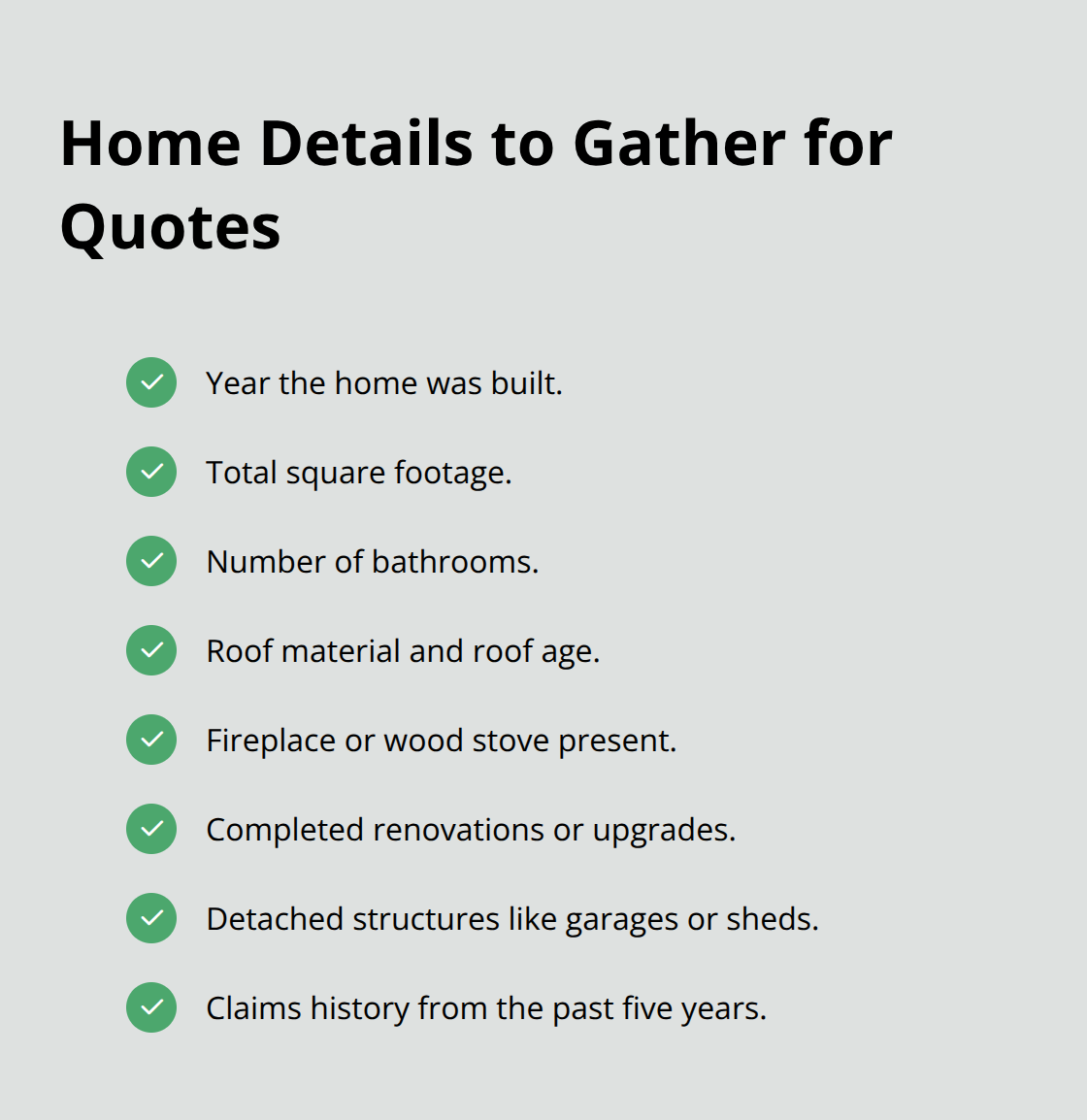

Gather Your Home Details Before Requesting Quotes

Getting three or more quotes from different carriers reveals what your coverage actually costs and which insurer offers the best value for your situation. Washington homeowners pay low average premiums compared to the national average, but this masks enormous variation between carriers. Amica costs around $97 monthly for a $300,000 dwelling, while Chubb runs roughly $154 monthly for similar coverage in some areas. The difference between the cheapest and most expensive option can exceed $800 per year, which means skipping quote comparisons costs you real money.

Start with these home details: the year it was built, square footage, number of bathrooms, roof material and age, whether you have a fireplace or wood stove, any renovations completed, detached structures like garages or sheds, and your claims history from the past five years. Carriers weight these factors differently, so what costs $1,800 from one insurer might cost $2,400 from another even though both policies provide identical dwelling and liability limits.

Match Coverage Across All Quotes

When comparing quotes, match the coverage exactly across all three policies before deciding which is cheapest. A quote showing $1,500 annual premium with a $2,500 deductible and $100,000 liability cannot be fairly compared to a quote showing $1,700 with a $1,000 deductible and $500,000 liability. Write down the dwelling limit, personal property coverage, liability limit, loss of use amount, deductible, and any endorsements included in each quote.

Then note which discounts each carrier offers for bundling home and auto, security devices, or being a new homebuyer. Bundling typically saves 15 to 25 percent on combined premiums, which means an insurer charging $2,000 for homeowners alone might cost only $1,500 to $1,700 when bundled with auto.

Compare Real Rates from Washington Carriers

State Farm in Washington averages about $2,195 annually for a $600,000 dwelling with standard coverage, while Allstate shows roughly $1,530 annually for identical dwelling coverage in some areas. These differences reflect how each carrier assesses risk in the Puget Sound region and structures their rating models. High-value items like jewelry or firearms should appear as separate endorsements on your quotes since standard policies severely limit coverage on these items (typically $1,500 to $2,500 per item).

Evaluate Financial Strength and Service Quality

After you’ve aligned all three quotes for identical coverage, the lowest premium wins only if you’re comfortable with that carrier’s financial strength and customer service ratings. Check each insurer’s A.M. Best financial strength rating and complaint scores from the National Association of Insurance Commissioners before committing. An independent agency like H&K Insurance Agency can help you gather multiple quotes from top carriers and verify their ratings, simplifying your comparison process.

The quotes you’ve now collected show you exactly what protection costs from each carrier-but your final choice depends on understanding which regional factors shaped those rates in the first place.

What Shapes Your NW Insurance Rate

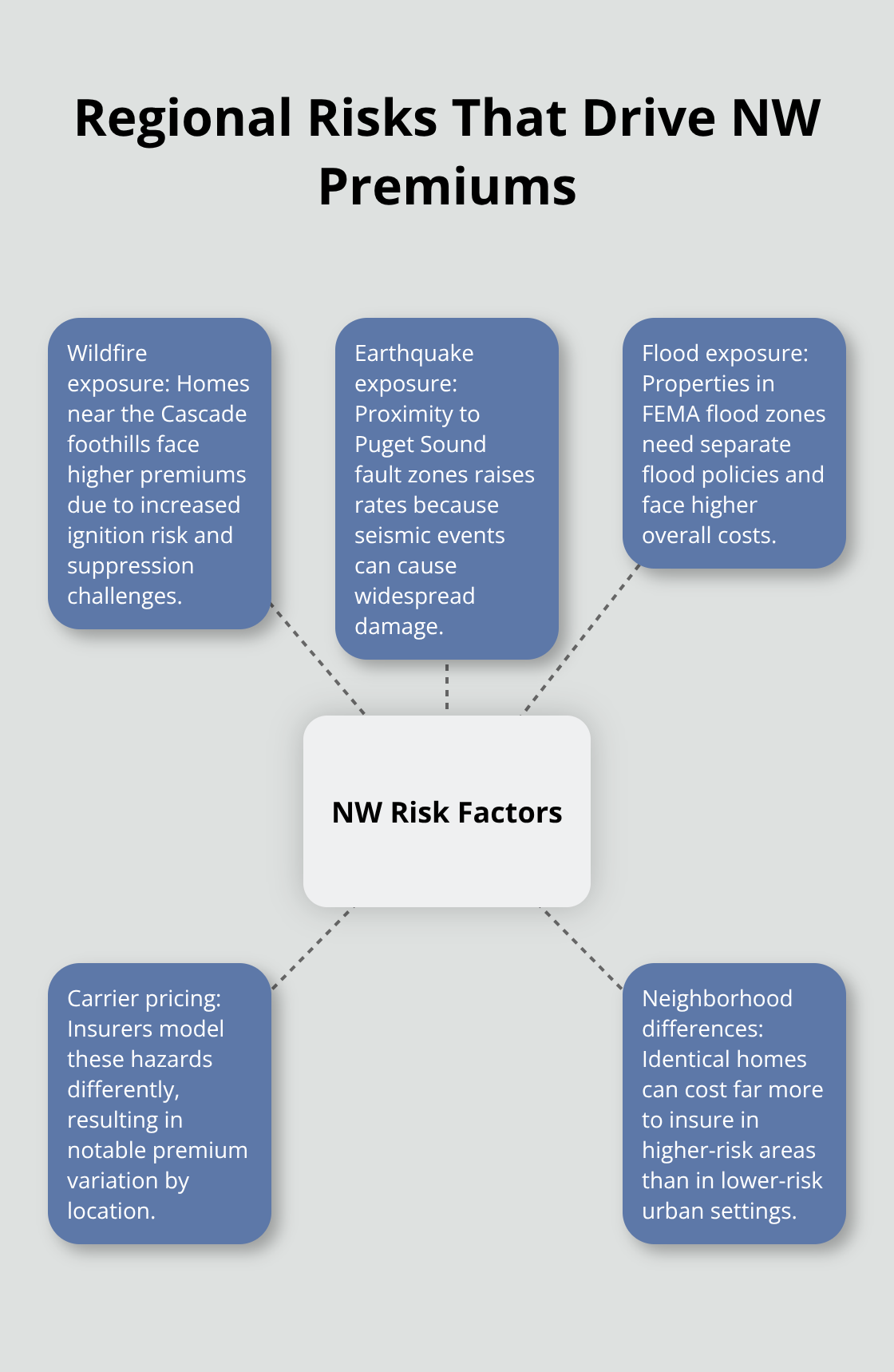

Natural Disasters Drive Regional Premium Differences

Washington’s natural disaster exposure directly determines what insurers charge for homeowners coverage, and understanding these regional risks explains why your quote differs from a neighbor’s in a lower-risk area. The Washington Emergency Management Division documents that wildfires, earthquakes, and floods occur regularly throughout the state, forcing carriers to price policies based on your specific exposure.

A home in a wildfire-prone zone near the Cascade foothills costs substantially more than an identical home in urban Tacoma or Bremerton, even though both sit in Washington. Earthquake risk varies dramatically by location as well-homes near the Puget Sound fault zone face higher premiums because the 2001 Nisqually earthquake caused significant damage across the region and reminded insurers of seismic exposure.

Flood risk depends on your proximity to rivers, streams, and low-lying areas that experience seasonal inundation or storm surge. If your home sits in a flood zone designated by FEMA, standard homeowners policies exclude flood damage entirely, forcing you to purchase separate flood insurance through the National Flood Insurance Program or private carriers. Carriers factor all these disaster exposures into your rate, which is why a $500,000 home in a high-risk wildfire area might cost $2,800 annually while the same home in a lower-risk neighborhood costs $1,900.

Construction Materials and Building Age Impact Your Premium

Construction materials and local building standards influence your premium because newer homes built to current seismic and wind codes present lower risk than older homes with outdated construction. A home built in 1970 with single-pane windows and a wood frame roof costs more to insure than a 2015 home with impact-resistant windows and a metal roof, even at identical dwelling values. Roof age matters significantly-insurers charge higher premiums for roofs over 20 years old and may decline coverage entirely on roofs exceeding 25 to 30 years.

If your inspection reveals a roof nearing the end of its life, you’ll face premium increases or coverage restrictions unless you replace it soon. Carriers also assess the condition of your home’s exterior, foundation, and mechanical systems when calculating rates. Homes with recent upgrades to electrical systems, plumbing, or HVAC equipment often qualify for lower premiums than homes with original systems from decades past.

Security Devices and Crime Rates Affect Liability Costs

Crime rates in your specific neighborhood affect liability and theft coverage pricing, with higher-theft areas commanding premiums 10 to 15 percent above regional averages. Installing security systems, deadbolts, and alarm monitoring systems reduces these premiums by 10 to 25 percent, making security upgrades a smart investment if you live in a higher-crime area. Many carriers offer discounts for professionally monitored systems that alert police to break-ins, and some provide additional savings for motion sensors or video surveillance.

Disclosure Prevents Coverage Gaps After a Loss

When requesting quotes, disclose your roof age, construction materials, security devices, and claims history honestly because underestimating these risk factors leads to policy cancellation after a loss or claim denial if the insurer discovers misrepresentation. Carriers verify information through inspection reports and public records, so inaccurate details on your application create serious problems down the road. An independent agency representing multiple carriers (like H&K Insurance Agency in the Puget Sound region) can help you accurately assess these risk factors and match them with carriers that offer competitive rates for your specific situation.

Final Thoughts

Your home represents your largest financial investment, and the right homeowners insurance protects that asset without forcing you to overpay for unnecessary coverage. After comparing NW homeowners insurance quotes and understanding how regional factors shape your rates, you can make a decision that balances adequate protection with realistic premium costs. A $500,000 dwelling requires $500,000 in dwelling coverage, not $350,000, because underinsurance penalties will devastate your claim payout if disaster strikes.

Your liability limit should match your household net worth-if you own $800,000 in assets, carry $500,000 to $1,000,000 in liability coverage. High-value items like jewelry or firearms demand separate endorsements because standard policies cap these at $1,500 to $2,500 each, leaving you exposed if you skip this step. Bundling home and auto policies typically saves 15 to 25 percent, which means exploring multi-policy discounts with each carrier before finalizing your choice.

Working with a local independent agent simplifies this entire process, and H&K Insurance Agency represents multiple top carriers across the Puget Sound region. Their team gathers quotes from several insurers simultaneously, saving you hours of phone calls and online forms while customizing coverage packages that fit your specific home and budget. Contact H&K Insurance Agency to start comparing quotes from carriers that serve your area.