Washington Earthquake Insurance: Safeguard Your Home Against Northwest Quakes

Protect your Washington home from earthquake damage with Seattle earthquake insurance. Learn coverage options and safeguard your property today.

Condo Homeowners Insurance Seattle: Protecting Your High-Rise Investment

Protect your Seattle condo investment with comprehensive homeowners insurance coverage tailored to high-rise living.

Personal Umbrella Insurance WA: Extra Liability Protection For You And Your Family

Protect your family beyond standard coverage with personal umbrella insurance in WA. Learn how extra liability protection shields your assets today.

Landlord Insurance Puget Sound: Protecting Rental Income Across The Region

Protect your rental income with landlord insurance in Puget Sound. Learn coverage options, costs, and how to safeguard your properties today.

Essential Guide to Protecting Your Jewelry: Everything You Need to Know

Jewelry holds not only aesthetic value but also sentimental significance. Whether it symbolizes decades of marriage, has been passed down through generations, or commemorates a special occasion, its worth goes beyond monetary value. With this in mind, our local insurance agency aims to ensure that you have comprehensive protection for your precious pieces. While the...

Flood Insurance Puget Sound: Are You Fully Protected Against Northwest Flood Risk

Protect your home from flooding in the Puget Sound region. Learn if your flood insurance coverage is adequate for Northwest flood risks.

Renters Insurance Bremerton WA: Essential Protection For Your Apartment

Protect your apartment with renters insurance in Bremerton WA. Learn what coverage you need and how to find affordable policies today.

Classic Car Auto Insurance: Protecting Your Collector On The Road

Protect your classic car with specialized auto insurance coverage. Learn how to safeguard your collector vehicle on the road today.

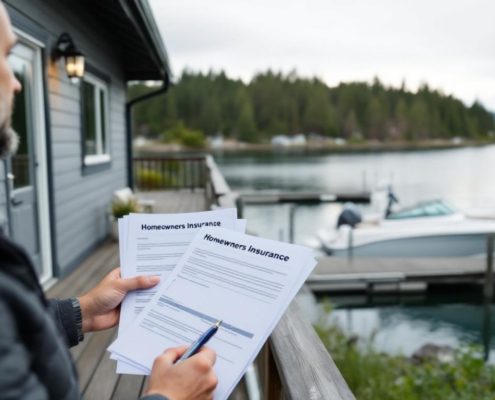

Homeowners Insurance Puget Sound: Finding Local Protection For Your Home

Find local homeowners insurance in Puget Sound that protects your home against weather, earthquakes, and more.

Earthquake Coverage Homeowners WA: Strengthen Your Northwest Home

Protect your Washington home with earthquake coverage. Learn essential tips to strengthen your property and secure the right insurance policy today.

The Importance of Having an Umbrella Insurance Policy

Protecting oneself from major claims or lawsuits and protecting assets and earnings is a priority for anyone. This is where an umbrella insurance policy comes into play, providing an additional layer of coverage that goes beyond traditional policies. By insuring your future, you can protect your home, cash savings, and future earnings from unforeseen circumstances....

NW Homeowners Insurance Quotes: Compare Top Local Carriers

Compare NW homeowners insurance quotes from top local carriers and save on your coverage today with our expert guide.