Condo Homeowners Insurance Seattle: Protecting Your High-Rise Investment

Condo homeowners insurance in Seattle isn’t a one-size-fits-all product. Your building’s master policy covers the structure, but it leaves gaps that could expose you to significant financial risk.

At H&K Insurance Agency, we’ve helped countless Seattle condo owners understand what they actually need to protect their investment. This guide walks you through the coverage gaps, Seattle-specific risks, and how to avoid the mistakes that leave owners underinsured.

Why Your Condo Needs More Coverage Than the Master Policy Provides

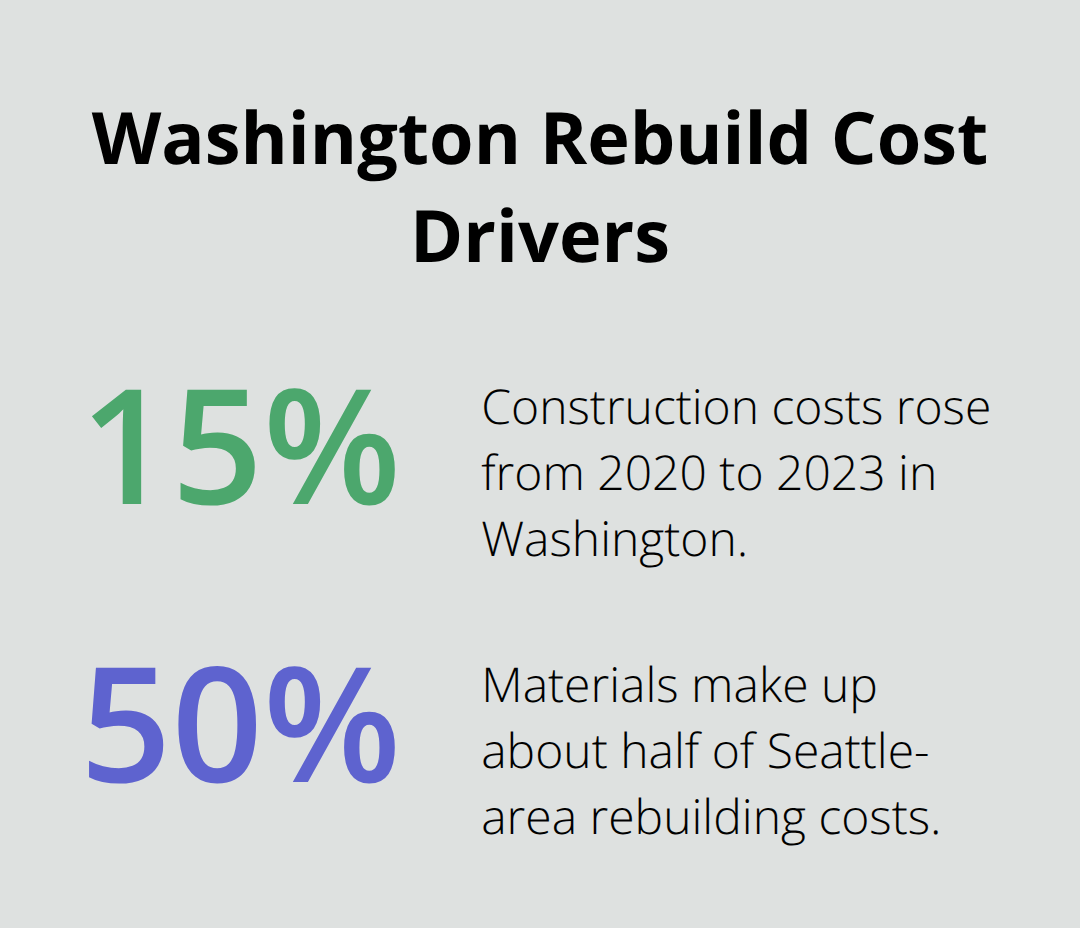

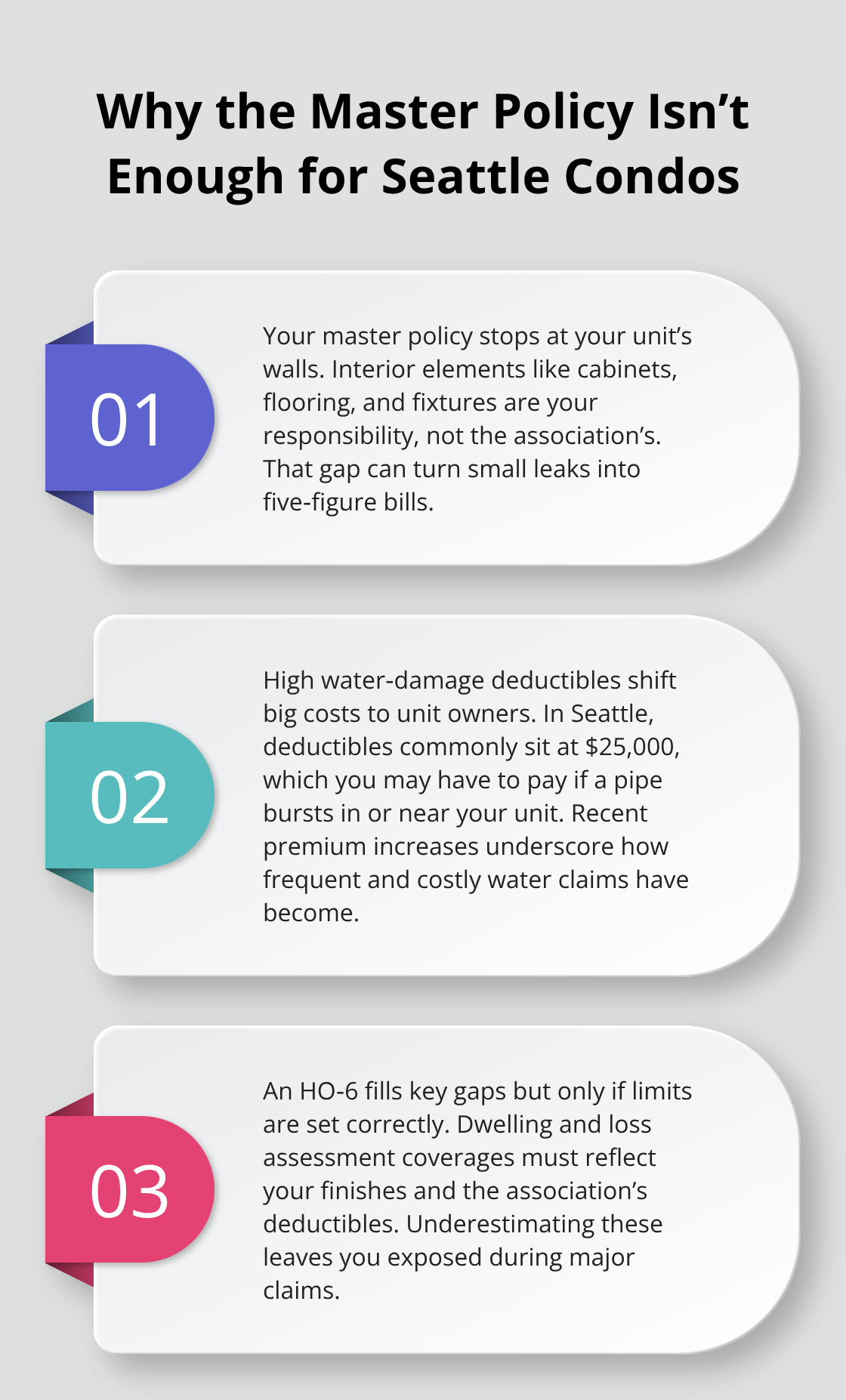

Your building’s master policy covers common areas like lobbies, hallways, and the structural shell, but it deliberately excludes your unit’s interior and personal belongings. This is where most Seattle condo owners face a dangerous gap. The Washington Condominium Act requires master policies to cover at least 80 percent of replacement cost for common elements, yet this protection stops at your unit’s walls. You remain responsible for everything inside: kitchen cabinets, flooring, fixtures, and all your personal property. A master policy with a $25,000 water-damage deductible-common in Seattle after the 2023 premium increases of about 8 percent driven by higher construction costs and frequent water claims-means you could face that entire out-of-pocket cost if a burst pipe floods your unit.

Why Standard HO-6 Dwelling Limits Fall Short

Your HO-6 policy fills the gap by covering your interior dwelling up to a limit you set, typically starting at $1,000 to $5,000 but often insufficient for modern Seattle condos. We recommend raising your dwelling coverage to at least $50,000 to match the value of built-in upgrades and finishes. Loss assessment coverage, usually around $1,000 in a standard policy, protects you when the association’s master policy deductible exceeds its limits and the HOA bills unit owners for the shortfall. Without this endorsement, you could face a special assessment of thousands of dollars after a major loss affecting common areas.

Personal Property Coverage Demands Real Numbers

Your belongings need their own coverage limit, separate from dwelling. If you own furniture, electronics, artwork, or jewelry worth $75,000, your personal property limit should match that amount. The average HO-6 policy includes personal property, but it typically pays actual cash value rather than replacement cost, meaning a five-year-old sofa worth $3,000 new might be valued at $1,200 after depreciation. For high-value items like jewelry or heirlooms, add replacement-cost endorsements to avoid the depreciation penalty.

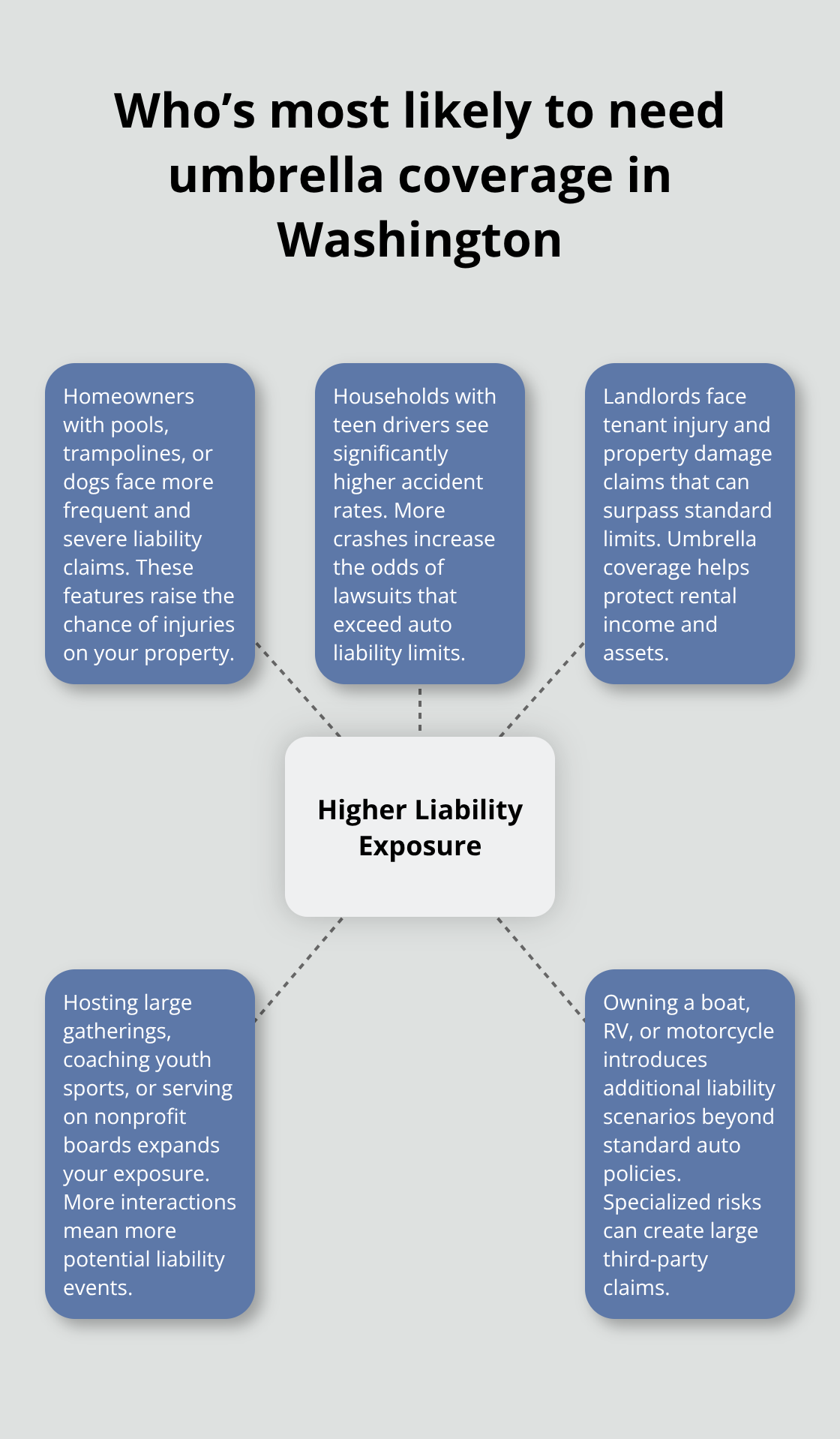

Liability Coverage and Your Financial Exposure

Liability coverage protects you if someone is injured in your unit or if you accidentally damage common property. Standard HO-6 policies offer liability coverage limits starting at $100,000, but given Seattle’s 2022 average premises liability settlements around $68,000, you should consider whether higher limits adequately cover your financial assets. If you own significant investments or equity in your unit, an umbrella policy providing an additional $1 million in liability costs only slightly more than the base policy and offers critical protection that standard condo coverage cannot match. The next step involves understanding what your specific building’s master policy actually covers-information that shapes every coverage decision you make.

Seattle’s Real Weather and Earthquake Threats

Water Damage Dominates Condo Claims in the Pacific Northwest

Water damage accounts for roughly 53 percent of Washington condo claims, making it the dominant risk you face in a Seattle high-rise. A burst pipe, failed seal, or neighbor’s overflow can cost tens of thousands to repair, yet your master policy’s standard water-damage deductible often runs $25,000 or higher. Standard HO-6 policies exclude water backup from sewers and drains entirely-a critical gap in older Seattle buildings where aging municipal infrastructure fails during heavy rain. You need to add water backup coverage as a separate endorsement, typically costing only a few dollars monthly but protecting you from bills that can easily exceed $10,000 when a basement drain backs up into your unit.

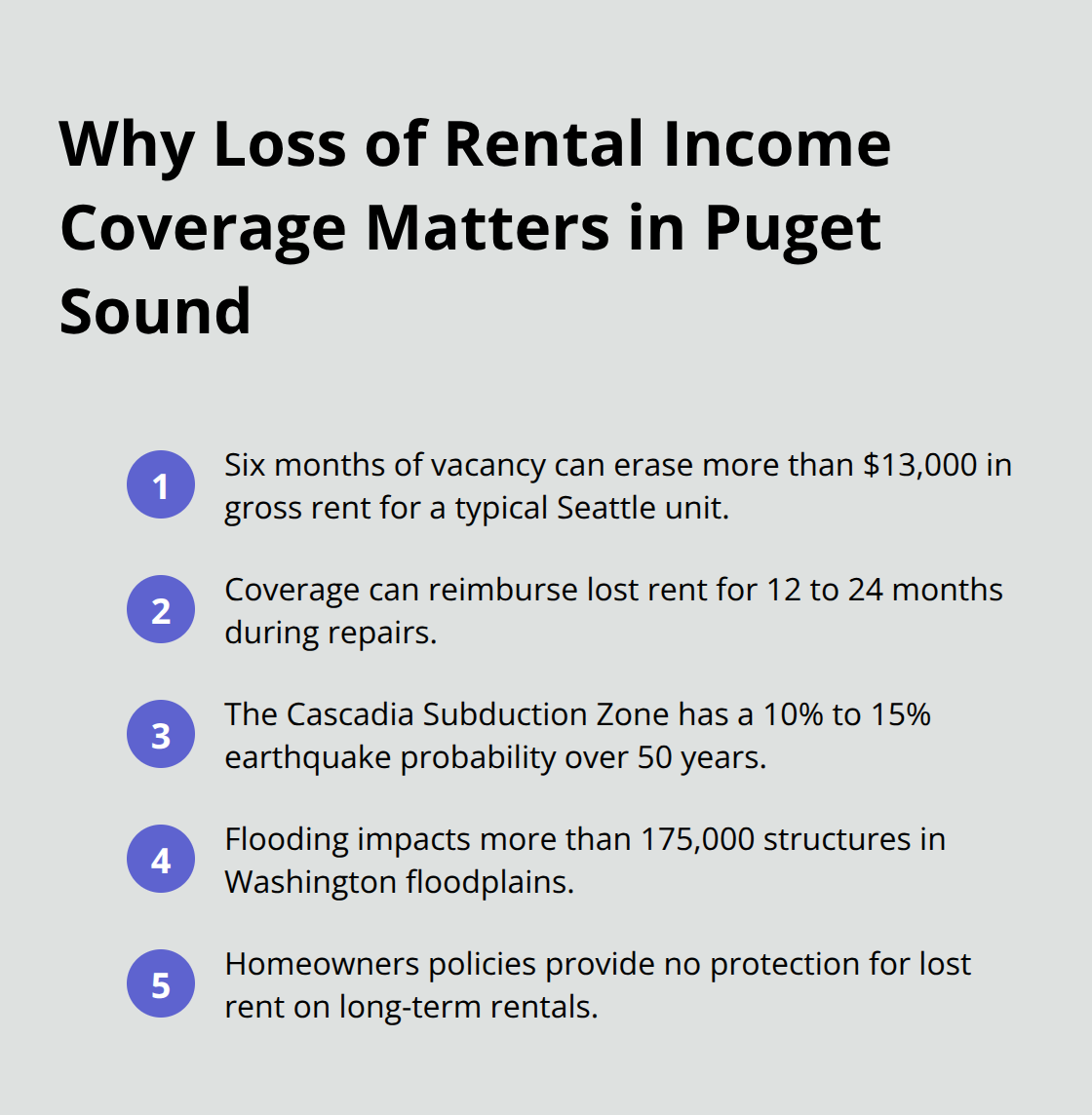

Flood Insurance Fills the Gap Your Master Policy Leaves

Flood insurance through the National Flood Insurance Program protects you if your building sits in a FEMA Special Flood Hazard Area, since neither your master policy nor standard HO-6 covers flood damage. Seattle’s winter storms bring heavy precipitation that stresses drainage systems, and climate trends show rainfall intensity increasing across the Pacific Northwest. This protection shifts from optional to essential as weather patterns intensify.

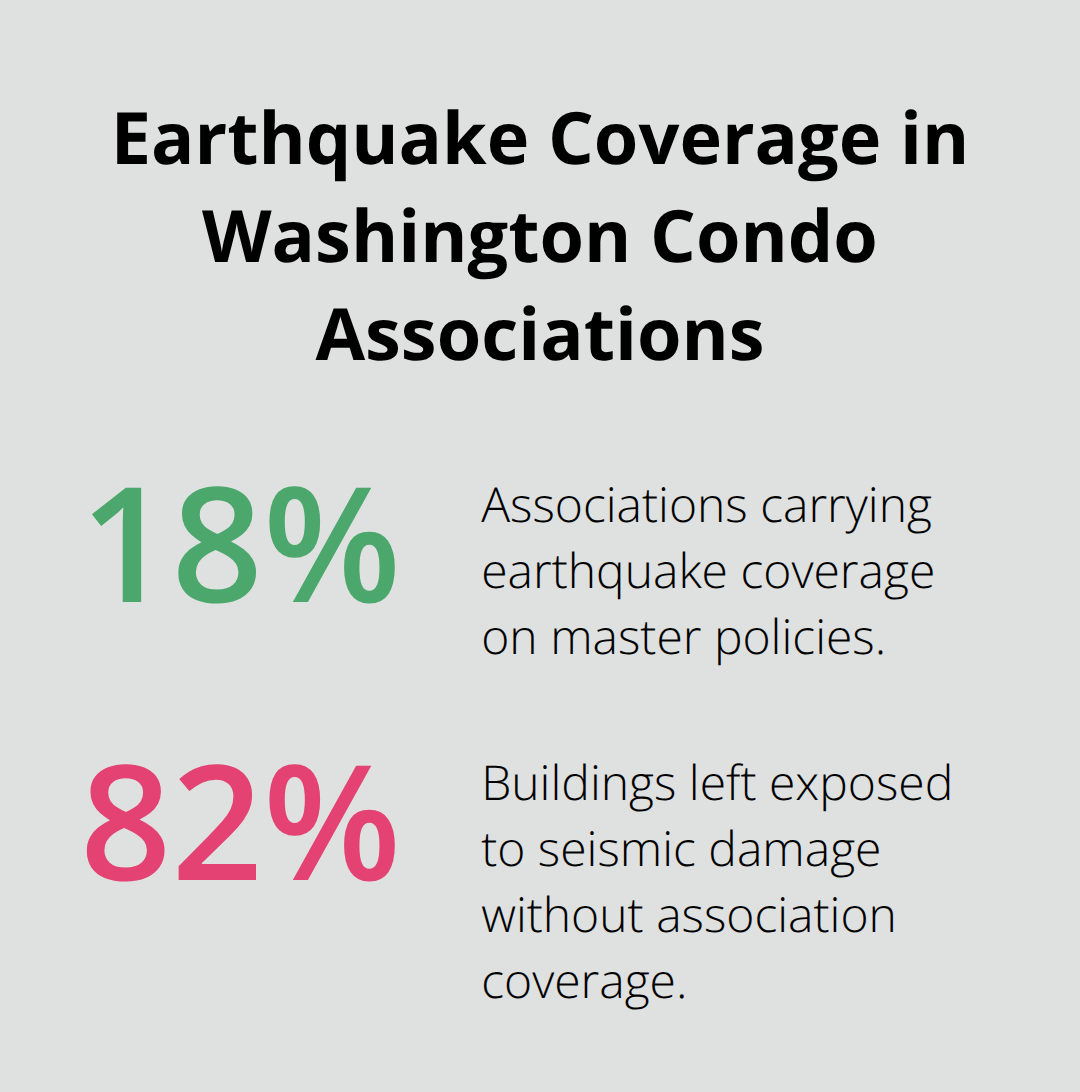

Earthquake Coverage Remains Largely Ignored in Washington

Earthquake coverage is where most Seattle condo owners make a deliberate but misguided decision. Only about 18 percent of Washington condo associations currently carry earthquake coverage on their master policies, leaving the remaining 82 percent of buildings completely exposed to seismic damage. The Cascadia Subduction Zone poses a genuine threat that the Pacific Northwest has largely ignored in insurance planning, yet earthquake deductibles when available commonly range from 5 percent to 20 percent of the insured value per building.

For a $2 million master policy with a 10 percent earthquake deductible, that means a $200,000 out-of-pocket obligation split among unit owners, and your standard HO-6 provides zero coverage for your share. Adding earthquake coverage to your personal policy costs significantly more than water backup or other endorsements, but it fills a void that your building’s master policy almost certainly ignores.

Ordinance or Law Coverage Protects Against Code-Upgrade Costs

Ordinance or Law coverage should also be on your radar because Seattle’s evolving building codes, including green-roof mandates and seismic upgrade requirements, can substantially increase reconstruction costs after a major loss. Without this coverage, you absorb the difference between what your insurance reimburses and what code-compliant rebuilding actually costs-a gap that can reach tens of thousands of dollars in a modern Seattle condo. Understanding these specific threats shapes the coverage decisions you make next when selecting the right policy for your situation.

How to Get the Right Coverage for Your Seattle Condo

Start with your building’s master policy certificate of insurance. Contact your HOA president or property manager to obtain this document, which reveals three critical details: the exact coverage limits, the deductible amount, and your building’s master policy type. Master policies in Washington fall into three categories: Bare Walls, Single Entity, or All-In. A Bare Walls policy covers only the structural shell up to the drywall, leaving you responsible for flooring, cabinets, countertops, and all interior finishes. An All-In policy covers the building including unit improvements like kitchen upgrades, shifting your responsibility to personal property and the master policy deductible. Single Entity policies, common in Seattle-area buildings, occupy the middle ground. Your HO-6 dwelling limit must align with what the master policy doesn’t cover. If your building carries a Bare Walls policy and you’ve invested $40,000 in kitchen and bathroom upgrades, your dwelling coverage should reflect that exposure. If the master policy shows a $25,000 water-damage deductible, add a deductible buy-down endorsement to your HO-6 so you don’t face that entire bill yourself. This single step costs only a few dollars monthly but prevents a catastrophic out-of-pocket expense.

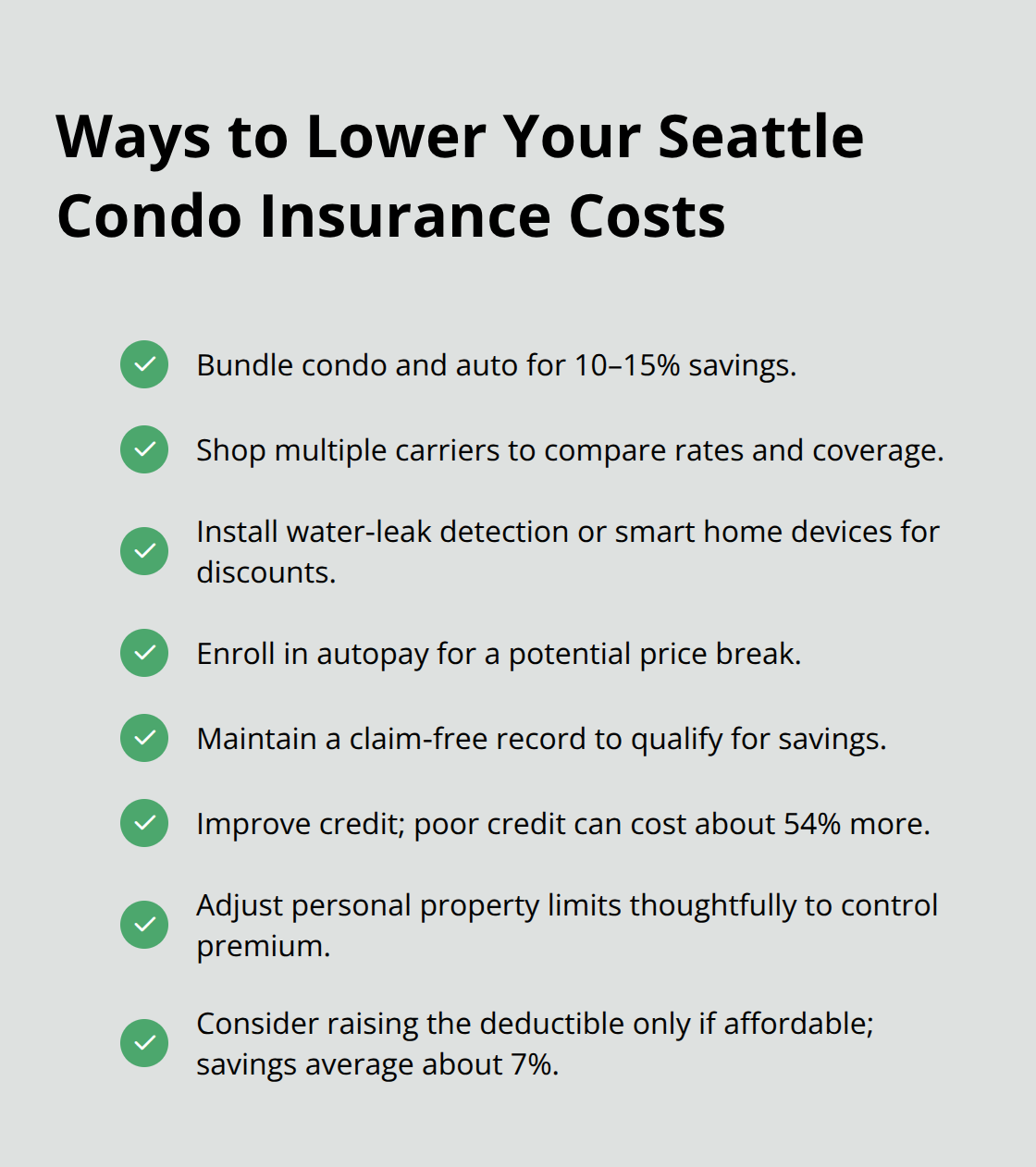

Bundling Creates Real Savings When Done Strategically

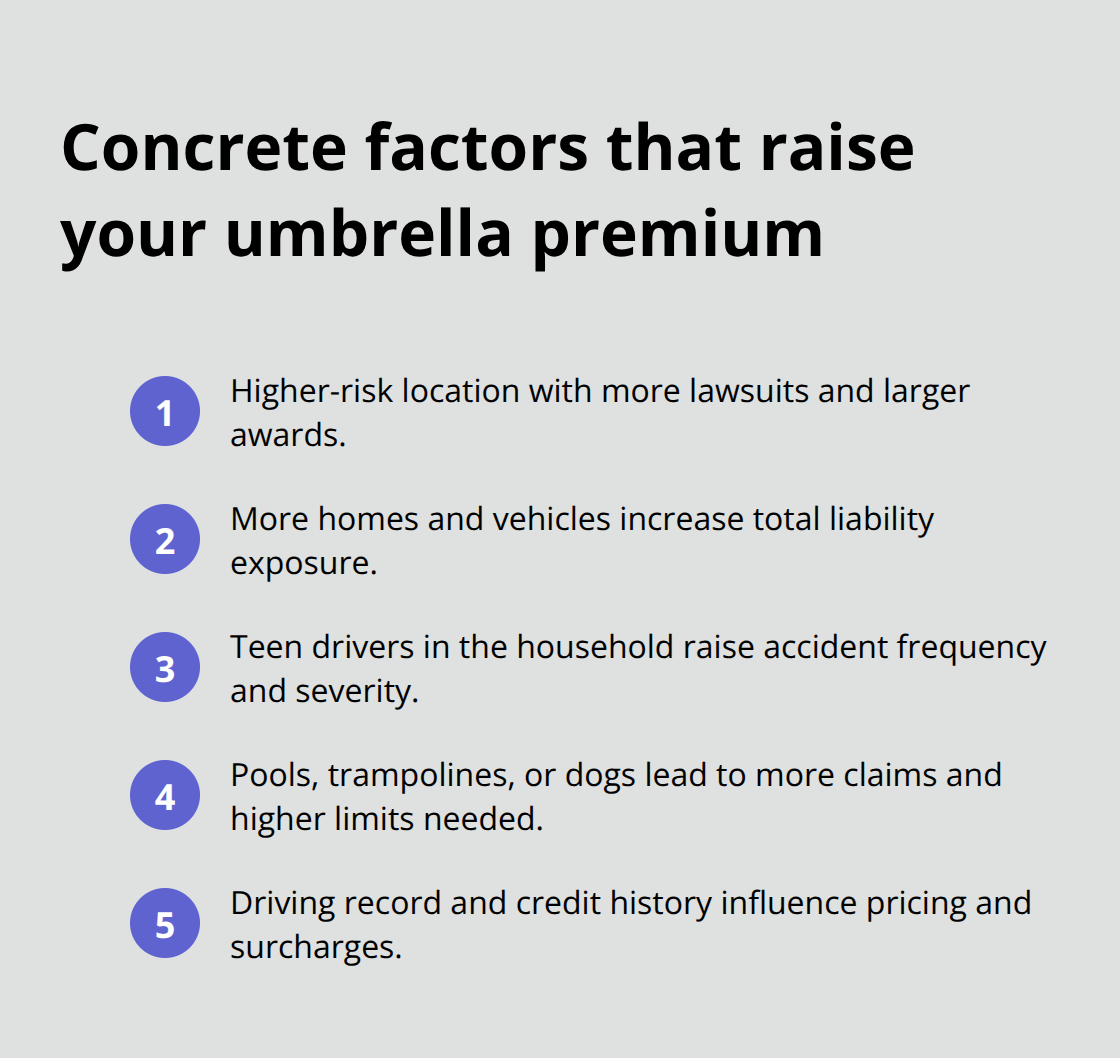

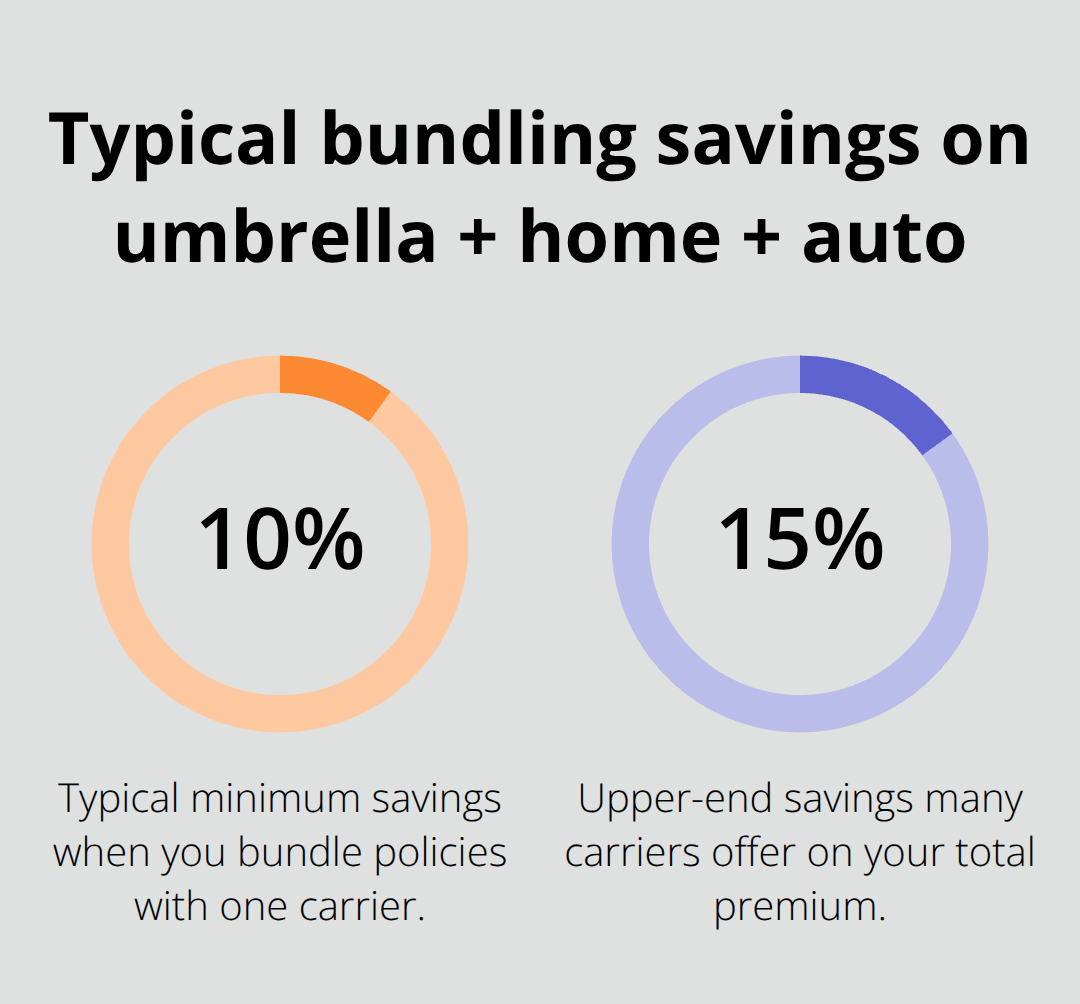

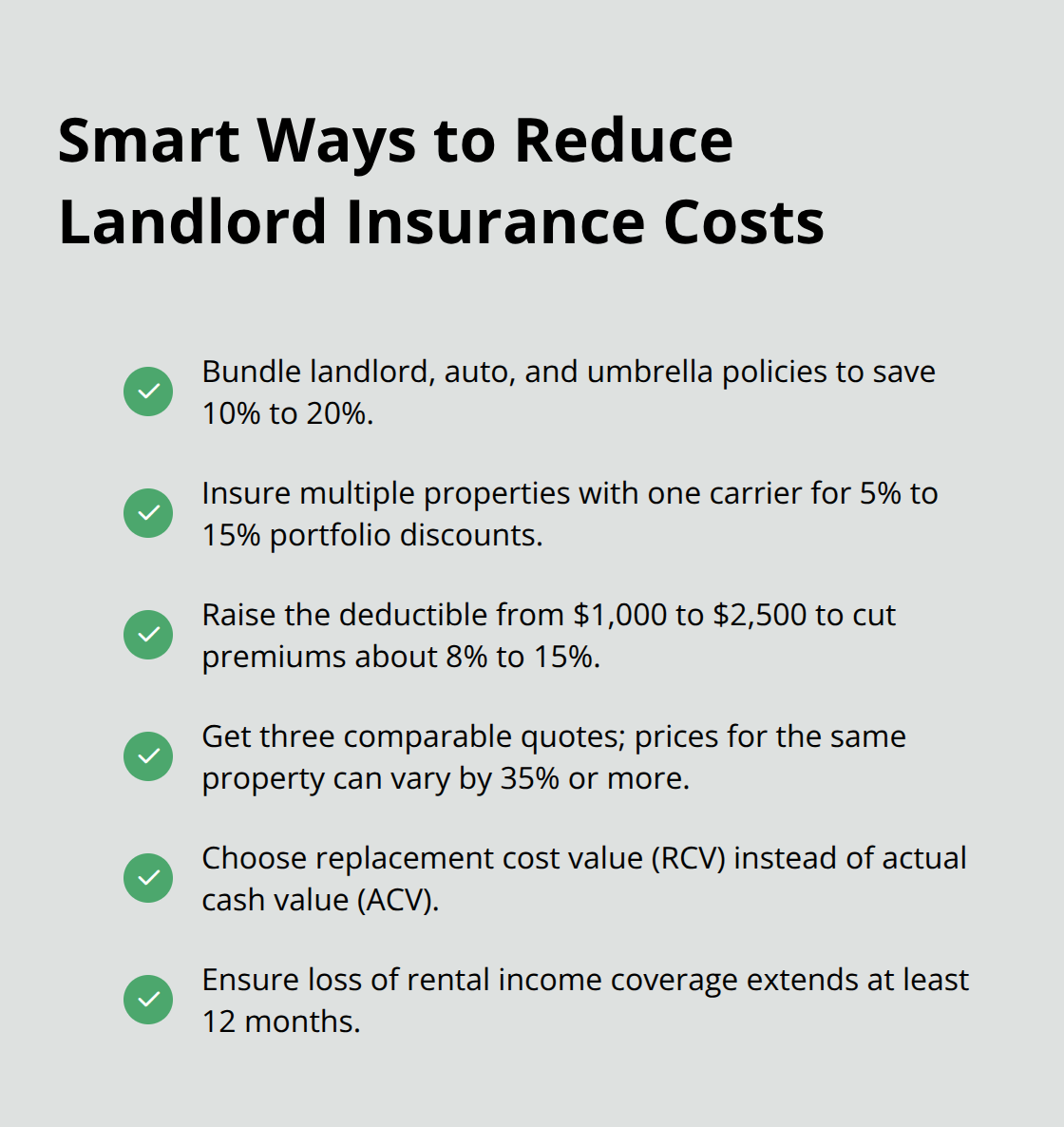

Bundling your condo insurance with auto coverage typically saves 10 to 15 percent on your total premium, though the actual discount varies by insurer. State Farm averages about $360 per year for condo coverage in national rate analyses, while American Family averages about $835 per year for the same coverage, illustrating why shopping across multiple carriers matters. In Seattle, the average condo insurance rate sits around $570 per year based on current market data, but this assumes $50,000 personal property coverage and a $1,000 deductible. If you increase personal property to $75,000, expect to pay roughly $570 to $620 annually; bumping it to $100,000 runs closer to $645 per year. Bundling discounts apply to the combined premium, so you reduce both policies simultaneously. Some insurers also offer discounts for installing water-detection devices or smart home systems, which align perfectly with Seattle’s water-damage risk profile. Ask about autopay discounts, claim-free discounts, and whether your credit score affects your rate. Your credit-based insurance score influences pricing significantly, with owners holding poor credit paying roughly 54 percent more on average than those with good credit, so addressing credit issues before shopping for quotes can lower your final premium substantially.

Local Agents Understand Seattle’s Specific Gaps and Risks

An independent agent who specializes in condo insurance in the Seattle market knows which master policy types dominate in specific neighborhoods, what deductibles are trending, and which endorsements most owners overlook. They understand that a 12-story downtown Seattle high-rise faces different risks than a mid-rise condo in Ballard, and they can explain why Equipment Breakdown coverage, which protects elevator systems and HVAC equipment, costs roughly $75 per elevator per year but prevents catastrophic repair bills when critical building systems fail. They also recognize that many Seattle condo owners carry inadequate loss assessment coverage when their buildings have high-deductible master policies. Standard loss assessment coverage maxes out at $1,000, yet if your 50-unit building faces a $50,000 water-damage deductible after a major loss, your share could run $1,000 or more before your loss assessment coverage even activates. An experienced agent will recommend raising loss assessment limits to $5,000 or $10,000 based on your building’s specific master policy and unit count. They know Seattle’s building codes evolve faster than most owners realize, making Ordinance or Law coverage increasingly important for units in neighborhoods undergoing seismic retrofits or where green-building standards are enforced. H&K Insurance Agency, a locally owned independent agency serving the Puget Sound region, represents multiple top carriers and can compare rates and customize packages including flood, earthquake, and other endorsements specific to Seattle’s market, so you avoid paying for coverage you don’t need while filling the gaps that actually matter for your building and situation.

Final Thoughts

Most Seattle condo owners make preventable mistakes that leave them underinsured when claims happen. They assume the master policy covers everything inside their unit, set dwelling limits based on affordability rather than actual exposure, ignore loss assessment coverage, and skip earthquake protection because it feels unlikely. Your condo homeowners insurance Seattle policy needs an annual review, not just at renewal. When you make interior upgrades, increase your dwelling coverage to match the new value. When your personal property grows, adjust that limit upward. When your building’s master policy changes or the deductible increases, revisit your loss assessment and deductible buy-down endorsements.

Your equity in the unit makes insurance more important after you pay off your mortgage, not less. Review your liability limits every two years against your growing financial assets. If you’ve accumulated significant investments or your condo’s value has appreciated substantially, an umbrella policy becomes increasingly valuable. Raising your deductible from $1,000 to $2,500 typically saves about 7 percent on premiums, but only if that higher deductible won’t strain your finances after a loss.

Finding competitive rates without sacrificing protection requires shopping across multiple carriers and comparing identical coverage limits and deductibles. An independent agent representing multiple carriers can compare rates and customize packages far faster than calling insurers individually. Contact a local agency that specializes in condo coverage tailored to Seattle’s specific risks so you get competitive pricing without sacrificing the protection your investment actually needs.