Washington New Driver Insurance: Confidence on the Road

Getting your first car in Washington comes with real responsibility. Washington new driver insurance isn’t just a legal requirement-it’s your financial protection on the road.

We at H&K Insurance Agency know that new drivers face confusing choices about coverage limits, discounts, and what actually matters. This guide walks you through everything you need to know to drive legally and affordably in Washington.

What Washington Actually Requires for New Drivers

Washington’s insurance law is straightforward but non-negotiable. You must carry liability coverage with specific minimum limits: $25,000 for bodily injury or death of one person, $50,000 for bodily injury or death of two or more people in one accident, and $10,000 for property damage. These minimums apply whether you own the car outright or finance it.

Liability Coverage: The Legal Minimum

If you finance your vehicle, your lender will require comprehensive and collision coverage on top of liability, which protects the lender’s interest in the car. Many new drivers mistakenly think minimum liability is enough, but here’s the reality: if you cause an accident that injures someone seriously, $25,000 in bodily injury coverage disappears fast. Medical bills, lost wages, and legal fees stack up quickly. Washington law requires you to show proof of insurance every time you drive, and your insurance ID card must display your insurer’s name, policy number, effective and expiration dates, and the vehicles or driver covered. Failing to produce this card is a traffic infraction.

The Real Cost of Driving Uninsured

Driving without insurance in Washington isn’t a minor violation. If you get caught, you face license suspension, fines, and a misdemeanor charge if you knowingly provided false proof of coverage. More critically, if you cause an accident while uninsured and can’t pay damages, your license stays suspended until you settle the claim or post a bond. This creates a vicious cycle: no license means no legal driving, no legal driving means no way to earn income to pay the damages.

Alternative Financial Responsibility Options

Washington offers alternatives to traditional insurance for specific situations. Self-insurance applies to fleets with 26 or more vehicles through the Washington State Department of Licensing. You can also post a $60,000 certificate of deposit or obtain a $60,000 liability bond from an authorized surety company. These alternatives rarely apply to new drivers, but they exist for business owners. For new drivers in Washington, traditional insurance remains your only practical path forward.

Now that you understand what the law requires, the next step involves finding coverage that fits your budget without sacrificing protection. Shopping for affordable insurance as a new driver requires strategy and comparison.

Finding the Right Price Without Sacrificing Protection

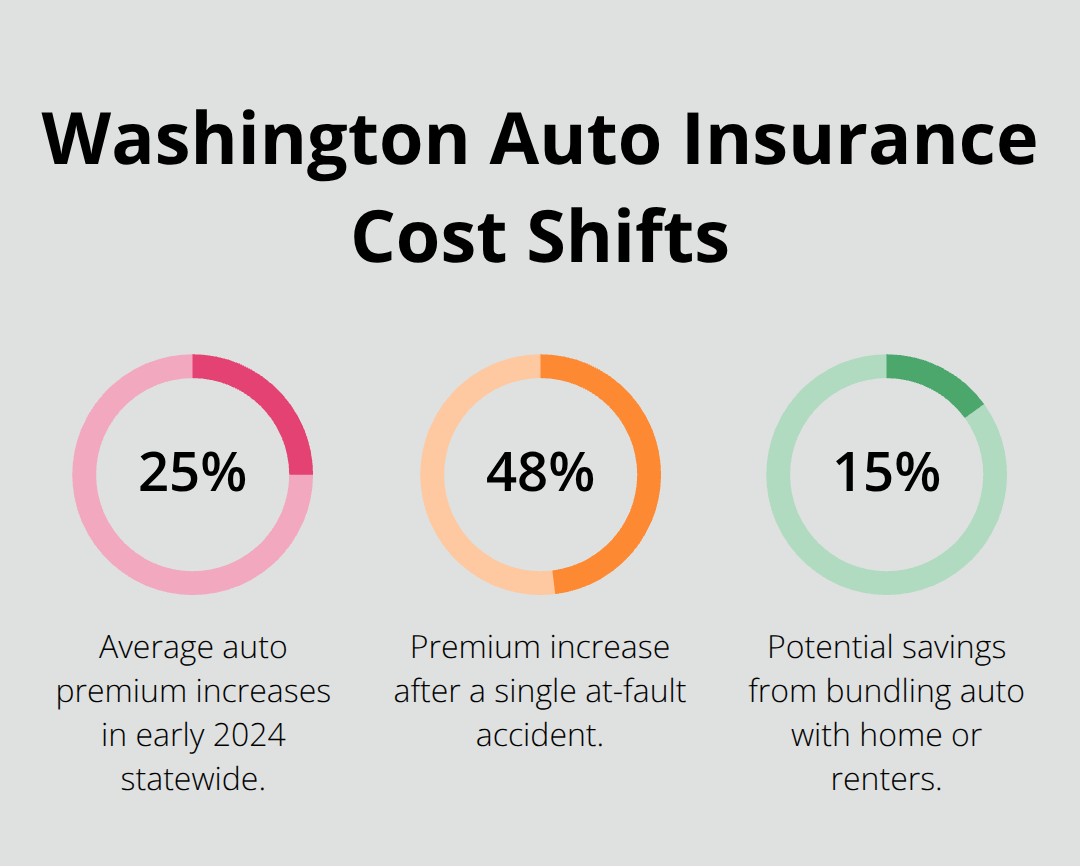

Shopping for new driver insurance in Washington demands more than picking the first quote that arrives in your inbox. The difference between the cheapest and most expensive option for the same coverage can exceed $2,000 annually, according to data from Bankrate and MoneyGeek. A 16-year-old added to a parent’s policy costs around $4,046 per year, while an 18-year-old on their own policy jumps to approximately $6,968 per year. These numbers shift dramatically based on which insurer you choose and what discounts you actually qualify for. The state saw average auto premium increases of about 25% in early 2024 due to higher repair costs and extreme weather, making comparison shopping non-negotiable.

Obtain Quotes from Multiple Insurers

Start by requesting quotes from at least three different insurers using multiple channels-comparison websites, independent agents, and direct company quotes-to see what rates your specific profile generates. Location matters significantly; Seattle full coverage averages around $2,154 annually while Port Townsend averages $1,562. Enter your zip code because this detail shapes your final premium substantially.

Discounts That Actually Reduce Your Premium

New drivers qualify for several concrete discounts that lower costs without tricks. Good student discounts apply if you maintain at least a B average-this typically reduces your premium by a meaningful percentage, though exact amounts vary by insurer. Usage-based insurance programs track your driving habits through a mobile app or device and reward safe driving with discounts; these programs work particularly well for new drivers because your careful habits generate immediate savings. The vehicle you choose affects your premium before you even buy it, so compare insurance quotes for different models before purchase. A Toyota Camry baseline in Washington sits around $1,919 annually for full coverage, while a BMW 330i costs approximately $2,398-that $479 difference happens every single year. A defensive driving course from the Washington Traffic Safety Commission qualifies you for additional discounts with many carriers. When you apply, disclose all eligible factors: employment status, residential stability, and marital status, as insurers may offer additional reductions based on these details.

Bundle Auto with Home or Renters Coverage

Adding your auto policy to an existing home or renters policy at the same insurer typically costs less than maintaining separate policies with different companies. The bundling discount alone can save 15–25% on your combined premiums, though exact percentages depend on your insurer and existing coverage. If your parents carry homeowners insurance, adding your auto policy to their account often produces better pricing than starting fresh with a new insurer. Before finalizing any policy, compare the total bundled cost across at least two insurers because sometimes switching everything to a new company produces lower overall costs than staying with your current provider. Verify that the bundled rate actually beats purchasing policies separately-occasionally insurers price bundled packages aggressively to win your business, but other times the discount remains minimal. H&K Insurance Agency, a locally owned independent agency serving the Puget Sound region, represents multiple top carriers and customizes bundled packages to help northwest residents find competitive rates on combined coverage.

Now that you understand how to find affordable coverage, the next step involves recognizing which coverage choices protect you adequately and which ones leave you exposed to serious financial risk.

Common Mistakes New Drivers Make with Insurance

Choosing Minimum Coverage to Save Money

New drivers in Washington frequently select minimum liability coverage limits to reduce upfront costs, ignoring the reality that these limits vanish in seconds during serious collisions. According to Bankrate data, a single at-fault accident increases your premium by approximately 48%, meaning you’ll pay roughly $915 more annually for years to come. That temporary savings of $300 or $400 annually by selecting minimum coverage disappears immediately after one accident, and you face personal liability for damages that exceed your policy limits. Medical costs in Washington average significantly higher than the state’s minimum coverage allows, so selecting these limits essentially gambles with your financial future. If you cause an accident that injures multiple people, you could face wage garnishment and asset seizure for years. Higher liability limits (such as $100,000 per person and $300,000 per accident) cost only marginally more than minimums but protect you substantially better when serious accidents occur.

Failing to Report Coverage Changes

New drivers often purchase a policy, then fail to notify their insurer when they move to a different city, change jobs, or their vehicle situation shifts. If you move from Port Townsend where full coverage averages $1,562 annually to Seattle where it averages $2,154 annually, your rate should adjust-but only if you report the change. Some insurers automatically update based on registration changes, while others require explicit notification. Failing to report that you’ve moved, changed vehicles, or altered your driving patterns can void your coverage during claims, leaving you unprotected when you need it most. Life changes like moving between two households (common in families with split custody) require you to verify how coverage applies with your insurer and provide residence proof as needed to avoid gaps in protection.

Delaying Accident Reports

Washington law requires you to report accidents promptly, and most insurers impose strict deadlines ranging from 24 to 72 hours. Waiting weeks to file a claim complicates investigations, reduces your chances of favorable outcomes, and may trigger coverage denials. Insurance adjusters need prompt accident scenes, witness information, and vehicle damage photos while evidence remains fresh. If you delay reporting and the other driver contradicts your account, you lose credibility. Contact your insurer immediately after any accident, even minor ones that seem inconsequential-insurers track these incidents for future rate calculations and claims patterns.

Reviewing Coverage Annually

New drivers should review their coverage annually and whenever significant life changes occur, comparing quotes across at least two carriers to confirm they’re still receiving competitive rates for their current situation. Before major policy changes, shop around and compare coverage across companies to find the best deal. When evaluating insurers, consider both premium costs and the insurer’s customer service and claims handling history to guide your choice. Checking your coverage regularly prevents you from overpaying for protection you don’t need or underpaying for protection you do need.

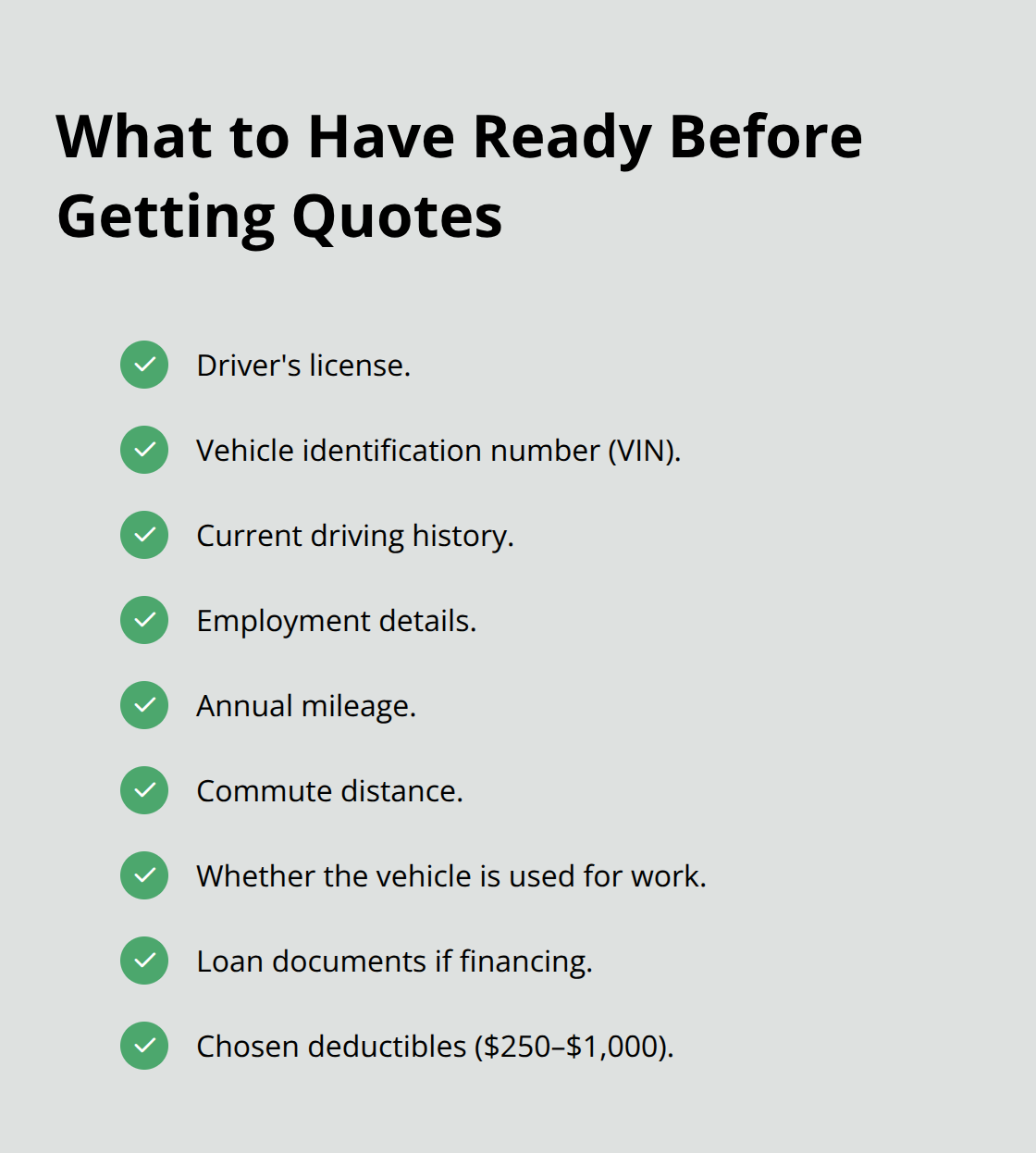

Getting Started with Your Washington New Driver Insurance

Collect your driver’s license, vehicle identification number, current driving history, and employment details before you request quotes for Washington new driver insurance. Most insurers ask about your annual mileage, commute distance, and whether you use the vehicle for work, so have this information ready along with your loan documents if you’re financing the vehicle. You’ll also need to decide your deductible amounts, typically ranging from $250 to $1,000, which directly affects your monthly premium.

Compare not just the price but also the insurer’s claims handling reputation and customer service ratings when you evaluate your quotes from multiple carriers. The Washington State Office of the Insurance Commissioner provides complaint data by carrier, helping you identify which companies handle claims efficiently and respond to customer concerns promptly. Independent agents at H&K Insurance Agency represent multiple carriers and compare rates across companies to find your best option, which saves time and often uncovers discounts you’d miss shopping alone.

Review your policy annually and whenever major life changes occur, such as moving to a different city, changing jobs, or purchasing a different vehicle. Track your safe driving habits through usage-based insurance programs if your insurer offers them, as these programs reward careful driving with concrete discounts that accumulate over time. Report any accidents or moving violations promptly to your insurer, and notify them immediately of coverage changes to maintain continuous protection on Washington roads.