Yacht Insurance Kitsap County: Protecting Your Watercraft On Puget Sound

Puget Sound’s unpredictable waters demand more than hope and a sturdy hull. Yacht insurance in Kitsap County isn’t optional-it’s the difference between a manageable incident and financial devastation.

We at H&K Insurance Agency know that standard homeowners policies won’t cover your vessel. That’s why we’ve put together this guide to help you understand the coverage options that actually protect your watercraft.

Why Yacht Insurance Matters on Puget Sound

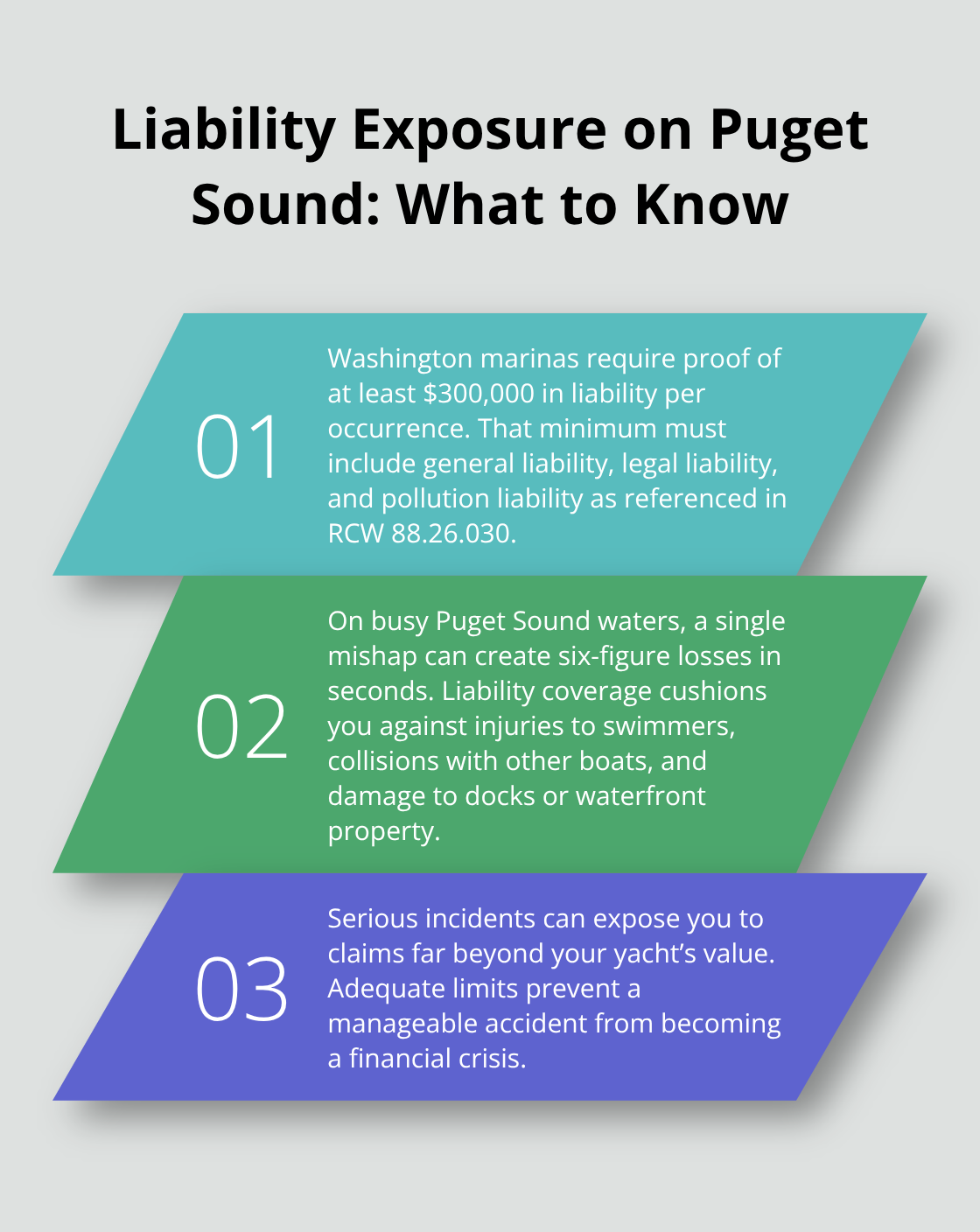

Liability Coverage Protects Against Real Exposure

Liability coverage is non-negotiable if you operate a yacht in Kitsap County. Washington state law requires private moorage facilities to demand proof that moored vessels carry at least $300,000 per occurrence in liability coverage, which must include general liability, legal liability, and pollution liability under RCW 88.26.030. This isn’t bureaucratic overkill-a single collision with another vessel, a swimmer, or waterfront property can generate six-figure claims in seconds. If your yacht strikes a ferry or damages a commercial fishing boat, you face exposure that extends far beyond your vessel’s value.

Physical Damage Coverage Handles What Liability Doesn’t

Physical damage coverage protects the cost to repair or replace your hull after a collision, weather event, or grounding. Puget Sound’s unpredictable conditions (sudden squalls, strong currents, and heavy commercial traffic) make this protection essential rather than optional. Progressive’s 2023-2024 data show that boat insurance in Washington averages around $400 annually, a modest investment against the reality that repair costs for fiberglass hulls, engines, and electronics routinely exceed $50,000 for moderate damage.

Medical Payments Coverage Protects Your Crew

Medical payments coverage rounds out the trio by covering injuries to passengers and crew members aboard your vessel, regardless of fault. If someone falls overboard or suffers a head injury during a maneuver, your medical payments limit covers their treatment costs without requiring a liability determination first.

What the Moorage Requirement Tells You

The moorage requirement tells you something critical: Kitsap County’s boating community takes protection seriously, and so should you. When you renew or sign a new moorage agreement after June 12, 2014, you’ll need to provide proof that your policy meets those minimum thresholds. Newer boats typically cost more to insure than older models, and higher horsepower engines drive premiums up as well, according to Progressive’s data. Experienced boaters can reduce rates by completing a boating safety course, a practical step that also makes you safer on the water.

The key is obtaining a current quote tailored to your situation rather than assuming a standard policy will cover your needs. Your vessel type, horsepower, and usage patterns all affect what you’ll pay and what protection you actually receive. Understanding these variables positions you to make an informed decision about coverage that fits both your watercraft and your budget-and that’s where comparing options from multiple carriers becomes your next critical step.

What Coverage Actually Protects Your Yacht

Hull Coverage Forms Your Foundation

Hull coverage pays to repair or replace your vessel’s structure, engine, and permanently installed equipment after collision, grounding, weather damage, or theft. Most yacht owners focus here, and they’re right to do so. The critical decision isn’t whether to buy hull coverage-it’s whether you want agreed value or actual cash value. Agreed value means you and your insurer settle on your yacht’s worth upfront, and that’s what you receive if total loss occurs. Actual cash value depreciates your vessel based on age and condition, often leaving you thousands short of replacement cost.

Agreed Value vs. Actual Cash Value: The Real Difference

For yachts in Kitsap County waters, agreed value is the only sensible choice. Your vessel appreciates in personal value (the joy of ownership, memories, specific upgrades you’ve made), but actual cash value ignores that reality and pays based on depreciation tables that don’t reflect what you’d actually spend to replace it. Washington boat insurance costs vary based on your boat’s age, horsepower, and the coverage structure you select.

Uninsured Boater Coverage Addresses Real Exposure

Uninsured boater coverage addresses a genuine problem on Puget Sound: operators without adequate insurance or hit-and-run incidents where the responsible party vanishes. If an uninsured boater collides with your yacht or someone hits your moored vessel and leaves, uninsured boater coverage pays your damages up to your policy limit. This protection matters because Washington’s commercial traffic, ferry systems, and recreational boating create real exposure to uninsured operators. Without this coverage, you’re left pursuing a claim against someone who likely has no assets to recover from.

Repair Costs Demand Realistic Coverage Limits

The agreement between your policy limits and your actual replacement costs determines whether you walk away whole or absorb losses yourself. Many yacht owners underestimate what repairs actually cost on Puget Sound. Fiberglass hull repair, engine overhauls, and marine electronics replacement routinely exceed $50,000 for moderate damage, and catastrophic events push costs far higher. When you obtain a quote from multiple carriers, ask explicitly what your agreed value will be and confirm it matches your actual replacement cost, not some outdated appraisal.

Experienced boaters who complete a boating safety course can reduce their premiums, so that investment pays dividends both in lower rates and safer operation. The moorage requirement you read about earlier-that $300,000 minimum liability coverage-is separate from your hull and physical damage protection. These coverages work together: liability protects others when you’re at fault, while hull and uninsured boater coverage protect your vessel itself.

Your next step involves understanding how to select the right policy for your specific situation and watercraft.

How to Choose the Right Yacht Insurance Policy for Kitsap County Waters

Know Your Vessel’s Specifications and Usage Patterns

Start with exact details about your yacht. A sailboat moored year-round in Poulsbo faces different risks than a cabin cruiser you operate seasonally from Bremerton. Your vessel’s age, horsepower, length, and equipment all affect premiums and available coverage options. Progressive’s 2023-2024 data show that newer boats cost more to insure than older ones, and higher horsepower engines drive premiums up significantly. A ten-year-old yacht with a 200-horsepower engine presents a different risk profile than a five-year-old model with 350 horsepower. Document your vessel’s specifications, maintenance history, and how many days per year you actually operate it. Insurance carriers use this information to calculate accurate quotes, and vague answers lead to inaccurate pricing or coverage gaps. When you contact carriers, provide specifics about whether you moor in protected waters, venture into open Puget Sound, or travel beyond the Sound seasonally. Carriers distinguish between these usage patterns, and misrepresenting your habits can void coverage when you need it most.

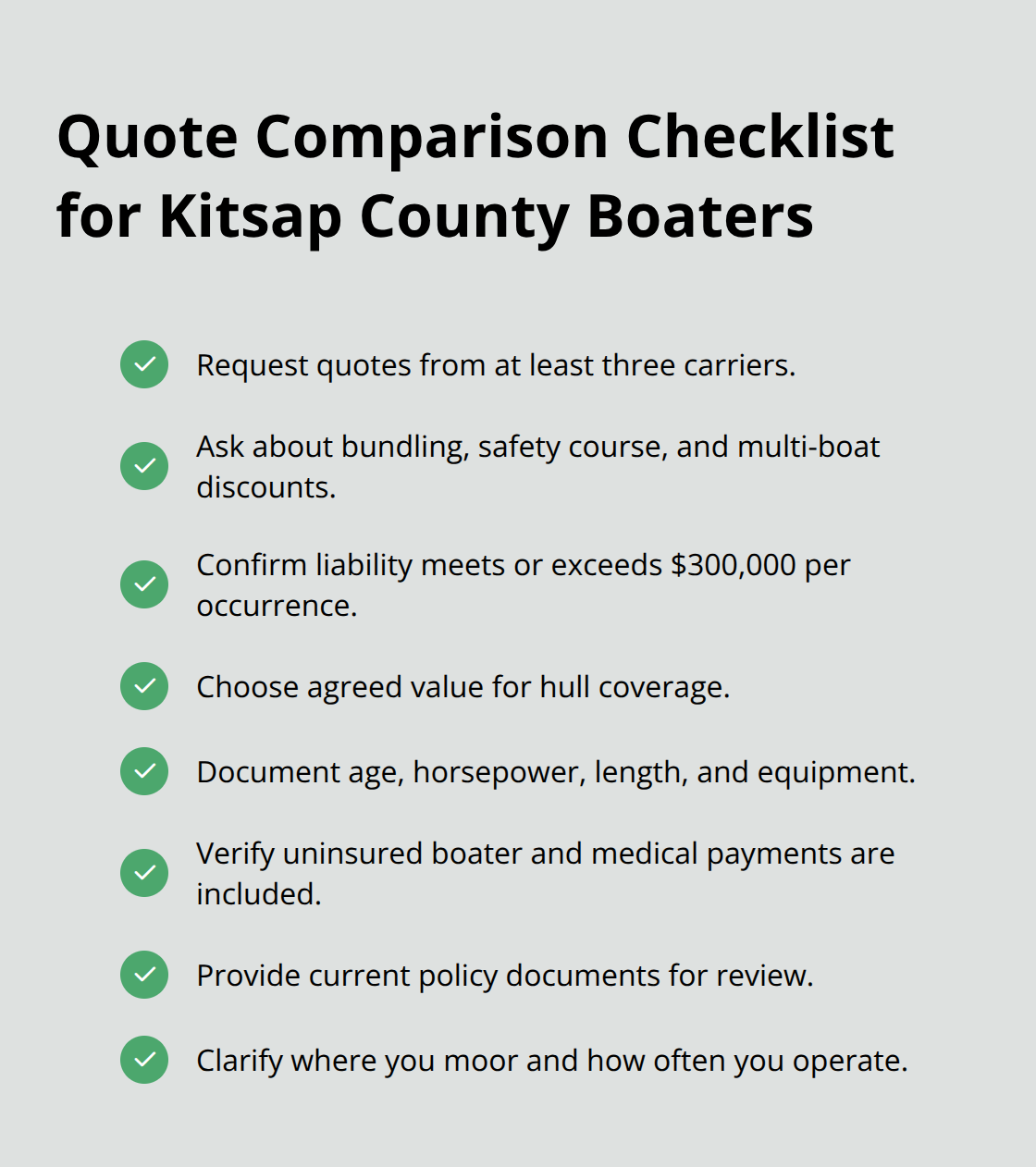

Compare Quotes from Multiple Carriers

Comparing quotes from multiple carriers yields competitive rates. Boat insurance typically costs between $200 and $500 per year, but your actual premium depends entirely on the carrier, your coverage selections, and discounts you qualify for. Request quotes from at least three carriers and ask each one explicitly about multi-policy bundling discounts, boating safety course discounts, and multi-boat discounts if applicable. Some carriers offer five to ten percent reductions for completing a Coast Guard Auxiliary boating safety course, so factor that investment into your decision. When reviewing quotes, confirm that liability coverage meets or exceeds the $300,000 per occurrence minimum required by Washington moorage facilities, and verify that your chosen hull coverage uses agreed value rather than actual cash value.

Leverage Bundling and Professional Guidance

Bundling your yacht insurance with auto or home coverage through one agency typically yields ten to fifteen percent savings across all policies. H&K Insurance Agency serves Kitsap County with personalized quotes that compare multiple carriers, so you avoid juggling separate applications. Request a free coverage assessment before committing, and provide your current policy documents if you have them so carriers can identify coverage gaps or overlaps. The quote process takes hours, not days, when you work with an agency that handles the legwork instead of shopping independently. This approach (comparing carriers while bundling policies) positions you to secure both competitive rates and comprehensive protection tailored to your specific watercraft and usage patterns.

Final Thoughts

Yacht insurance in Kitsap County protects you against the real hazards that Puget Sound presents-unpredictable weather, heavy commercial traffic, and strict moorage regulations that demand proof of adequate coverage. Generic policies fail because they ignore the specific risks your vessel faces when operating on these waters, and local agents understand what distant carriers miss. They recognize that a sailboat moored year-round in Poulsbo faces different exposure than a cabin cruiser you operate seasonally from Bremerton, and they can compare multiple carriers simultaneously to identify bundling opportunities with your auto or home insurance.

We at H&K Insurance Agency serve the Puget Sound region as an independent agency representing multiple top carriers, and we specialize in personalized coverage for boats, autos, homes, and specialty needs. Our approach means you receive a customized quote that reflects your vessel’s specifications, usage patterns, and the protection you actually need-not what some algorithm thinks you should buy. We compare rates across carriers so you secure competitive pricing without the legwork of separate applications.

Contact H&K Insurance Agency for a free coverage assessment and bring your vessel’s specifications, current policy documents if you have them, and details about how you use your yacht. We’ll compare options from multiple carriers, identify coverage gaps, and show you exactly what bundling discounts you qualify for. This conversation takes hours, not weeks, and positions you to secure both competitive rates and comprehensive protection before your next moorage renewal or the start of boating season.